Different analysts will have their own opinions, but I’d suggest that £2.4m is just enough money to generate £10,000 a month. or £120,000 a year.

That’s based on having £2.4m invested in stocks, debt, bonds or active savings that collectively pay an average of 5% annually. What’s more, when this money is invested within a Stocks and Shares ISA, that income would be entirely tax free. That’s the equivalent of earnings £205,000 annually in a salaried job, given the current tax bands.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Wait! It may be easier than you think

Now, I’m sure many Britons will have zoned out when they saw the figure £2.4m. However, it’s much more achievable than many people think. The answer lies in the economics of a pension, which admittedly many people won’t be familiar with as they don’t actively manage it throughout their working career.

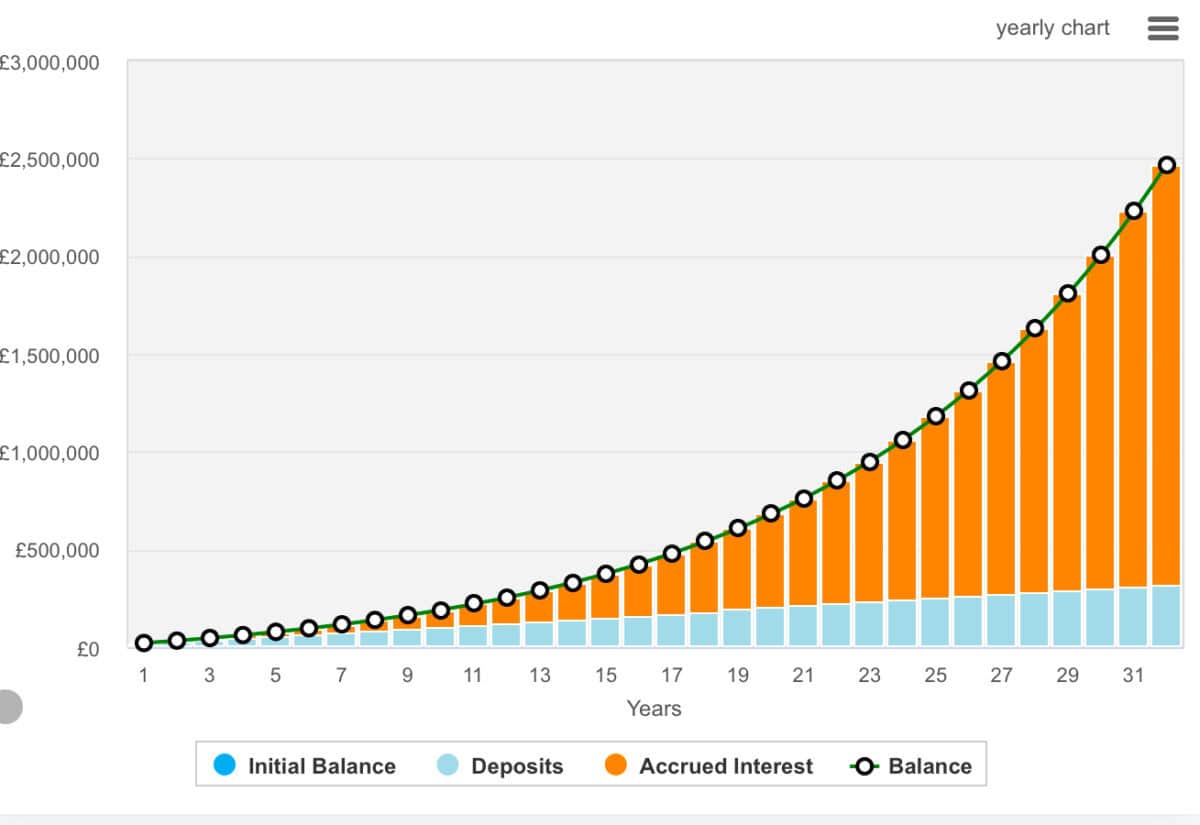

Nonetheless, there’s a critical component and it’s called ‘compounding’. When we invest over a long period of time, our gains compound as each year builds on the next. It may not sound like a winning strategy, but it really is.

Here’s just one example of how an investor might be able to build a £2.4m portfolio:

- Initial investment of £10,000

- Monthly contributions of £800

- 32 years of consistent contributions and reinvestment

- An average annualised return of 10%

Investing well is key

The above formula is great. However, it doesn’t tell us how to invest. And if we invest poorly, we can lose money. Sadly, this is what happens to lots of novice investors looking to replicate get-rich-quick stories.

Many financial planners or analysts will start by recommending index funds — these attempt to track the performance of an index like the FTSE 100. This is a great approach to achieve diversification quickly.

However, the more adventurous may want to consider investing in individual stocks, more focused funds, or trusts. The Monks Investment Trust (LSE:MNKS) is one with interesting prospects, aiming for long-term capital growth — instead of income. This is because the fund’s managers are attracted to “businesses addressing a particular ‘crisis’ in a novel manner which can help to reduce costs and/or produce a radically improved quality of service”.

Over the past 10 years, the shares have seen 246% growth, driven by investments in companies such as Meta, Amazon, Microsoft, TSMC, and Nvidia, which also represent the five largest holdings.

However, it’s very diversified with the largest holdings all representing less than 5%. The trust’s portfolio consists of about 100 holdings across various growth profiles. As of February, it has total assets of £3,056m and a low ongoing charge of 0.44%. The trust’s dividend yield is just 0.16%.

Risks? Well, its top holdings are big tech names and some of those valuations are getting a little frothy, and some analysts will suggest that a downturn’s coming. However, over the long run, these big tech names look set to dominate.

Another risk of investing in Monks is the use of gearing (borrowing to invest). The trust can borrow money to make further investments, which can amplify both gains and losses.

In short, it’s an investment I like a lot, and it’s one I’ve added to my daughter’s Self-Invested Personal Pension (SIPP) so I feel it’s worth considering.

This post was originally published on Motley Fool