Things have been a bit stagnant on the FTSE 100 lately, with the index slipping almost 3% in the past month. Now, I’m looking further afield for lesser-known but promising UK shares for my Stocks and Shares ISA next year.

I often find when times are tough, the little guys come out of the woodwork and start to shine.

Here are two that I think could enjoy decent growth in the coming years — if the economy plays ball!

Trainline

Trainline (LSE: TRN) is a digital ticket booking service that’s gone from strength to strength recently. The share price has surged an impressive 41.5% over the past year. Not bad for what is essentially a train and coach comparison site, helping users find the most cost-effective or time-efficient journey anywhere in the EU.

I remember when it was just a small UK train booking site called thetrainline.com. It rebranded to just Trainline in 2016 before expanding across Europe and going public in 2019. Things were a bit rocky at first but in recent years it seems to have found its feet (or rails).

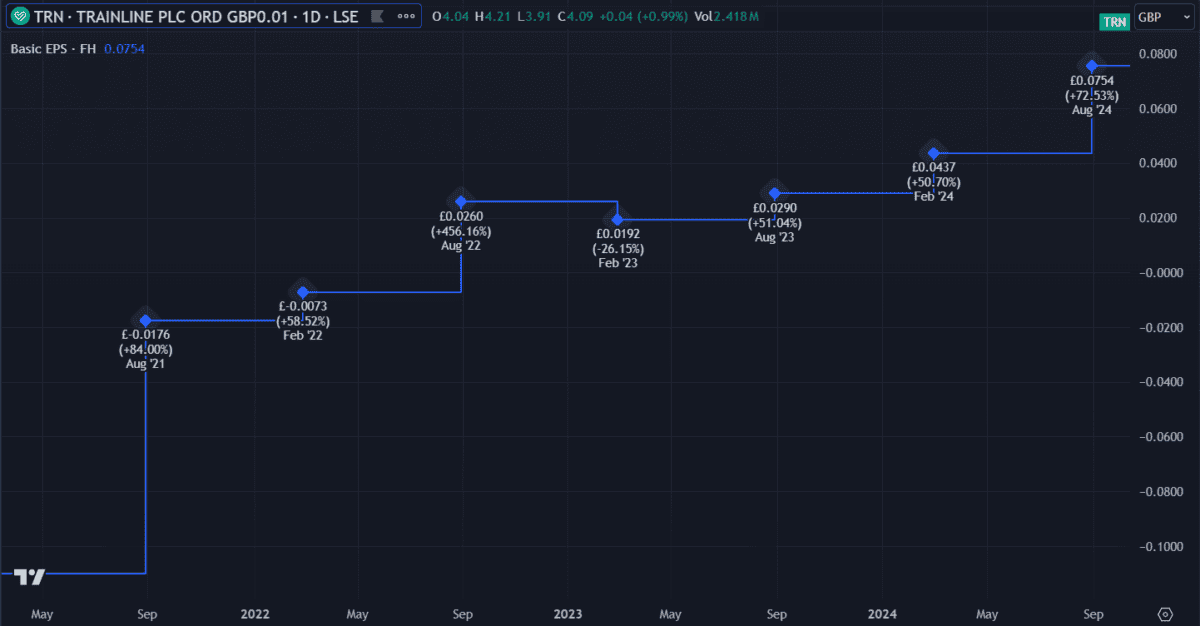

The company now sports a meaty £1.85bn market cap and revenue of £114.5m as of August this year. It has a strong net profit margin of 14.8% and earnings per share (EPS) that climbed 300% year on year.

On the downside, the high price means it also has a high price-to-earnings (P/E) ratio of 32.8 — far ahead of the industry average of 22.8. That makes further growth less likely. Other risks that threaten profits include travel restrictions and competitor apps, particularly from low-cost alternatives like budget airlines. On average, train travel remains relatively expensive compared to short-haul flights.

Still, recent performance suggests it must be doing something right, so it’s firmly on my list of ISA options for 2025.

XPS Pensions Group

XPS Pensions Group (LSE: XPS) is a British pension consultancy firm providing a variety of services focused on pensions, investment consulting and administration.

The main reason I like it is the slow but stable growth. I’m a big fan of investments I can forget about for years without worry. Plus it has a 2.8% yield — although it only recently started paying dividends so reliability isn’t certain yet.

The second reason I like it is the solid balance sheet, with low debt and sufficient interest coverage. It has a high net profit margin of 27.2% and a high return on equity (ROE) of 29.1%. Plus, at 14.5, its P/E ratio has been reducing for some time.

However, one recent development concerns me. The co-CEO and Director Ben Bramhall recently sold 51% of his shares at slightly below the current price. It’s impossible to say exactly why — maybe he needed the money — but it’s a risk nonetheless. If an insider sells, we have to wonder if they know something we don’t!

Looking ahead, revenue is forecast to grow by 12% in the next year while earnings are forecast to decline by around 10%. This won’t necessarily affect the share price but it could limit growth.

With steady growth and a good dividend yield, I’m happy to put it on my list of potential ISA additions for next year.

This post was originally published on Motley Fool