One common way to value shares is to look at their price-to-earnings (P/E) ratio. As a rule of thumb, the lower it is, the cheaper the share is, although there are a couple of important caveats to consider: the sustainability of the earnings and the firm’s debt both matter. At the moment, one well-known FTSE 250 share sells for pennies and has a P/E ratio of just 8.

So, is it a bargain I ought to buy for my portfolio?

Well-known consumer brand

The share in question is Dr Martens (LSE: DOCS).

With an iconic footwear brand, large customer base, and unique place in the market, I think there is a lot to like about the business.

So, why is the FTSE 250 share selling for pennies? (And why has it fallen 88% since it listed on the London stock market just three years ago?)

The answer lies in the firm’s weak performance lately.

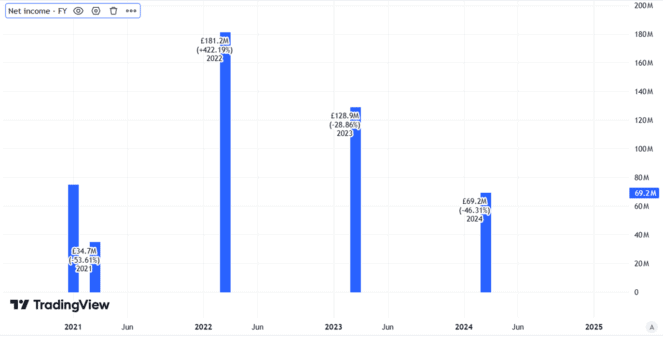

Take last year as an example. Revenues fell by 12%. Profit after tax crashed by 46%.

Created using TradingView

Meanwhile, net debt rose by 24%. As I said above, debt matters when it comes to valuation as servicing and repaying it can eat into earnings.

Potential for turnaround

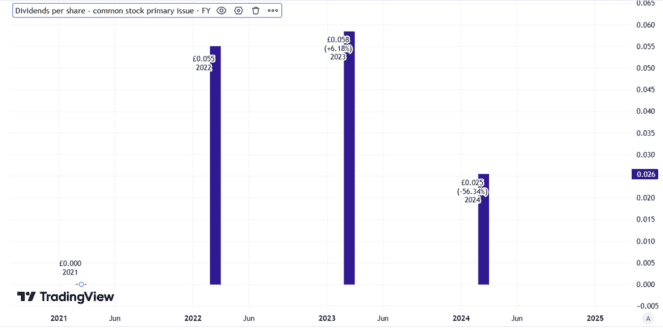

Still, while the company’s profits after tax fell badly, it remained firmly in the black. It cut the dividend, but did not cancel it altogether.

Created using TradingView

Weak US consumer demand was given as a key reason for last year’s poor performance. But the business announced plans to address that, including increasing marketing spend in the crucial region.

The most recent update came in July, when the company said that trading in its most recent quarter had been in line with expectations. I think a big test will come this month, when Dr Martens is set to announce its interim results.

If they contain positive news about sales trends and costs, I reckon the current share price could turn out to be a bargain.

However, the reverse could happen. If there are only weak signs of a turnaround (or none at all), the share price may fall further. Dr Martens shoes are not cheap and US consumer spending remains fairly weak.

I’m not buying

I am in no rush to buy here. The company’s huge share price decline since listing points to a number of factors that concern me, from net debt to the seeming fragility of the business model.

At best, I think the business can start to show evidence of a turnaround and see the share price climb. But any such turnaround is unlikely to happen overnight. So there will likely be time for me to buy when evidence of it comes, even if that means paying a higher price than today for the FTSE 250 share.

Meanwhile, the risks concern me. Dr Martens is a strong brand but it is a business that has been battling sizeable challenges. Those may continue.

This post was originally published on Motley Fool