The FTSE 100 lists some of the UK’s biggest companies. Yet there are some huge London-listed growth stocks that aren’t on the index. That’s because specific listing rules make it impossible for certain stocks to join. Some reasons why include being incorporated abroad, lacking liquidity, or being denominated in another currency.

However, a recent shake-up of the rules means some previously unwelcome stocks now have a chance to join the FTSE. One specific change is the merging of standard and premium listings into a single category. Previously, standard listings were not eligible as they didn’t comply with the higher standards of the UK Corporate Governance Code.

In July, the Financial Conduct Authority (FCA) eased the rules in an attempt to reinvigorate the UK stock market.

Subsequently, a massive £28.6bn company that’s been on the London Stock Exchange (LSE) since 2019 might soon join the FTSE 100.

Coca-Cola Europacific

Coca-Cola Europacific Partners (LSE: CCEP) manufactures and distributes Coca-Cola and other drinks that fall under the Coca-Cola brand, such as Fanta, Sprite, and Schweppes. Besides the UK, it operates in a further 30 countries in Europe and Asia Pacific, including France, Germany, Australia, and Indonesia.

In October, the company announced it would transfer its UK listing to the new Equity Shares (Commercial Companies) category, making it eligible for the FTSE 100 during the December review. If everything goes ahead as planned, it’s expected to join the index in March 2025.

The stock’s currently traded in euros at a price of around €73 per share. It’s a steadily growing stock that’s up 63% over the past five years, equating to annualised growth of 10.29% a year.

What’s it worth?

Value-wise, the price looks fair, at 18 times forward earnings. It’s also 1.8 times sales, which is okay but ideally could be lower. The stock’s debt-to-equity ratio’s a bit high, at 1.23, and the net profit margin is a bit low, at 8.42%.

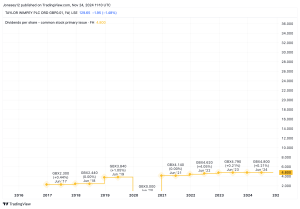

It has a decent dividend yield of 2.7% that’s well-covered by earnings, with a 55% payout ratio. Overall, it seems like a fairly stable company with the potential for moderate returns.

In its first half of 2024 earnings call, revenue increased 9.5% while earnings slipped 6.7%. The profit margin also decreased slightly by half a percentage point due to higher expenses.

A steady earner

Revenue’s forecast to increase at a rate of 5.5% a year or the next three years. However, inflation and a tightening economy present some risks, as cash-strapped consumers turn to cheaper alternatives. This is already evident in regions facing financial struggles, where expensive soda may be viewed as an unnecessary luxury.

If it loses market share to cheaper brands in these areas, profits could take a hit.

However, people are unlikely to stop buying Coca-Cola brands entirely. I don’t expect revenue to take a big hit. At the same time, I don’t expect the company to deliver outstanding returns in the immediate future either.

It looks like a good option to consider as part of a defensive portfolio aimed at slow, steady growth. But I already have enough exposure to those stocks in my portfolio, so I don’t plan to buy the stock if it gets a place in the top-tier index.

This post was originally published on Motley Fool