This article provides information for educational purposes. NerdWallet does not offer advisory or brokerage services, nor does it recommend specific investments, including stocks, securities or cryptocurrencies.

Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a discussion about NerdWallet’s holiday shopping report.

Then we pivot to this week’s money question from Danni, who sent us an email asking:

“Hey there, I’m searching through past episodes and I’m wondering if you’ve covered retirement plan options for self-employed people. I’m looking through the catalog and I can’t seem to find anything about that, except Roth IRA stuff. What about SEP, Simple, etc.?

Check out this episode on any of these platforms:

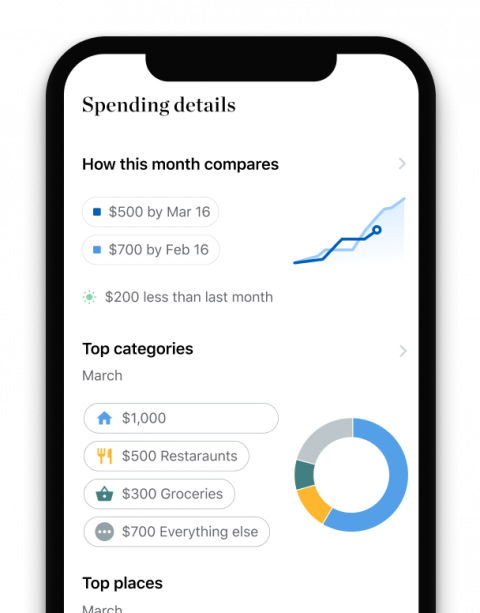

Spot your saving opportunities

See your spending breakdown to show your top spending trends and where you can cut back.

Our take

You’ve probably heard that holiday shopping this year is going to be a little unusual. The findings from NerdWallet’s 2021 Holiday Shopping Report back that up. Many Americans are concerned about supply chain issues. And some are trying out newer methods to pay for gifts, such as buy now, pay later loans. To avoid the headache of shopping online this year, you might be better off shopping locally or keeping an eye on Black Friday deals.

If you’re a self-employed worker considering your retirement plan options, take some time to research what’s available. You might be surprised by the number of options you have and the varying advantages of each. Common retirement account choices for self-employed workers include the SEP IRA, the SIMPLE IRA and the solo 401(k).

The option that’s best for your situation may depend on how many employees you have. The SEP IRA, for example, allows you to contribute up to 25% of your income or $58,000 in 2021, whichever is less. That’s a good deal more than the $6,000 contribution limit on a traditional IRA ($7,000 if you’re age 50 or older). If you have employees at your company, the SEP IRA requires that you give them contributions as well.

Our tips

-

Know your options. There are a lot of retirement account options for self-employed workers, each with its own pros and cons.

-

Get ahead of your taxes. Self-employed workers have more complicated tax situations than other workers, so stay on top of what you owe the IRS.

-

Take advantage of your opportunity to save. You may be able to save considerably more than you could as an employee in a workplace plan.

More about holiday shopping and self-employed retirement options on NerdWallet:

Episode transcript

Sean Pyles: Welcome to the NerdWallet Smart Money Podcast, where we answer your personal finance questions and help you feel a little smarter about what you do with your money. I’m Sean Pyles.

Liz Weston: And I’m Liz Weston. To send the Nerds your money questions, call or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. Or email us at [email protected] Hit that “subscribe” button to get new episodes delivered to your devices every Monday. And if you like what you hear, please leave us a review and tell a friend.

Sean: One last thing before we get into this episode. Liz and I want to hear about what you did with your money this year. Did you get super into meme stocks and make a killing? Maybe you maxed out your retirement contributions for the first time ever. Whatever you did with your money in 2021, Liz and I want to celebrate your wins for a special episode of the podcast that we are putting together.

Liz: Leave us a voicemail on the Nerd hotline. Once again, 901-730-6373. That’s 901-730-NERD. You can also send a voice memo to [email protected] We’re hoping to include as many of your actual voices as possible in this episode, but we’ll also accept a written email of your accomplishments.

Sean: OK. On with the show. This episode, Liz and I answer a listener’s question about how to save for retirement as a self-employed worker. The great news? You have lots of options, more than if you’re just a W-2 employee.

Liz: But first in our “This Week in Your Money” segment, we’re talking with personal finance Nerd Kim Palmer about NerdWallet’s 2021 holiday shopping report and how consumers should navigate this unusual holiday shopping season. Welcome back to the podcast, Kim.

Kim Palmer: Thanks for having me.

Sean: Kim, for those just getting started shopping for the holidays, where do you think they should start?

Kim: I think it always makes sense to start with a list, especially this year, because a lot of us want to start earlier than ever, and it’s so easy to forget what you’ve already purchased, to forget what your budget is, to forget even who’s on your list. Being super organized is a really important thing, even more than normal. And then if you are coordinating with anyone, if you have a partner you’re coordinating with, you want to make sure you’re on the same page and you’re not each buying gifts for the same person at the same time.

Personally, I like using something like a shared doc, a shared sheet, so we can both be editing and keeping track of what we have already purchased. The most important thing this year, too, is to be tracking prices, especially for those big-ticket items, because you don’t want to end up spending more than you intended or more than you need to because you didn’t buy at the right time.

Kim: You don’t have to do it all yourself. There’s a couple tools I really like using for this, especially if you have a few weeks that you’re shopping over, or in some cases, even months, if you started early enough. Using the Honey browser extension is really useful. It basically lets you know if there’s a lower price elsewhere. It pulls in any coupon codes. If you’re shopping on Amazon, the Camelizer browser extension tracks price history for you. You don’t have to do it all manually. You can use some tools to make your job a little bit easier.

Sean: I gotta say I’m a big fan of the Honey extension. They are not paying us to say this, but I am a big user of it. It helps me know whether what I’m about to buy is actually at the best price, so if you don’t have that on your Chrome browser, or whatever browser you’re using, I highly recommend it. Kim, I also want to ask you about holiday debt. We know a lot of consumers go into debt when they’re shopping for the holidays because they’re using credit cards, and this can get really expensive.

Kim: It can. We at NerdWallet conducted a survey with the Harris Poll of over 2,000 adults in the U.S. And we found that 29% of those surveyed who put holiday gifts on a credit card last year, so in the 2020 season, they still haven’t paid off that debt. And so it really shows you how it can just stick around and cause stress.

Sean: Holiday debt can linger. Any kind of credit card debt can be difficult to pay off, but I was really shocked in reading this report that gift buying this year is expected to result in over 2.8 billion in interest charges. And that is a huge amount of money.

Kim: It really is. I think one good place to start when you’re thinking about your budget first, see: Do you have debt right now that you’re carrying? Are you still paying off debt from last year? And that can help keep you in line. It can help give you some motivation to pay off existing debt, to avoid building up more debt this year, if at all possible. I have to say in general, using credit cards can be useful if you are paying off the balance, so they can give you extra perks. You might get additional rewards, purchase protection, maybe you’re earning cash back. And if you are avoiding paying interest by paying off the balance, that can be very beneficial. But the trouble comes when you don’t pay off the balance, and then you’re paying so much interest that it cancels out all of those benefits.

Liz: And most of us do use plastic. The survey found that most holiday shoppers will charge gifts to their credit cards. Three quarters of 2021 holiday shoppers will use credit cards to pay for gifts, charging $620 on average. But ideally you’ll have a plan to pay off those bills when they arrive.

Sean: Yeah. Right. While carrying a balance on holiday debt can make shopping for any kind of present pretty pricey, using a credit card is a smart idea when shopping for the holidays, as you touched on Kim, and one that really stands out to me is purchase protection. This is a perk that some issuers offer that can help you get your money back if an item you purchased is stolen or damaged. This can be especially helpful if you’re shopping online a lot, like a lot of people will be doing this year, and are worried about porch pirates.

Kim: That is definitely true. And I also think if you tend to shop at one particular store, say you’re buying a lot of your gifts at Target or Amazon or Walmart, you might even want to consider looking at the benefits of using that store’s credit card. And that’s because in a lot of cases you will get the largest cash back or discount possible by using that store’s credit card. In some cases with the Target RedCard, for example, not only do you get a 5% discount on your purchases, but you also get extra time to make returns, which is especially valuable around the holidays.

Liz: Oh, that’s a good point. And if people are shopping early, that changes the window for returns, so that’s something to keep in mind. Kim, can we talk a little bit about the supply chain issues? We hinted at that at the beginning, but what should people know about these issues?

Kim: What it means is you want to shop as early as possible. You don’t want to wait if you have a specific item that you want. For example, maybe for your kids, they have their heart set on a specific toy. You definitely want to grab that as soon as possible. And you might not even want to wait to see if there is a discount coming up because it might be too late by that time. The risk for people this year is just not getting what you want, and that can be stressful when you’re shopping for the holidays. One approach I love using is a hybrid of in-person and online shopping, and that’s curbside pickup. Basically you order the item ahead of time from your local shop, and then you know it’s waiting for you. You can go and pick it up. There’s no stress of worrying about empty shelves. That’s one strategy I really like, especially this year.

Sean: Additionally, we’re also seeing a continuation of the trend from last year of retailers having more rolling sales versus one big day of doorbuster deals. And we already have some roundups published on the NerdWallet site of when various retailers are having these big sales and we’ll have a link to that in this episode’s show notes post.

Liz: Let’s also talk about payment methods. We talked about credit cards, but what’s different about how consumers are spending their money this year?

Kim: One of the biggest trends we’ve seen this year is buy now, pay later, which has really taken off during the pandemic. And it basically means instead of paying up front the entire price, you’re spreading out your payments, typically over several months or even a year or longer. And we found in our survey that one in five holiday shoppers actually plan to use a buy now, pay later service to help them budget for their gifts this year and spread out those payments. What’s important to know about it is that in some cases it can be helpful, but also you still have to make those payments. And so you want to make sure that you can afford them. It’s still a form of debt. You want to make sure you understand any fees or interest that’s baked into those payments. Sometimes there really isn’t any, but sometimes there is. You want to make sure you read all that fine print really carefully.

Sean: I also want to talk about shopping local, which is another trend that we’re seeing more of this year as a way to avoid shipping delays. One tool I’ve become particularly fond of is Sook, S-O-O-K. It’s a browser extension that can connect you with local businesses that sell the items that you’re already shopping for online. And I’m also a sucker for local weekly publications. And they’ll typically publish holiday shopping guides this time of year to connect you with local small businesses that are also selling the things that you are looking for.

Liz: Oh, those are so cool. You said it was Sook? S-O-O-K?

Sean: Yeah. They’ve been emailing me daily at this point, so you won’t be able to get out once you sign up.

Liz: OK, so how are you two approaching holiday shopping this year?

Sean: Kim, you want to go first?

Kim: Sure. Number one, I’m starting earlier than ever. I have literally never purchased holiday gifts before Halloween, but I did this year. And then I’m trying to set expectations with my kids, let them know that we might not get everything we want. I think that’s important. And then also in terms of what I’m asking for, things I want, is I’m focusing really on digital gifts and not actual items that have to be shipped. For example, I have let my husband know that I would really like a monthly recipe subscription. It’s all digital. He doesn’t have to worry about any shipping problems.

Liz: Oh, that’s really smart.

Sean: I’m still sorting out what I want for Christmas, so thank you for mentioning that. I really have no idea. But in terms of shopping for people that I care for, I’m going to be using Sook, as I mentioned, and I’m also going to be taking a page out of Liz’s book and going to local craft fairs. This is counter to your advice at the top of the segment, Kim. But I’m hoping to go in with my budget in mind per person, but nothing in particular that I want for each person I’m shopping for, so I can go with the flow, see what stands out to me, and then buy things there.

Liz: I think that’s a perfectly legit approach, but I’m a belt and suspenders kind of person. I probably would have a backup gift just in case.

Sean: Yeah, that’s fair. How are you shopping this year, Liz?

Liz: I’m the kind of person who buys so early that she hides the gifts and then doesn’t find them at Christmas, or maybe doesn’t find them for another two or three years. That has happened. I’m trying to keep better track. As Kim mentioned, there are a lot of apps that help, and Santa’s Bag is one of my favorites. I love using that to keep track of where the gifts are: if they’re in process, if they’re wrapped, where I’ve hidden them in the house.

I started this time shopping all the way back in September, because I was writing a column about how there may be a coming toy shortage. Most of the toys we get come from Asia, all kinds of backups and problems. And on top of that, there was part of this that we didn’t mention, which is that a lot of people have extra cash. Parents have been getting those up-to-$300-per-child monthly payments. People are back to work and they’re making more money. There’s a lot of demand building up with all these supply issues, and that could make it even more difficult to find the items that you want.

Sean: Yeah.

Liz: Anyway, I was writing about that, so I knew to start early; and we already talked about the craft fair thing, but that’s another way to buy local and make sure that you’re spreading your money around your local community.

Sean: I think I’m going to try a little bit of what both of you are doing, starting early, checking out the craft fairs. I do not want to be in a rush a week before Christmas hoping that I can get whatever I want — because it might not be there.

Liz: There’s always gift cards. I’m one of those people that doesn’t really think gift cards are actual gifts, but this year I’ll make an exception.

Sean: Yeah, that’s fair. All right. Kim, do you have any final advice for our listeners?

Kim: My final advice is to invest some time in a little bit of organization, whether you’re using Santa’s Bag like Liz mentioned, or a Google Doc. I actually think that can end up saving you a lot of money.

Sean: Well, thank you so much for talking with us.

Kim: Thanks for having me.

Sean: And with that, let’s get on to this episode’s money question.

Liz: All right, let’s do it.

Sean: This episode’s money question comes from Danni who sent us an email. They said, “Hey, there, I’m searching through past episodes and I’m wondering if you’ve covered retirement plan options for self-employed people. I’m looking through the catalog and I can’t seem to find anything about that except Roth IRA stuff. What about SEP, Simple, etc.? Thanks, Danni.”

Well, Danni, thank you for the question, because this is giving me an opportunity to plug our sizable catalog of episodes. We have over 100 at this point. And while we talked about things like retirement plans before, there is always something new to discuss given your own personal context as a listener and a consumer, so thank you so much for sending this on.

Liz: And to help us answer Danni’s question, on this episode of the podcast we’re joined by small business Nerd Tina Orem.

Sean: Welcome back onto the podcast, Tina.

Tina Orem: Hi there. Great to be back. Thanks for having me.

Liz: Tina, it seems like people who are self-employed have some really great options to save for retirement, but we probably should talk about who is considered self-employed because it’s not just somebody running a florist job, right?

Tina: That’s right. It may surprise people to learn that they count as self-employed. The IRS says generally you’re self-employed if any of these three things apply to you: The first one is that you carry on a trade or a business as a sole proprietor or an independent contractor.

Liz: Like a gig worker.

Tina: Number two, you’re a member of a partnership that carries on a trade or a business. Or three, you’re otherwise just in business for yourself, including a part-time business. So that means if you freelance, if you’re a side-gigger, you might be able to open one of these accounts.

Sean: Can you talk about SEP IRAs and the SIMPLE IRA? Also a quick warning to listeners that we are about to dive deep into an alphabet soup of retirement account acronyms. If you have any trouble at all keeping these letters straight, check out our show notes post for this episode at nerdwallet.com/podcast, which will have links to the relevant NerdWallet articles that spell out the differences between all of these retirement options.

Tina: Whew. OK. Are you ready? All right. Well, here we go. There are basically two special IRA options to know about. That is the SEP IRA and the SIMPLE IRA. The SEP IRA, and SEP stands for simplified employee pension, is for self-employed people or small-business owners. You can put in the lesser of $58,000, or 25% of basically what you pay yourself.

Liz: Those limits are considerably higher than what you could put into a regular IRA or a Roth IRA typically. Those have limits of $6,000 a year, and you can put in another thousand dollars if you’re 50 or older.

Tina: If you want to see the chapter and verse and all of the rules, the IRS has two publications for you to check out. One is IRS Publication 560. The other one is IRS publication 4333. Anyway, the contributions are tax-deductible, but you pay tax when you withdraw the money. One other thing about the SEP IRA is that if you make contributions to your account, you have to make the same percentage contributions to all of your eligible employees’ accounts; so that can add up if you have several employees.

Liz: And what about SIMPLE IRAs?

Tina: A SIMPLE IRA — and SIMPLE is another acronym — it stands for savings incentive match plan for employees. They’re another way you could go. Can’t contribute as much though. The max is typically $13,500. People who are 50 and older can make catch-up contributions of an extra $3,000. Here’s a catch with SIMPLEs. In most cases, you do have to provide a 3% match or a 2% flat contribution to your employees. And so that can add up.

Sean: All right. Well, I’m trying to think through who these different options might be best for. What do you guys think?

Liz: Well, despite the name, a SIMPLE might not be the simplest solution. I think for most people — for most self-employed people — the SEP is probably easier. You just go to a brokerage, any brokerage, and you open a SEP IRA account, and then you find out at the end of the year how much self-employment income you have. You take 25% of that, put it into the SEP, and you’re done. You can figure that out with tax software, or a tax pro can help you find out what your contributions should be. And you have until the tax filing deadline to make that contribution, so that’s April 15th in most years. If you file an extension, it can be October 15th. Like most retirement contributions, it’s going to reduce your taxable income. It’s a win-win.

Sean: But what about if someone has employees? It sounds like with a SEP, only the employer makes contributions, but with a SIMPLE, both the employee and the employer put in money.

Liz: SEPs are probably the easiest route if you only have a few employees or if your business income fluctuates a lot. Where SIMPLEs start to make sense is where you have more employees and a steadier income. But it could get pretty technical. That’s why we send people to the tax pros to talk about this because with employees, the rules can get pretty complicated pretty fast.

Sean: Yeah, this is already quite technical. And just to add some more numbers and letters into the mix, people can also have solo 401(k)s, right? How do those work, Tina?

Tina: That’s right. Another option is the solo 401(k). It’s also called a one-participant 401(k). And these are basically 401(k)s for self-employed business owners who have no employees. You can put up to $58,000 into these accounts, and an extra 6,500 bucks if you’re 50 or older. But there are some detailed rules about how you make the contributions, and these are generally a little more complicated than SEPs and SIMPLEs. But I’m trying to keep this brief, so I’ll save that all for another day. One downside is that you can’t contribute to these accounts if you have employees who aren’t your spouse.

Tina: And those are the big three: SEP, SIMPLE, and solo. And I know I’ve run through them super fast at a super-high level, so if there’s only one thing that you can take away from this conversation, it should be that you have options. And there are even more options out there than the three S’s. There’s pensions, there’s employee savings plans, profit sharing plans, money purchase plans, employer-sponsored emergency savings accounts even. It’s a good idea if you’re going to do this, see a tax advisor or a financial advisor who specializes in small businesses. That can be a really good idea here.

Liz: That’s especially important if you are thinking about a pension. And when we say pension, we mean traditional defined benefit. The kind that they used to have that sent out a check every month to retirees. You could put a ton of money into a traditional pension. If your business is doing really, really well, you might want to look into it. The downside is they’re super expensive. They are expensive to set up. They’re expensive to administer. This would be something to check out if you are making six figures and above.

Sean: It’s clear that self-employed workers have a lot of different options. And Tina, you mentioned folks talking to tax or financial advisors, which is something we recommend a lot. But for people who maybe don’t want to do that or know that they won’t do that, how do you think they can tell which one might be quote-unquote “best for them”?

Tina: One big thing to think about is whether you have employees, because that can affect which plans are open to you and what your obligations are. Another thing to think about is that these plans all have various administrative requirements, and so time and effort may be another factor in your decision process.

Sean: And what about having multiple retirement accounts? I have my 401(k) through work and I also have my Roth IRA. Is it possible for self-employed workers to do this too?

Tina: It’s possible. It’s just a complicated area. And so again, you should see a tax pro to make sure you’re doing things correctly. One thing on my mind, for instance, is that there are various contribution limits that you have to adhere to. And when you’re self-employed, some of the money that you put in your account may be classified as an employee contribution, for example, and some may be classified as an employer contribution. It can get technical.

Liz: Are there any particular issues that self-employed workers should prepare for when it comes to retirement that non self-employed workers don’t have to worry about?

Tina: Yeah. You’re going to have a more complex tax situation, so you should be sure that your tax preparer understands how to deal with your retirement plan and plan contributions. And because of that, the cost of having your taxes done every year and filing the compliance paperwork, it might be higher too. Another thing is you should be sure you know how much you can contribute to your retirement accounts and to your employees’ accounts. When you’re an employee, typically the HR department might alert you if you’re about to over-contribute to your plan or make some sort of error. But when you’re self-employed, you’re the only you you’ve got. It might be pretty easy to over-contribute or under-contribute when there are fewer guardrails in place to alert you in time.

Liz: Yeah. And the IRS really does not like over-contributions. But you definitely can have a plan at work and one for a side business. We have a 401(k) at work at NerdWallet, but my husband and I also have a side business with SEPs. For us, the SEP is easiest. It allows us to contribute more, and it reduces our tax bill, which is always nice.

Sean: It seems like self-employed workers have a lot more to figure out when it comes to sorting through their retirement options and how to even manage their contributions. But I’m wondering if there are any unique opportunities for self-employed workers when it comes to their retirement planning.

Tina: Yeah. Some of the upside is that you might be able to stash away more than the typical $19,500 limit that people have if they’re just W-2 employees at a company that offers a 401(k). That’s one upside. Another opportunity, and this isn’t actually really necessarily limited to self-employment retirement plans, is that your contributions can be tax-deductible, so that can lower your tax bill by saving for retirement.

Sean: Well, Tina, any final thoughts on this topic, which admittedly is pretty technical and complicated.

Tina: I guess I would just say you’d have options. You can save some money here. You can enhance your retirement with some of these plans, and it’s worth the time and effort to just talk with a pro about it.

Sean: All right. Well, thank you so much for talking with us.

Tina: Thanks. Anytime.

Sean: And with that, let’s get on to our takeaway tips. And Liz, do you want to kick us off?

Liz: My pleasure. First, know your options. There are a lot of different retirement accounts for self-employed workers, each with their own pros and cons.

Sean: Next, get ahead of your taxes. Self-employed workers have more complicated tax situations than other workers, so stay on top of what you owe the IRS.

Liz: Finally, take advantage of your opportunity to save. You may be able to save considerably more than you could as an employee in a workplace plan.

Sean: And that is all we have for this episode. Do you have a money question of your own? Turn to the Nerds and call or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. You can also email us at [email protected] and visit nerdwallet.com/podcast for more info on this episode. And as always be sure to subscribe, rate and review us wherever you’re getting this podcast.

Liz: And here’s our brief disclaimer, thoughtfully crafted by NerdWallet’s legal team. Your questions are answered by knowledgeable and talented finance writers, but we are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes, and may not apply to your specific circumstances.

Sean: And with that said, until next time, turn to the Nerds.

This post was originally published on Nerd Wallet