The Halma (LSE:HLMA) share price is up 10% on Thursday (21 November) after the firm’s interim report. And it’s not hard to see why.

The latest update was impressive, with strong growth in both revenues and profits. And that has investors feeling good about the stock overall.

Results

For the six months leading up to the end of September, Halma’s revenues came in at £1.07bn. That’s a 13% increase compared to the year before.

Of this, around 11% came from organic growth with the rest coming through acquisitions. The company completed four of these for a total of £85m, which it outlined in its September update.

The strongest performance was in the Environment segment, which accounts for 33% of total revenues. This grew 27%, while Safety managed 11% and Healthcare grew 1%.

Earnings per share were 36p, which was up 15%. On an adjusted basis – leaving out one-off costs and amortisation expenses – the figure was 43p, implying 17% growth.

Analysis

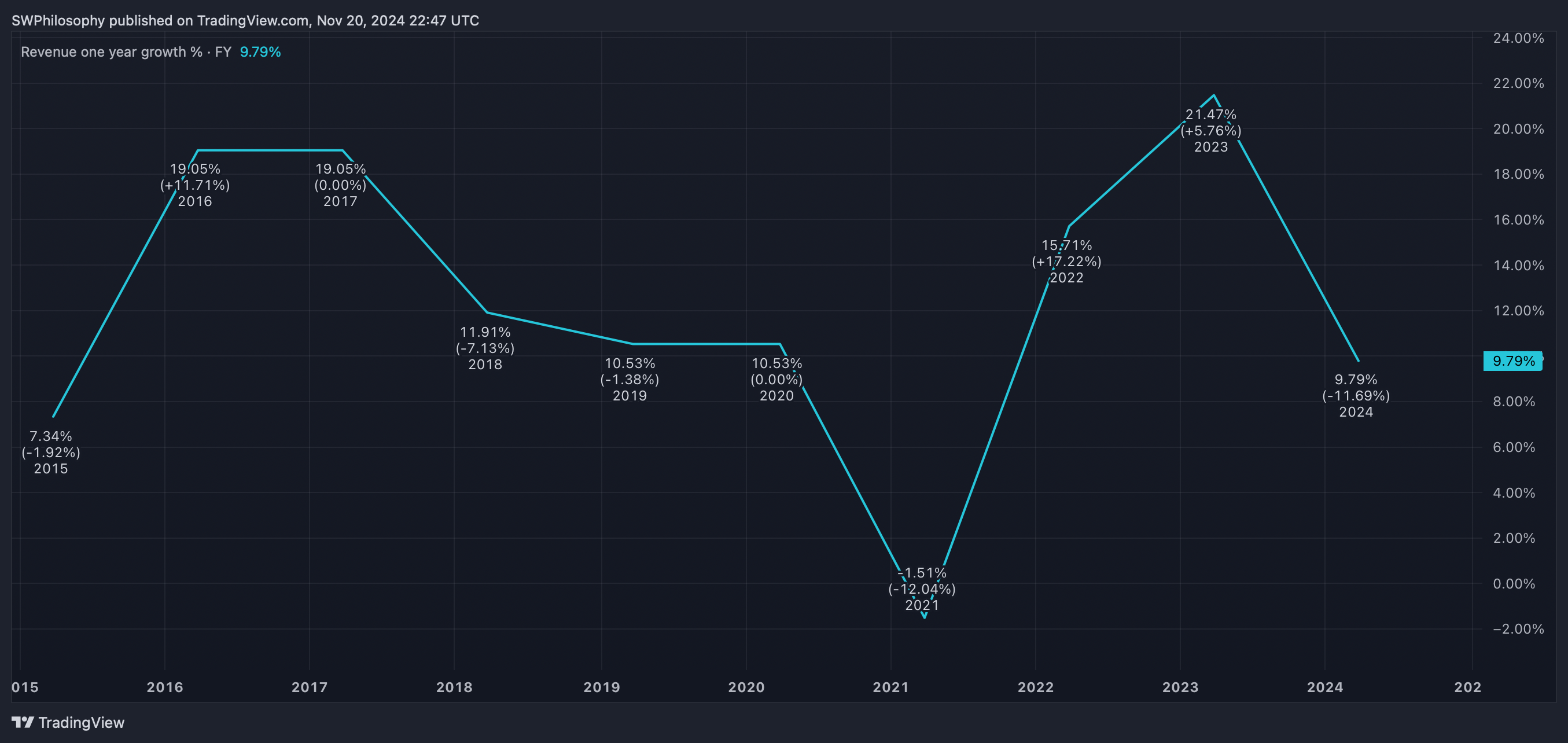

Halma’s revenues have grown at an average of 11% per year since 2015. And a price-to-earnings (P/E) ratio of 33 (or 28 on an adjusted basis) implies investors expect this to continue.

Halma Revenue Growth 2015-24

Created at TradingView

Given this, the company’s sales increasing by 13% is a very positive sign. The stock is priced for growth and I think at least some of this is going to have to come from the top line.

For Halma, growth comes through a combination of buying other businesses and finding ways to increase their profits. And I think the indications here were encouraging as well.

While the company completed four new deals, 11% of revenue growth came from its existing businesses. Given the risks that come from acquisitions, this should cause shareholders to feel good.

Outlook

As one might expect, Halma’s management is optimistic about the next six months. Despite this, I think there are some important potential challenges to consider going forward.

This is an unconventional view, but I see the prospect of falling interest rates as a risk for the firm. It’s generally thought lower rates help boost growth stocks, but I’m dubious in this case.

As I see it, lower borrowing costs are likely to increase competition for acquisitions and push up prices. And it’s obviously better for Halma to pay less, not more.

The Bank of England has indicated interest rates might stay higher after last month’s Budget. But I think they’re set to fall sooner or later and Halma will need to cope with the effects.

Long-term returns

Halma has shown an admirable ability to maintain its discipline when it comes to making acquisitions. And I don’t expect this to change, even if interest rates fall.

Despite this, the latest report shows that revenue growth is still strong. Furthermore, I expect this to continue for some time into the future.

There are never any guarantees, but I think Halma is in a strong position for future growth. Investors might need to be patient, but I see this as a stock that’s well worth considering for the long term.

This post was originally published on Motley Fool