I already had a Stocks and Shares ISA when I started work at 22, and it was topped up by inheritance and sporadic gifts. However, it wasn’t until much later that I started making regular contributions to my ISA.

At 22, the rationale for not contributing was simple: “I’ll be earning more in the future, so why now?” But this mindset can mean missing out on the power of compounding. The key advantage for young investors isn’t how much they invest, but how long their money has to grow. It’s all about time in the market.

The rationale

Investing £3.33 per day is the equivalent of investing £100 per month. That would have been about 5% of my first paycheque. It might not sound like a lot, especially as it would now take me more than three months to afford one Tesla share, but it adds up over time. Plus, investors can use fraction shares to gain access to more expensive stocks.

The secret ingredient is compounding. This is what happens when investors keep their money invested over the long run. It’s like a snowball that, as it gets bigger, can pick up even more snow.

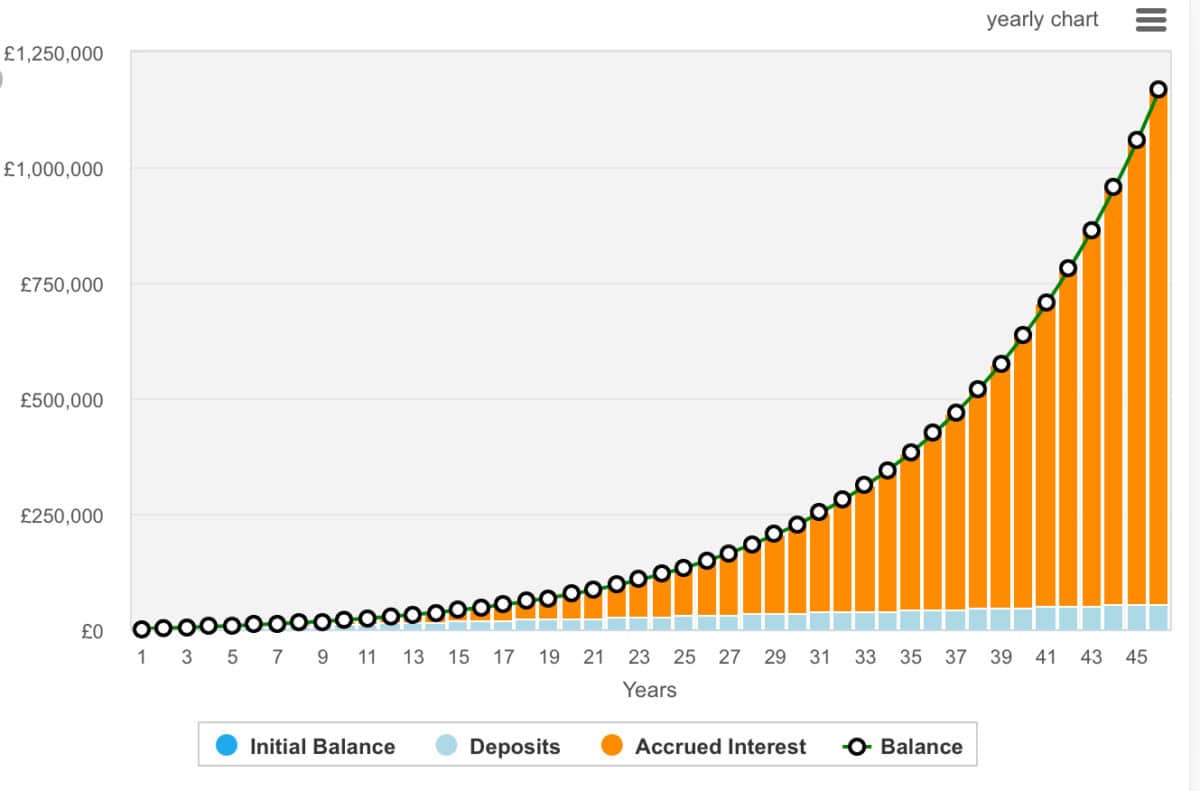

As we can see from the below graph, £100 really starts to compound after 15 years — this example assumes a growth rate of 10% annually. Towards the end of the 46-year period, £100 of monthly contributions should seem very affordable, while the portfolio will be growing at an impressive rate.

Why 46 years? Well, that’s the number of years between me starting work at 22 and my predicted retirement age at 68.

Getting there

So, we’ve got the formula. But how can we actually turn £3.33 a day into a small fortune? Well, many novice investors will invest in index-tracking funds. This is a wise move that provides diversification and relatively low risk.

Another option could be an exchange-traded fund (ETF) or even a conglomerate like Berkshire Hathaway (NYSE:BRK.B). Warren Buffett’s holding company provides exposure to a broad mix of businesses, from insurance to consumer goods, with a proven track record of compounding shareholder value.

Buffett’s value investing approach, focusing on undervalued companies with strong fundamentals, has proven successful over decades. However, investors should consider risks such as Berkshire Hathaway’s large size potentially limiting future growth opportunities, the challenge of finding attractively priced acquisitions in the current market, and the eventual succession of leadership as Buffett ages.

Despite these concerns, Berkshire Hathaway’s strong balance sheet, cash-generating businesses, and proven investment philosophy make it an attractive option for long-term investors seeking stability and growth potential. Over 10 years, the average return is 12.3%. This is one I’m adding to my daughter’s pension.

The passive income part

In the above example, £100 a month would grow into almost £1.2m over 46 years. Now, with all that money invested in stocks, funds, and bonds with an average yield of 5%, an investor would receive around £60,000 a year or £5,000 monthly.

Of course, there’s a caveat. £60,000 in 46 years will likely feel like £20,000 in today’s money. However, when using the ISA, this would be entirely tax free and would nicely complement a pension.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

This post was originally published on Motley Fool