The best-performing share of the whole FTSE 100 index last year was aeronautical engineer Rolls-Royce (LSE: RR). Fast-forward to 2025 and has that huge growth in the value of Rolls-Royce shares gone into reverse?

As if.

In fact, the Rolls-Royce share price has soared So far this year, it is up 93%. Compared to 5% for the FTSE 100 as a whole, that is outstanding performance – again.

What’s driving the share price gain

To unpick the reasons behind this soaring price, I think it is useful to consider a few different factors.

One is customer demand. After a very difficult time due to government-imposed travel restrictions and weak consumer demand during the pandemic years, airlines have been struggling to meet soaring demand, meaning they have been servicing planes and ordering new ones.

Making aircraft engines is a difficult and costly business, so there are high barriers to entry. That gives the few dominant players, such as Rolls-Royce, pricing power.

Another factor has been performance beyond the core civil aviation division. European governments have increased military budgets, helping Rolls’ defence division. Meanwhile its nuclear power generation expertise is coming increasingly into demand.

But there have been internal factors at play too. Since the start of last year, new management has set very aggressive growth targets. So far, business performance has been strong. I think that, if Rolls-Royce continues to look on track to meet or even beat those targets, its share price could move up further even from here.

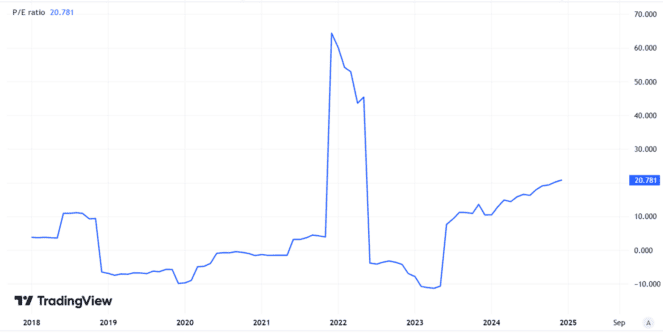

The current price-to-earnings (P/E) ratio of 21 may look high today (for my tastes, at least). However, if earnings grow strongly — as the company’s strategy suggests they could — the prospective P/E ratio looks to me as if it may actually still be potentially cheap from a long-term investor’s perspective.

Created using TradingView

Potential for further gains – but no guarantees

The thing that puts me off investing in Rolls-Royce – and I have no plans at the moment to buy the shares – is what else might happen.

For example, what if the ambitious growth plan fails?

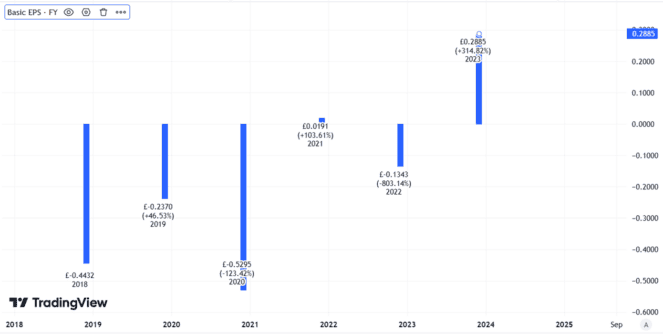

Rolls has a history stretching back decades of mixed performance. Look at its roller-coaster earnings per share, for example.

Created using TradingView

Its business involves large fixed costs and projects with timelines that can shift dramatically due to external factors like airframe manufacturers pushing back launch dates.

I think the current price of Rolls-Royce shares reflects investor hopes that the company will deliver on its plans. So if that does not happen, I expect the share price could fall.

Another significant but external factor that, again, Rolls has struggled with for decades is civil aviation demand shocks outside its control. The pandemic was just the latest in a long line of such shocks, from the 2001 US terrorist attacks to volcanic dust clouds grounding European aviation.

I see a risk of some such event throttling demand again at some unknown future point.

The current Rolls-Royce share price does not offer me enough margin of safety to compensate for such risks, as far as I am concerned.

This post was originally published on Motley Fool