Vanquis Banking Group‘s (LSE:VANQ) a dividend stock that caught my eye over Christmas. I noticed that the sub-prime lender was listed as the 11th best on the FTSE All-Share index for passive income.

But these league tables need to be treated with caution.

As nobody’s able to predict future payouts with any certainty, yields tend to be calculated on a historical (‘trailing 12 months’) basis. And using this methodology, having returned 6p to shareholders over the past year — and given its current (8 January) share price of 48.95p — it’s fair to say that the bank’s stock is, indeed, yielding 12.3%.

Bad news

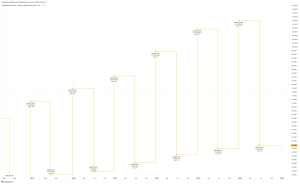

But in March 2024, the bank’s shares halved in value after it said it had received an increase in complaints and that the “associated costs are likely to materially impact the Group’s profitability in 2024”.

The directors immediately cut the dividend for 2024 to 1p. Therefore, based on the company’s current share price, the ‘true’ yield’s a more modest 2.1%.

With the company promising only “measured progression in 2025”, it’s likely to be several years before the bank’s in a position to return (in cash terms) to its previous level of dividend.

However, although the stock’s status as a dividend share has been tarnished, I wonder whether it could be an excellent growth share for me.

A specialist lender

Vanquis provides finance to those with a “less than perfect credit history”. Due to the increased risk of default, its lending rates are high. For example, its credit cards have an APR of 37.9%.

At first sight, this feels like the most vulnerable are being exploited. But it’s estimated that 3m people borrow on the black market where there’s no regulation and interest rates are far higher.

By charging more, the bank’s able to earn a higher margin than rivals. During the first six months of 2024 (H1 24), it reported a net interest margin of 18.8%. Lloyds Banking Group’s was 2.94%.

However, these margins are reported before potential bad debts and loan write-offs. And this is where Vanquis has a major problem. During H1 24, these accounted for 43% of total income.

A different approach

To counter this, the bank‘s transitioning to a new business model. At the moment, most of its 1.7m customers are described as “under financial pressure”. Vanquis is now looking to expand into the “stretched but managing” cohort.

And to help further manage the risk of default, it plans to adopt a new money management app called ‘Snoop’. This uses artificial intelligence (AI) and open banking data to help users control their spending. It reckons the average customer can save £120 a month with the product.

In future, these savings will be used to help those customers in financial difficulty. Until now, bad loans would’ve been written-off with a negative impact on the bank’s bottom line. Under this new approach, an impairment charge is avoided helping to maintain earnings. In this situation, the bank claims “everybody wins”.

I think the new strategy being pursued by Vanquis is an interesting one. But I think it’s a little too early to tell whether it’s going to work. I’m therefore going to watch how the bank performs over the next six months or so before revisiting the investment case later in 2025.

This post was originally published on Motley Fool