Is it realistic to dream of becoming a stock market millionaire? Even starting with zero, I think it is credible to aim for a million, although I think that takes a long-term approach to the stock market and also money to invest.

But what is the right approach?

Some people aim to find the ‘next big thing’ and hope that they will stumble on a Tesla or Nvidia before the share price soars.

But if finding the next big thing was easy, the army of well-paid professionals who aim to do just that would be finding it with more regularity than they do! For every promising company that turns into an incredible success, there are lots that fall by the wayside.

So, how am I aiming for a million?

I am not looking for new companies. I am not focusing on emerging sectors of the economy. I am not necessarily even looking for big growth prospects.

Instead I am looking for ‘unexciting’ companies that tick over quietly year after year, churning out profits.

Doing the maths

What does it take to aim for a million?

Imagine I invested £800 every month and was able to grow it at a compound annual rate of 12%.

After 23 years I would have a portfolio worth over £1m.

Yes, 23 years is a long time. But I am a long-term investor – and for £800 a month, I think seven figures in that timeframe is a solid return!

How to earn 12% per year over the long run

A return of 12% might not sound like a lot to aim for. But remember – that is a compound annual growth rate, meaning it includes the bad years as well as the good ones.

This is where I think focussing on solid, long-term performers in the stock market can really pay off.

Take Ashtead Group (LSE: AHT) as an example.

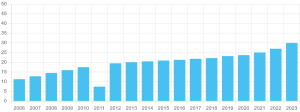

Over the past year, the Ashtead share price has soared 33%. That is not a one-off: its long-term performance is also impressive. Over five years the growth has been 170%.

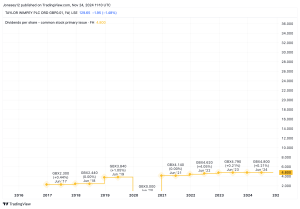

On top of that, the dividend yield is 1.3%. Small beer, perhaps, but compound annual growth includes dividend income as well as share price movement. Also, if I had bought at the lower price five yeas ago, I would currently be earning a markedly higher yield of 3.5%.

Does that mean I ought to buy the FTSE 100 rental firm for my portfolio now?

Not necessarily.

I do still like its industry focus, as I expect construction firms will need to keep renting equipment in years to come, though I do see a risk that a weaker economy could hurt demand. I also like Ashtead’s US business as it gives it big economies of scale. Plus its business strategy, which has performed so well, continues to impress me.

But after that leap in the Ashtead share price, the valuation attracts me less. I find the company’s price-to-earnings ratio of 22 too rich for my appetite.

But, as I aim for a million, I am looking for similarly unexciting, well-established, and proven businesses — but at a more exciting valuation!

This post was originally published on Motley Fool