The FTSE 100 index has mostly been disappointing investors this century. On 31 December 1999, the main UK stock-market index hit a record close of 6,930.2 points, topping off a terrific decade.

Unfortunately, the brutal crashes of 2000-03 and 2007-09 sent the index plunging far below its millennial high. Indeed, the blue-chip index didn’t exceed this previous peak until 24 February 2015. Hence, I call the long years from 1999’s peak to 2015’s new highs the ‘Big W’ — what the Footsie‘s chart closely resembles — or its ‘Wilderness Years’.

The FTSE 100 hits new highs

Over the last four weeks, the UK stock market has seen strength that’s mostly been missing for years. Since closing at 8,201.54 on 14 January, the index has leapt by 7.1% to 8,781.56 as I write. Along the way, it has set multiple fresh closing and intra-day highs.

This sudden surge surprised me, as I’m used to the Footsie just plodding along. Alas, it has underperformed on the global stage for years, as the following table shows:

| Index | Six months | One year | Five years |

| FTSE 100 | 7.0% | 16.0% | 18.5% |

| S&P 500 | 13.5% | 20.8% | 79.5% |

| Difference (UK minus US) | -6.6% | -4.9% | -61.0% |

What’s clear is that the US stock market has thrashed its British rival over the past half-decade. However, the above figures all exclude cash dividends, which are far larger from Footsie firms than S&P 500 companies. But while dividends will narrow these gaps, America still reigns supreme.

Make London great again?

Good news: after this recent spurt, the FTSE 100 has started beating the S&P 500. Over one month, the gains are 6.5% for the UK index and 4.1% for the US, while the year-to-date rises are 7.4% and 3.2%. What might explain this sudden shift?

I’ve heard various reasons for this abrupt turnaround. Some pundits claim that global investors have finally realised how cheap UK shares are. Others see investors in US stocks worried about sky-high valuations, Trump’s trade tariffs, and stubborn inflation. Whatever the causes, it’s good to see the Footsie enjoying its days in the sun.

One British share going great guns

As an old-school value investor, I’ve argued for years that UK shares are deeply undervalued, both in historical and geographical terms. And yet go-go US growth and tech stocks continue to defy financial gravity by soaring skywards.

That said, one FTSE 100 share that I’m happy to have in my family portfolio is Barclays (LSE: BARC). Shares in the Blue Eagle bank have trounced the wider market, particularly since October 2023. Over six months, Barclays stock has leapt 38.2%, while it has rocketed by 112.9% in the past 12 months. In addition, the shares are up a market-beating 72.9% over five years.

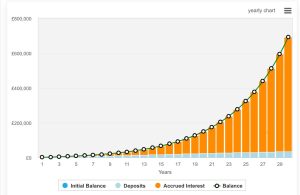

My family bought our stake in this Big Four bank in July 2022, paying 154.5p a share. With the share price now at 304.55p, we are close to doubling our money in this ‘boring’ FTSE 100 stock. Even better, we have reinvested our generous and rising yearly dividends into buying more Barclays shares, thus turbocharging our gains.

However, with UK inflation falling, interest rates are set to fall. This will hit Barclays’ 2025-26 profits by reducing its interest income and lending spreads. Despite this, we aim to hang onto this fabulous FTSE 100 stock!

This post was originally published on Motley Fool