The US might have a monopoly on artificial intelligence (AI) but there are still a few FTSE 100 shares that could benefit. Sure, the British aren’t big on building semiconductor chips or developing generative AI tools. Yet local businesses are finding ways to harness the groundbreaking tech in powerful ways.

By integrating advanced AI solutions into their day-to-day operations, UK companies are beginning to discover the true potential it has to offer. So here are a few worth considering.

Sage

One of the leading AI-driven growth companies in the UK is Sage (LSE: SGE). Many people will know the British software company for its popular accounting and payroll solutions. Several years ago it enthusiastically started exploring AI’s capabilities and now those efforts look to be paying off. Its most recent development, Copilot, is an assistance tool that helps finance teams rapidly identify common issues like budgeting errors.

The share price jumped 20% recently after it posted promising full-year 2024 results. Organic sales were up 9.2% with a 22% increase in cloud-native revenue. It also announced a £400m buyback programme.

But the rapid growth means the price could now be overvalued. At over £13, it’s 40 times earnings per share (EPS), which puts it at risk of short-term losses. Investors that bought last month will be happy but new buyers may have missed the best returns this month.

Still, I think it looks well-positioned to reap the benefits of AI in the long term.

The festive season has squeezed me dry but I plan to buy the stock as soon as I have cash again next month.

Rolls-Royce

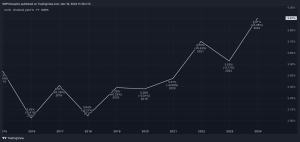

One of the biggest winners of the past two years has been Rolls-Royce (LSE: RR.), up 526% since 1 January 2023.

The aerospace engineer may not immediately seem like a company to benefit from AI. However, it’s been aggressively finding ways to optimise operational efficiency with the technology. Notably, it’s using AI sensors embedded in jet engines to enhance its maintenance monitoring systems. This reduces costly unscheduled downtime, improves safety and boosts airline efficiency.

It’s also partnered with Google for the development of a system to guide maritime ships autonomously using AI.

The company’s been working hard to improve its balance sheet since Covid but liabilities still outweigh assets. The cost of servicing debt could restrict its performance. This risk is further impacted by the cyclical nature of the aerospace industry, supply chain disruptions and potential interest rate hikes.

However, it’s managed to reduce its total debt from £7.7bn in 2022 to £5.7bn today. In the same period, gross profit’s grown from £2.75bn to £3.62bn.

I already have exposure to Rolls-Royce via a FTSE 100 fund but for investors looking at AI, it’s worth considering.

Alternative AI stocks

Other UK-based AI stocks to consider include Kainos, which works closely with US software giant Workday, and Softcat, an IT company with an AI focus. Polar Capital Technology Trust‘s a UK-listed fund that holds shares in some of the leading US AI stocks. Think Nvidia, Microsoft, Meta, Apple and Alphabet (Google).

However investors choose to allocate their funds in 2025, AI’s likely to feature somewhere. Set to revolutionise everything from mining to medicine, there may come a time when every investment is an investment in AI.

This post was originally published on Motley Fool