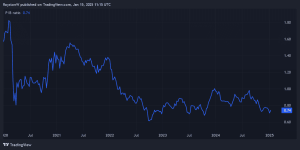

I have reconciled myself to the possibility that Aviva (LSE: AV) shares may never again decisively break the £5 price barrier. The last time it did so was in the second half of 2018.

However, I am reassured in continuing to hold my stake in the insurance, savings and investment firm by two key factors.

The first is that I bought it primarily as a stock to generate passive income. This is money made with minimal effort, most appositely in my view from dividends paid by shares. Such income can make life a lot better in the short term and can allow for an early retirement. Crucially in this context, the yield that generates passive income rises if a stock’s price falls.

The second is there is every reason for me to think Aviva’s share price might also rise at some point. A risk here is the intense competition in its sector that may squeeze its profits. However, it remains technically very undervalued, and its planned acquisition of Direct Line should add value. Anyway, hope is a wonderful thing.

Passive income generation

In 2023, Aviva paid a total dividend of 33.4p, yielding 7.1% on the current £4.68 share price.

£11,000 is the average UK savings amount and investors considering taking such a stake in Aviva would make £781 in first year dividends.

Provided the yield averaged the same, this would increase to £7,810 after 10 years and to £23,430 after 30 years.

Yields change frequently along with a firm’s share price and annual dividend payments, as mentioned. For Aviva, analysts forecast its dividend will increase to 34.2p in 2024, 37.5p in 2025, 40.1p in 2026 and 41.9p in 2027.

These would give respective yields of 7.2%, 7.9%, 8.5% and 8.9%.

Turbocharging that passive income

I always use the dividends paid by a stock to buy more of it – a standard investment practice known as ‘dividend compounding’.

Doing this on the current 7.1% yield, would generate £11,327 in dividends over 10 years, not £7,810. And after 30 years on the same basis, the dividends would be £80,984 rather than £23,430.

Including the £11,000 initial investment and the Aviva holding would be paying £6,531 a year in passive income from dividends!

Making something from nothing in the bank

I find a common misconception is that a lot of money is needed before any big returns can be made. This is simply not true.

For example, just foregoing that extra fancy coffee or pint of lager nowadays can save someone £5 a day.

Continuing to invest only that saving (£150 a month) in Aviva shares can generate £8,415 in dividends after 10 years. This is on the same twin bases as before – a 7.1% average yield and using dividend compounding.

After 30 years on the same basis, the dividends paid would have swelled to £134,856. By that point, this would be paying £9,575 a year in passive income from dividends.

None of that is guaranteed, and anyway, inflation would diminish the buying power of that money somewhat by then, of course. However, it underlines that big returns can be made from much smaller initial investments, especially using dividend compounding.

Indeed, the Aviva holding could be paying for a lot of coffees and lagers – both icy cold – on a beach somewhere beautiful by 2055.

This post was originally published on Motley Fool