Vodafone’s (LSE: VOD) share price fell 7% on the release of its Q3 fiscal year 2025 results.

I thought the numbers unveiled on 4 February were positive overall. The share price’s mini-rally since then appears to indicate that others share my view.

That said, the stock is still down 13% from its 17 September one-year traded high of 79p. This may provide a bargain buying opportunity to consider for those whose portfolio the stock suits.

A closer look at the results

A 6.4% year-on-year revenue decline from its German operations weighed on the quarterly figures.

This was due to a legal change forbidding landlords from passing on cable TV fees to tenants. It remains a key risk to the firm, in my view.

However, the firm’s total revenue jumped 5% to €9.8bn. Another positive for me in Q3 was the sale of Vodafone Italy to Swisscom for €8bn. The proceeds will be used to reduce net debt and to begin a share buyback of up to €2bn. These tend to support stock price gains.

Also promising was the final regulatory approval of the firm’s merger with Three in the UK. This will create the UK’s largest mobile phone operator and should bring cost and coverage benefits for the new entity, I think.

Are the shares undervalued right now?

On the price-to-book ratio, Vodafone trades at just 0.4. This is bottom of its peer group, which averages 1.8. These peers comprise Orange at 0.9, BT at 1.2, Telenor at 2.6, and Deutsche Telekom at 2.7.

So, Vodafone looks a major bargain on this measure.

The same is true on the price-to-sales ratio too, with the firm at 0.6 against a peer average of 1.3. And its also looks very cheap on its price-to-earnings ratio of 8.9 compared to its competitors’ 19.9 average.

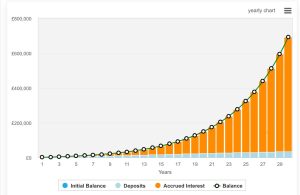

To translate all this into share price terms, I ran a discounted cash flow valuation using other analysts’ figures and my own.

This shows Vodafone shares are technically 54% undervalued at 69p. Therefore, the fair value for the stock is £1.50.

Market unpredictability may push the shares lower or higher than this. However, it confirms to me that they look a serious bargain right now.

Will I buy the stock?

My age – over 50 – is the key factor why I will not buy this stock at its current bargain price. I am now in the later part of my investment cycle, which means two things to me.

First, I am focused on reducing my working commitments by increasingly living off stock dividends. Analysts project Vodafone’s annual yield will be around 5.5% in each of the next three years. This compares well to the FTSE 100 average of 3.6%. But it is much less than the circa 9% average I receive from my high-yield stocks.

Second, the price volatility risk on a sub-£1 share is unacceptable to me. At 69p, each penny of Vodafone’s share price represents 1.4% of the stock’s value.

So, it does not look like an unmissable bargain to me now. However, if I were younger, it might appear so.

This post was originally published on Motley Fool