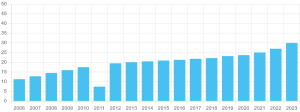

BAE Systems (LSE: BA.) has been a great stock to own over the last three years. With geopolitical uncertainty having remained very high, it has been one of the best performers in the Footsie. Do City analysts expect the shares to continue rising from here? Let’s take a look at the latest BAE Systems share price targets.

Brilliant returns

Three years ago, BAE Systems shares were changing hands for around 550p. Today, however, they’re trading for around 1,250p – about 130% higher.

That’s an excellent return in three years. When you consider that the company has paid dividends (yields of around 2.5%-3% annually) on top of this, the stock has returned over 30% per year over that period.

For context, the FTSE 100 index has returned less than 10% per year over the last three years (dividends included). So, BAE Systems shares have outperformed the market by a wide margin.

Share price forecasts

It seems that City analysts see further share price gains on the horizon though. Since the middle of the year, a number of brokers have announced price targets for the stock. I’ve listed the targets below:

| Date | Broker | Price target |

| 18 October | Jefferies | 1,360p |

| 6 September | Berenberg | 1,360p |

| 29 July | Citi | 1,440p |

| 25 July | JP Morgan | 1,500p |

Looking at those targets, all are comfortably above the current share price. JP Morgan’s is the highest at 1,500p – about 20% above today’s price.

The average of the four figures is 1,415p. That’s about 13% above the current price.

Scope for further gains

I reckon that average price target is achievable.

Next year, BAE Systems is forecast to generate earnings per share of 76.2p. So, a share price of 1,415p would equate to a price-to-earnings (P/E) ratio of about 18.6.

That’s above the FTSE 100 average (about 13.8). But it seems reasonable to me given the complex geopolitical backdrop.

This backdrop should ensure that government defence spending remains robust. It’s worth noting here that BAE’s revenues and earnings are projected to grow 8% and 12%, respectively, next year, which is a decent level of growth for a large-cap company.

It should also ensure that investor interest in defence stocks remains high. When geopolitical uncertainty is elevated, investors tend to pile into defence stocks for protection in a phenomenon known as a ‘flight-to-arms’.

Of course, there’s a bit of a risk with this second factor. If geopolitical tension globally was to suddenly die down, global interest in defence stocks may dissipate, resulting in profit taking across the sector (and lower share prices).

Another risk is a broader market wobble caused by non-geopolitical factors such as rising bond yields or inflation concerns. This could also lead to a lower share price.

Overall though, I think this stock has the potential to grind out solid (but not spectacular) returns from here. For those seeking slow and steady returns in the form of both share price gains and dividends, I think it’s worth considering.

This post was originally published on Motley Fool