NatWest Group‘s (LSE:NWG) been one of the best-performing FTSE 100 shares of 2024. The big question for investors now is whether or not it can do it again next year.

Let there be no suspense – I’m doubtful. In general, share prices go up for one of two reasons and I’m not convinced either’s likely to apply to NatWest in 2025.

Why stocks go up

In general, stocks go up for two reasons. Either the underlying business increases in value or investors put a higher value on the company’s existing assets. NatWest’s shares benefited from both in 2024. The bank’s earnings per share reached some of their highest levels since before the pandemic.

NatWest Earnings per Share 2019-24

Created at TradingView

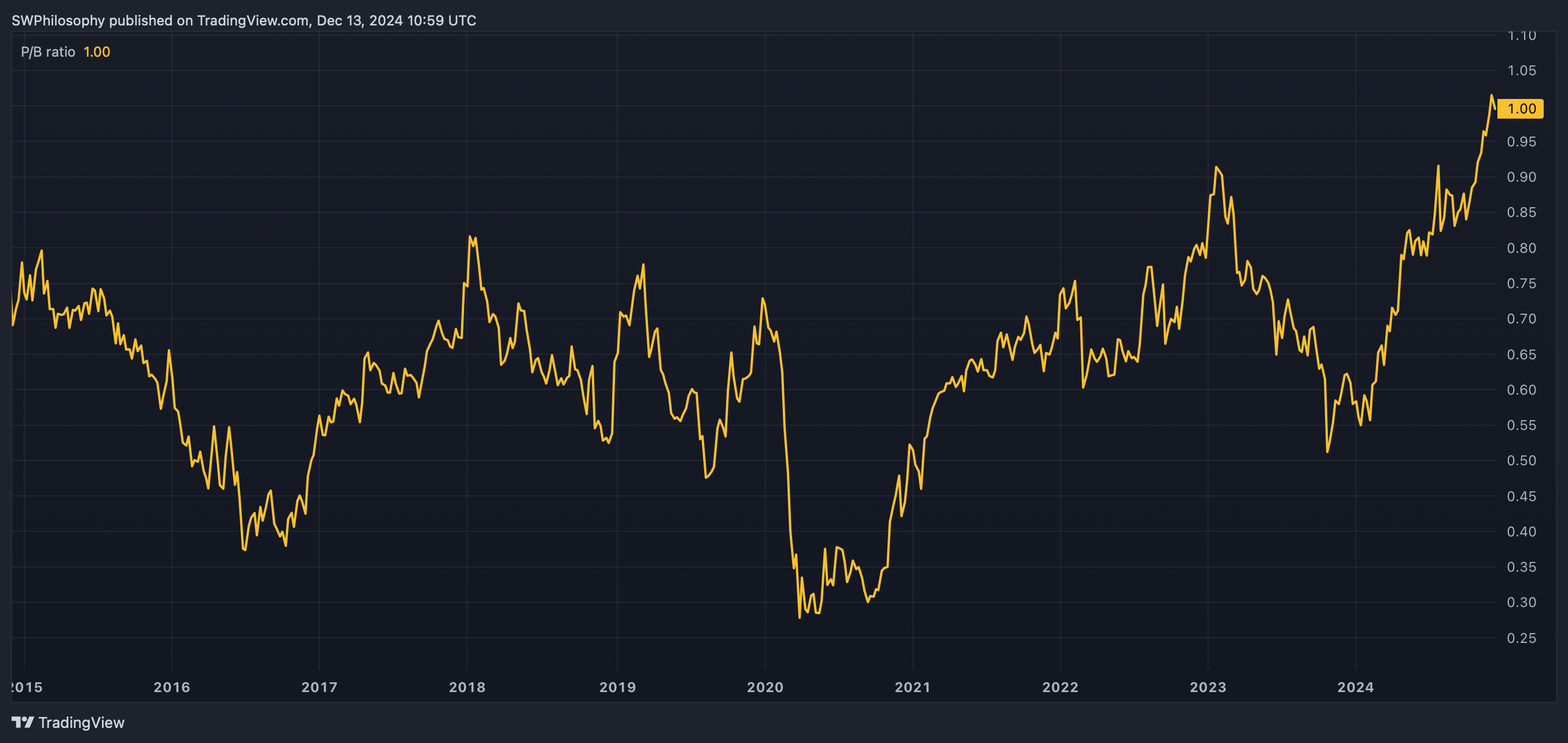

On top of this, the price-to-book (P/B) multiple the stock trades at has increased from 0.6 to 1. Together, these two factors have caused the share price to climb 88%.

My suspicion however, is that this combination of growth and multiple expansion’s unlikely to be repeated in 2025. And that makes it less likely the stock will outperform the FTSE 100 next year.

Growth

A lot of NatWest’s success over the last year has been due to interest rates being unusually high. This has allowed it to achieve unusually good returns on its loans.

Throughout 2024, the bank’s managed to keep its net interest margin (the difference between the interest it pays and the interest it receives) above 2%. But this will be a challenge in 2025.

The Bank of England has been lowering interest rates, which should cause lending margins to contract. While the effect of this might not be immediate, I expect it to limit potential growth.

I don’t expect rates to come down to where they were in 2021, and I’m not too worried about profits falling. But I also don’t anticipate the same level of growth it achieved this year.

Valuation

The bigger issue, in my view, is valuation – a P/B multiple of 1’s unusually high for NatWest. In fact, the stock hasn’t traded at that level in the last 10 years.

NatWest P/B ratio 2014-24

Created at TradingView

It’s a fair point that the bank’s probably in a better state than it has been at any point since 2014. For one thing, the UK government’s stake in the business has been reduced significantly.

Nonetheless, I think it’s a big ask for the P/B multiple to expand further in 2025. A similar increase to 2024 would mean the stock traded at 1.66 times book value. The stock already trades at a higher multiple than Barclays (0.5) or Lloyds Banking Group (0.7). And while those banks have challenges of their own, I’m not sure NatWest is that much better.

2025 outlook

I’m not expecting NatWest to outperform the FTSE 100 next year. The stock’s been boosted by higher interest rates and an expanding valuation, but I think the effects of these have played out.

Of course, investing’s about more than the next 12 months. But with the stock at an unusually high multiple, I think there are better opportunities elsewhere for me while the business catches up.

This post was originally published on Motley Fool