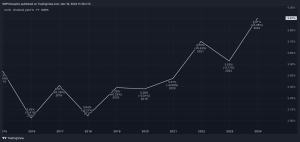

At first glance, the FTSE 100‘s had a so-so 2024. It’s up nearly 5% year to date, as I write.

However, that doesn’t tell the whole story. Include dividends and the blue-chip index’s total return is more like 8.25%.

Admittedly, some might not see that as particularly impressive, especially when the S&P 500 has returned over 25% with dividends. Meanwhile, the tech-packed Nasdaq is up 30% year to date without dividends!

But for the FTSE 100, which is almost devoid of technology stocks in the technological age, 8.25% is decent, in my opinion. Especially when its oil and mining stocks have had a rough year.

What might 2025 bring?

The FTSE 100 turned 40 years old in 2024. This means the index is quite long in the tooth, though still a spring chicken compared to some centuries-old UK firms!

It’s also seen a fair few governments come and go. In fact, the general election of 2024 was the 10th since the index was formed.

I’ve been looking at how the FTSE 100 has done in the year following an election. Naturally, past performance is no reliable indicator of what’ll happen in future. But it’s still interesting to consider.

Looking at the data, most post-election years have seen positive returns, particularly when the broader economy is stable. This is what we have today, with the Organisation for Economic Co-operation and Development (OECD) recently upgrading its 2025 growth forecast for the UK economy to 1.7% from 1.2%.

The exceptions were 2002 (when the index fell 24.3%), 2011 (-5.5%), and 2020 (-14.3%). However, these post-election years align with major external crises (the dot-com crash, eurozone debt crisis, and global pandemic, respectively).

With over 75% of FTSE 100 company sales coming from abroad, the index is sensitive to international goings-on, particularly in major economies like China.

The good news is that the OECD projects global GDP growth of 3.3% in 2025. Barring a financial crisis or black swan event then, history suggests 2025 will likely be another positive year for the FTSE 100.

A stock I’m considering

One falling Footsie share that’s caught my attention is Ashtead Group (LSE: AHT). The equipment rental firm’s share price has plunged 20% in December.

This came after the company, which operates as Sunbelt Rentals, delivered a profit warning on 10 December due to weaker local construction activity in its key US market.

For the full year, rental revenue is now expected to grow by 3-5%, rather than earlier guidance of 5-8% growth. That said, it does expect free cash flow of $1.4bn, up from $1.2bn, due to lower full-year capital expenditure.

Ashtead said higher interest rates are taking their toll on construction. If rates don’t come down in 2025, there’s a risk that trading could weaken further.

However, the longer-term growth outlook looks attractive. As governments ramp up spending on crumbling infrastructure in the US and UK, Ashtead is well-positioned to capitalise on the rising demand for rental equipment.

As the firm reminds us, its equipment can be used to “lift, power, generate, move, dig, compact, drill, support, scrub, pump, direct, heat and ventilate — whatever is required.”

I already have a decent-sized position. But I think this dip might be a good opportunity for me to buy more Ashtead shares in January.

This post was originally published on Motley Fool