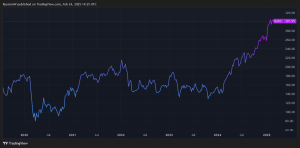

Tesla (NASDAQ: TSLA) stock is a strange case. Just when you think it’s grossly overvalued, it bounces back to hit new highs.

Just look at the incredibly volatile share price recently. It’s down 17% in a month and 29% since a December high of $479. Yet since Donald Trump’s election victory, it’s still up 34%. Over one year, the stock is 69% higher — similar to Nvidia!

In the past, all significant dips in the Tesla share price have proven to be buying opportunities. So, should I take this one? Here are my thoughts.

Mounting issues

Tesla has always given investors things to worry about, and today is no different. It’s facing rising competition from both cheaper Chinese electric vehicles (EVs) and traditional Western automakers. Consequently, Tesla’s market share is falling in both Europe and China.

Second, consumer spending remains weak, with many people avoiding big-ticket items like new cars. So the overall growth of the EV market has been decelerating. Long term, it seems certain to be much larger, but for now it’s hit a major speed bump.

Next, Elon Musk has vocally entered politics by backing Donald Trump. This has extended to supporting political parties in Europe, including Germany’s AfD. From a Tesla perspective, I have to imagine this is alienating many core potential customers. Indeed, reports say that the company’s market share in Germany has plummeted from 23% two years ago to just 4% in January.

Moreover, Musk has taken on the task of cutting US government spending. Between this and running X and several other companies (including SpaceX, the world’s most valuable private firm), it makes me wonder how much of Musk’s attention is focused on Tesla.

Most other CEOs would be pressured to leave their role to focus on politics. Yet Tesla’s $1trn market cap might implode if visionary Musk left the company. So this is a bit of a unique situation.

Finally, the company’s growth has ground to a halt. In Q4, revenue increased only 2% year on year to $25.2bn, with automotive revenue declining 8%. Operating profit slumped 23% to $1.6bn.

Remember, it wasn’t that long ago that Musk was projecting supercharged 50% annual growth for the years ahead. Such growth now appears firmly in the rear-view mirror.

Sky-high valuation

According to all conventional metrics, Tesla stock is currently very overvalued. It’s trading at 12 times sales and 113 times forward earnings.

Meanwhile, Tesla’s price-to-earnings-to-growth (PEG) ratio, based on its forecast five-year earnings growth rate, stands at 4.7. That’s a significant premium to the 1.6 average of the other six stocks in the ‘Magnificent Seven’ grouping.

My move

Despite all this, there are things to be excited about in future. One developing business that intrigues me is the Optimus humanoid robot (also known as the Tesla Bot). The company plans to have these working in Tesla factories by the end of this year.

On the Q4 earnings call, Musk said: “Optimus has the potential to be north of $10trn in revenue.” That’s trillions!

While Tesla thinks it could be selling them as early as next year, I’d take that with a pinch of salt. This business might not be producing any meaningful revenue until the 2030s.

As things stand, I’m not going to invest in the stock.

This post was originally published on Motley Fool