There’s a handful of FTSE 100 stocks that appear undervalued. But these companies often need to provide investors with a catalyst. Something to make the market reconsider the stock’s valuation and attract investment.

Standard Chartered‘s (LSE:STAN) one such company. The stock’s surged over the past 12 months but still appears undervalued and discounted versus its banking sector peers. Adjusted for growth, it may be one of the cheapest banks out there.

The value proposition

Standard Chartered stock’s forward price-to-earnings (P/E) ratio of 8.1 times represents a 36% discount compared to its global financial peers, suggesting potential for price appreciation. This valuation’s particularly attractive considering the bank’s projected earnings growth.

Analysts forecast an average annual earnings growth of 12.1% over the next three-to-five years, resulting in a price-to-earnings-to-growth (PEG) ratio of 0.66. A PEG ratio below 1’s generally considered to indicate an undervalued stock, making Standard Chartered’s 0.66 particularly compelling, given the 2.5% dividend yield.

Comparing it with its peers

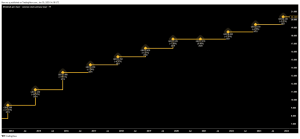

Here’s a chart comparing the P/E ratios for Standard Chartered and several international peers. It and Lloyds show the lowest P/Es, potentially indicating they’re undervalued compared to their peers. Goldman Sachs has the highest, suggesting it may be trading at a premium.

| Company Name | P/E Non-GAAP (FY1) | P/E Non-GAAP (FY2) |

|---|---|---|

| Standard Chartered | 8.11 | 7.17 |

| DNB Bank | 9.07 | 9.93 |

| Goldman Sachs | 15.6 | 13.6 |

| National Bank of Canada | 11.94 | 10.90 |

| Fifth Third Bancorp | 12.38 | 11.01 |

| First Citizens BancShares | 13.04 | 11.43 |

| JPMorgan Chase | 14.56 | 13.62 |

| Lloyds Banking Group | 8.86 | 8.56 |

CEO agrees

Speaking at the World Economic Forum in Davos, CEO Bill Winters reiterated his long-held thoughts that the company remains undervalued by the market. “We’re still trading below book value, which doesn’t make any sense to me given the returns that we’re generating”, he told Bloomberg TV.

His note on book value is even more illuminating when we consider that JP Morgan’s price-to-book ratio’s 2.3 (Standard Chartered sits at 0.75).

This view is supported by the bank’s strong performance, as evidenced by its stellar third-quarter results in 2024, where pretax profit nearly tripled to $1.72bn, beating analyst forecasts. Standard Chartered has also upgraded its income guidance for 2024, expecting growth towards 10%, and revised its outlook for 2025 and 2026.

Concerns are potentially overplayed

Standard Chartered’s emerging markets focus exposes investors to significant geopolitical and economic volatility. Developing countries face heightened risks of political instability, currency fluctuations, regulatory unpredictability, and economic turbulence.

Moreover, sudden policy changes, potential civil unrest, and macroeconomic challenges can dramatically impact the bank’s performance and investment returns in these complex markets.

Coupled with an appreciation of the dollar, these factors can hurt the bank’s earnings. However, investors have to take the rough with the smooth here. By operating in developing world economies, Standard Chartered also promises stronger growth than many of its peers.

What’s happening in February? Well, the bank’s set to unveil its full-year results on 21 February. It’s certainly on my radar and it may be a stock for investors to consider.

This post was originally published on Motley Fool