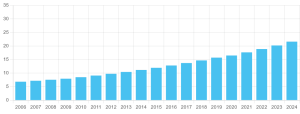

2024 is proving to be a truly miserable year for FTSE 100 share JD Sport Fashion (LSE:JD.).

On 4 January, JD got things off to a stinker with a shock profit warning that sent its share price tumbling. After a solid recovery, the retailer plunged again from late September, in part due to fallout from October’s UK Budget.

And it’s struck a fresh nadir for 2024 today (21 November), with another chilly trading statement sending its shares below 100p. At 96.5p, JD is down 15% in Thursday business, and 40% for the year to date.

I’m wondering though, if this year’s price collapse represents an attractive dip-buying opportunity for long-term investors like me. Let’s take a look.

Forecasts cut

More recently, JD’s been battered by a toxic mix of poor weather, higher promotional activity, and weak consumer spending ahead of the US presidential election.

At group level, like-for-like sales dropped 0.3% in the 13 weeks to 2 November, the business said.

In the UK, corresponding revenues dropped 2.4% year on year, while in the US sales declined 1.5%. Combined, these territories make up two-thirds of group sales.

Sales in Asia Pacific dropped by an even-sharper 3.8%. However, strength in Europe provided some rare consolation, with revenues rising 3.5%.

JD’s weak third-quarter result means it now expects full-year profits “at the lower end” of its guidance. Profit before tax and adjusted items are tipped at £955m to £103.5m, though still up from £917.2m last year.

Cheap on paper

JD clearly has a challenge to navigate what it describes as a “volatile trading environment.” Consumer spending remains weak in key markets. And it faces higher costs following the Budget, with its National Insurance contributions set to rise, and changes to the Minimum Wage pushing up staff expenses.

However, could all this be reflected in the company’s rock-bottom valuation? At today’s price, the retailer trades on a forward price-to-earnings (P/E) ratio of 7.4 times. This is far below the FTSE 100 average of 14.2 times.

Meanwhile, JD shares trade on a prospective price-to-earnings growth (PEG) ratio of 0.9. A sub-1 figure implies that share’s undervalued relative to expected profits.

That said, these figures are based on predicted earnings growth of 8% this year. City forecasts could be slashing their growth forecasts following today’s update.

A top buy?

On balance, I think today’s plunge below 100p could represent an attractive level for me to open a position.

This is because I invest for the long term. And over this timescale, things continue to look good in my opinion for JD and its share price.

Despite current turbulence, demand for athleisure products is tipped to grow further this decade in response to changing lifestyles. Grand View Research expects compound annual market growth of 9.3% between now and 2030.

It’s a market that JD’s a leader in thanks to its strong branding and tight working relationships with premium brands like Nike and Adidas. And encouragingly, the FTSE firm continues rapidly expanding to maximise this opportunity. It opened another 79 stores across the globe in the third quarter.

I’ll be looking to add some shares to my portfolio in the coming days.

This post was originally published on Motley Fool