In pre-market trading today (1 November), Amazon (NASDAQ:AMZN) stock is up 6.4%. This comes after it released its latest quarterly earnings once the market closed last night. Given the mixed bag of results out from other mega-cap peers, I think the reaction is very telling for what could happen next.

The results

Let’s begin by quickly running through the details. For the quarter, revenue increased by 11% versus the same period last year to $158.9bn. One of the main factors that helped to drive this increase was the continued outperformance in the Amazon Web Services (AWS) division. This ultimately filtered down to the bottom line and helped a 52% jump in the earnings per share figure.

Both the revenue and EPS numbers were above analysts’ expectations, which usually means the stock would rally given the positive surprise.

It wasn’t just the numbers from the past quarter that helped the share price. The final quarter of the year is the most important for Amazon, given that it coincides with the festive season. This is traditionally the most profitable time. In terms of guidance, the company expects sales to rise by 7%-11% versus Q4 last year. For a company so large already, achieving that kind of percentage growth would be very impressive.

The future

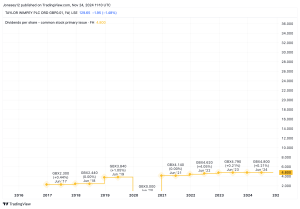

Excluding the potential move when the market opens on Friday, the stock is up 36% over the past year. It’s true that the gains aren’t as large as some peers like Meta Platforms, with the tech stock up 82% over the same period.

However, it’s the outlook from here that I think could change things. Meta shares fell 4% yesterday. Why? Even though results were good, the outlook wasn’t very inspiring. This contrasts to Amazon, where I believe the company has a lot of momentum going forward.

It has a very diviersified revenue stream. It can bank on traditional areas such as retail sales and Amazon Prime services. Yet it’s also pushing ahead with new generative AI-powered features, which have the potential to further increase income.

Let’s also not forget that the business has a global presence. In the last quarter, North American sales grew by 9%. Yet international retail sales also grew by 12%, showing that it’s not relying just on one area.

Bringing it together

One risk is that the tech stock isn’t exactly undervalued. With a price-to-earnings ratio of 45.67, it’s well above what I’d look for as a fair value. Of course, some of this is due to the potential for future earnings to increase. However, even with this the stock simply isn’t cheap.

On balance, I think Amazon shares have legs to keep moving higher, based on the outlook given by management. I also feel that some investors might cut their holdings in other tech stocks after earnings are done and allocate that money to Amazon. On that basis I’m thinking about putting some money in the stock.

This post was originally published on Motley Fool