Last year, billionaire investor Warren Buffett famously compared artificial intelligence (AI) to nuclear weapons. Like letting a genie out of a bottle, he fears the technology could have disastrous and irreversible effects.

When the first nuclear weapon was tested in 1945, he was 15 years old and had already been investing for four years. Regardless of that, his track record means It’s safe to say his words shouldn’t be taken lightly.

But like it or not, AI isn’t going away. By now, it’s so deeply embedded in all aspects of society that any attempt to ‘rebottle the genie’ would likely fail. One thing I’ve learned in my 40-odd years is that there’s no point standing in the way of progress.

So rather than fear an imminent AI meltdown, I’m doing what any good investor would do and searching for opportunities.

Hidden value

AI stocks are a plentiful these days, so it’s important to separate the wheat from the chaff. The trick is to avoid value traps while identifying true innovators.

Some may assume the obvious options are semiconductor giants — Nvidia, Broadcom, and AMD. In some ways, yes. After all, they’re the ones “selling shovels in a gold rush“, that is, providing the tools to power AI models.

But while that may be true, I think there are more lucrative opportunities elsewhere.

If Buffett’s right and AI is more nuclear than gold, we’ll need security not shovels. That’s where the world’s third-largest cybersecurity firm comes in.

Fighting fire with fire

Even the brightest minds in AI have admitted that they “don’t really know how it works“.

That’s by design. It wouldn’t be very intelligent if it was just following instructions. As hackers increasingly adopt it to streamline their attacks, only AI-enhanced security will be fast enough to respond effectively.

Fortinet‘s (NASDAQ: FTNT) one of the companies at the forefront of developing AI-enhanced cybersecurity. Its FortiAI generative AI assistant is aimed at automating tasks to help analysts rapidly respond to threats and develop pre-emptive defence strategies. According to the company, it can “adapt and evolve, continuously learning from new data and improving its ability to identify and counter emerging threats”.

But if 2024 has taught us anything, it’s that even the world’s toughest security giants are vulnerable. In September last year, Fortinet revealed it had suffered a data breach on a third-party cloud drive. The hacker reportedly demanded a ransom and released 440GB of confidential data when the company refused.

In this instance, the breach was small but a bigger one could cause a lot of reputational – and financial – damage. When you’re responsible for the world’s data, a slight error can be devastating. Just ask Crowdstrike.

Solid performance

With a profit margin of 36% and return on equity (ROE) of 168.5%, its recent performance speaks for itself. In the latest Q3 2024 results, revenue and profits exceeded analysts’ expectations by 1.9% and 58% respectively.

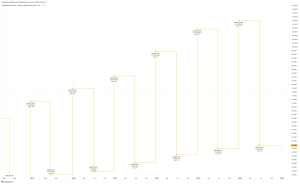

Based on future cash flow estimates, the $96 shares are trading at 30% below fair value. Currently, at around 48 times earnings, that price initially seems a bit overvalued. But that ratio’s only slightly above the industry average for US software companies.

So while Apple, Meta and Amazon dominate the headlines, I think Fortinet could emerge as a dark horse in the race for the AI crown.

This post was originally published on Motley Fool