I continue to think that there are some excellent shares in the flagship FTSE 100 index that are cheaper than they ought to be, based on the long-term prospects of the business.

Here is one such share that I think investors should consider buying.

Discount retailer, discount price

The FTSE 100 business in question is B&M (LSE: BME).

Currently, it trades on a price-to-earnings (P/E) ratio of under 11. That is cheaper than has been the case for much of the past few years.

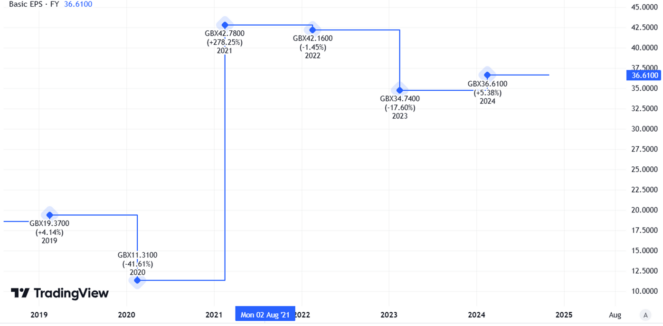

Created using TradingView

So, what is going on? Partly the low P/E ratio reflects a falling share price. B&M this week hit the lowest price it has traded for in a couple of years.

Post-tax profits last year were not the highest ever, but they did beat the preceding several years. Basic earnings per share also rose from the prior year.

Created using TradingView

The retailer’s most recent trading update, in July, showed sales growth in the first quarter compared to the same period last year (at a constant exchange rate).

Why has the share price fallen?

Given all of that, what is going on?

B&M is well-established, it is growing its footprint of shops in the UK and France and its discount offering means that weak economic performance could actually improve rather than hurt its attractiveness to shoppers.

One possible clue is in the detailed breakdown from the trading statement. While the company saw overall sales growth in the quarter under review, the UK B&M-branded business saw a like-for-like sales decline of 3.5%. If that is a precursor of worse performance across the year overall, it could help explain why the City has taken fright.

With interim results due this month, we will soon find out how the FTSE 100 business has been performing.

Still, even if the UK B&M business shows a decline this year, does that justify the 31% fall seen in the share price so far this year?

This looks overdone to me

I do not think so.

The UK retail market is highly competitive and that is an ever present risk for B&M. But it is firmly profitable, has a proven business model, is expanding its shop estate so can likely grow economies of scale and also offers a dividend yield of 3.8%.

The company made an average of over £1m per day of profit after tax last year yet commands a market capitalisation of under £4bn at the moment.

With investor sentiment on the FTSE 100 share apparently lukewarm I think it may fall even further from here.

But as a long-term investor, I think it looks undervalued relative to how I expect the business may perform over the coming five to 10 years.

This post was originally published on Motley Fool