When buying FTSE 100 shares, I always add them to my portfolio with the plan of holding them for at least a decade.

This has two big advantages. It gives my portfolio time to recover from bouts of share price volatility, and it saves me making regular buy and sell decisions, allowing my investments to compound over time without frequent interruptions.

But my plan isn’t set in stone. A share’s investment case can rapidly deteriorate for a wide variety of economic, industry, or company-specific reasons. So I may be forced to reluctantly sell.

Buying any stock market instrument involves taking a risk. However, there are plenty of shares in my portfolio I feel confident of holding onto for the long term.

With this in mind, here are two FTSE 100 shares I plan to hold for at least the next five years.

Persimmon

Times have been tough for UK housebuilders. Buyer demand has slumped in response to higher mortgage costs. And the sector isn’t in the clear yet given the threat of persistent inflation and its potential effect on interest rates.

But the long-term outlook for Persimmon (LSE:PSN) remains super bright in my opinion. My bullishness has improved further following this week’s Budget too.

Housebuilder’s share prices have benefitted this year from Labour’s pledge to build 300,000 new homes each year. On Wednesday, Chancellor Rachel Reeves gave these plans solid foundations. She pledged £5bn for next year alone to build affordable residential properties.

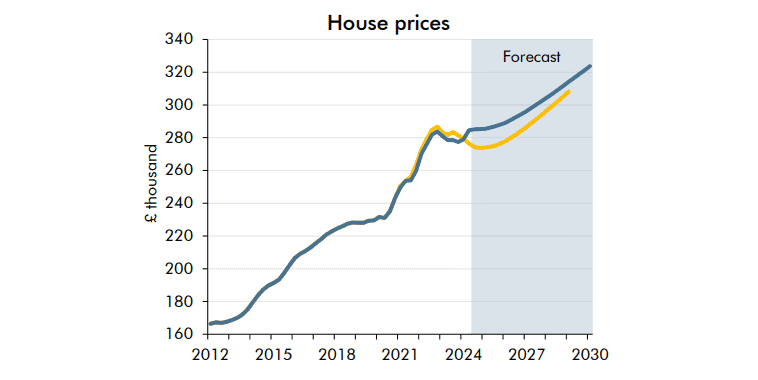

Also on Wednesday, the Office for Budget Responsibility (OBR) hiked its house price forecasts for the next few years.

Price growth of 1.7% and 1.1% is tipped for 2024 and 2025 respectively, and 2.5% between 2026 and 2030.

This double-whammy of positive news saw housebuilding shares soar following the Budget. Persimmon’s share price has risen 16% this year, and I expect it to continue rising strongly as building activity ramps up and market conditions stabilise.

Diageo

Embattled drinks giant Diageo (LSE:DGE) could be set to endure more near-term trouble. The alcoholic drinks market remains under pressure from weak consumer spending, as Campari‘s terrible third-quarter trading update this week showed.

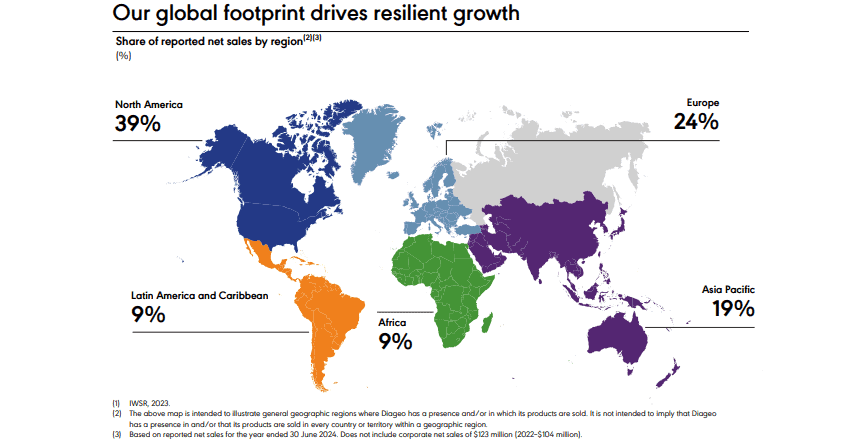

Diageo has had sales problems of its own, and especially in its Latin American and Caribbean markets. Its share price has slumped 13% in 2024 as a result.

But I’m backing the Smirnoff and Captain Morgan manufacturer to bounce back, and then some. Its five-star brands remain as popular as ever, so demand should recover when economic conditions improve.

Diageo is taking steps to better exploit the upturn when it comes as well. Measures include revamping its route-to-market channels in the US, restructuring its Nigerian operations, and boosting productivity savings.

The company’s substantial emerging market footprint also gives it scope to capitalise on fast-growing markets in Asia, Africa, and South America.

Diageo’s share price has experienced volatility before. And like on those occasions, I’m expecting it to spring back strongly again.

This post was originally published on Motley Fool