Contrarians may claim that the best share to buy at any point is the one that’s performed the worst. If only it was that simple.

Because if it was, I would swoop on housebuilder Vistry Group (LSE: VTY), whose shares have crashed 28.93% in a month. That shouldn’t happen to a blue-chip stock, until it does.

This is the FTSE 100’s biggest monthly loser by far, with number two flopperoo JD Sports Fashion down a relatively modest 17.65%.

Can the share price recover?

As a paid-up contrarian I’d happily buy JD Sports but I already have plenty of exposure. I hold one housebuilder (Taylor Wimpey) but there’s room for another. Is this my moment to buy Vistry at a reduced price?

The shares crashed on 8 October after the board issued a profit warning, admitting it had underestimated build costs in its Southern Division.

Vistry said the issue affected just nine out of 300 sites, but it still slashed 2024 profit guidance by 20%, or £80m. It also slashed 2025 guidance by £30m in 2025 and 2026 by £5m.

This isn’t a mortal threat to the company. The board is still targeting a net cash position at the end of this year, against net debt of £88.8m in December 2023.

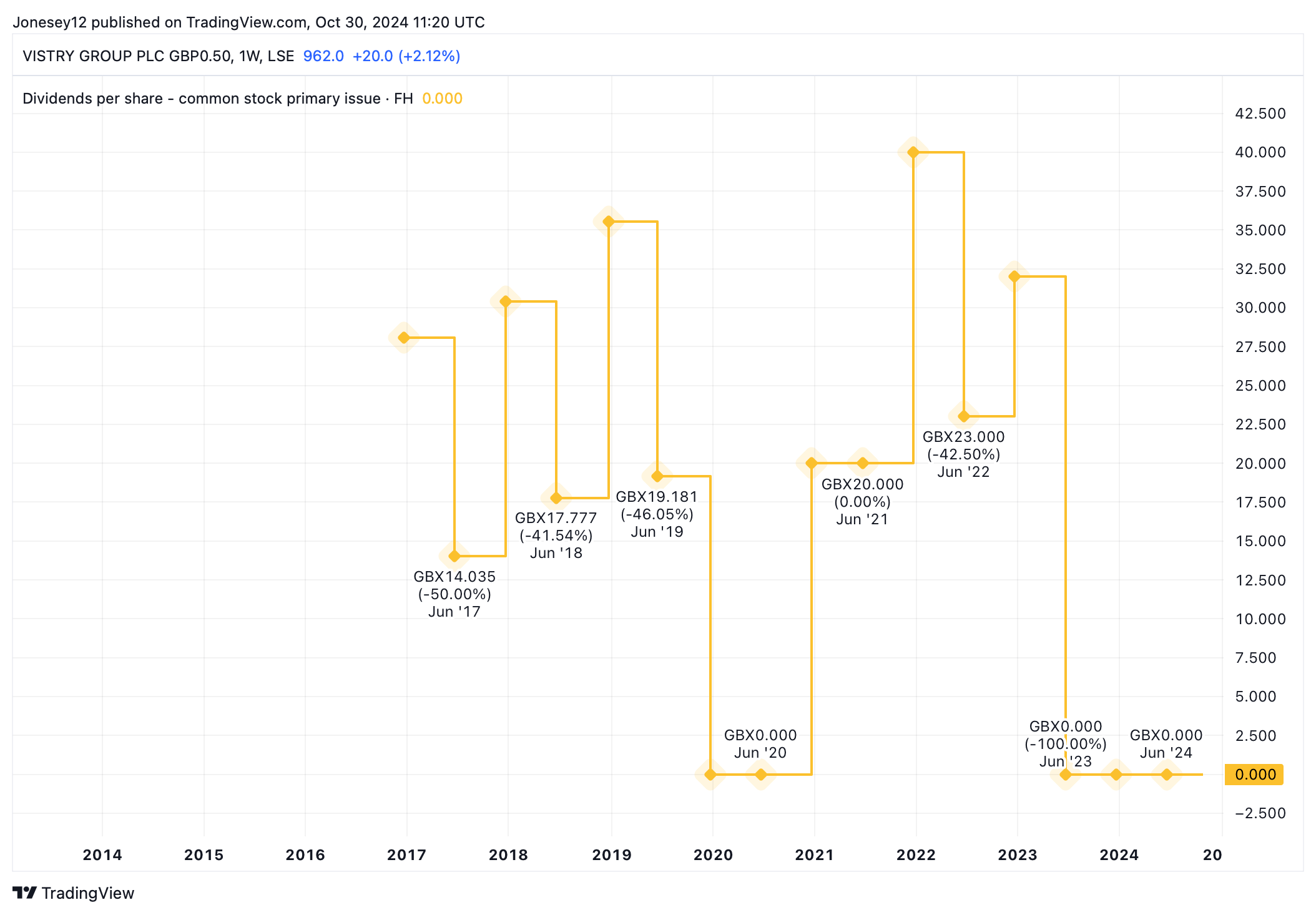

It has a medium-term target of £800m adjusted operating profit, plus £1bn of capital distributions to shareholders. The forecast yield is 3.5%, nicely covered 2.4 times by earnings. However, its recent dividend track record is decidedly bumpy. Let’s see what the charts say.

Chart by TradingView

Until this month, Vistry shares were flying. In fact, they’re still up 36.86% of over the last 12 months.

What we don’t know is whether all the bad news is out there. Investors will remain shaky as they anticipate further shocks, and understandably so. For now, all is calm, with the share price slipping just 0.88% over the last week.

Unsurprisingly, Vistry shares now look decent value, with a trailing price-to-earnings ratio of 10.86. The price-to-revenue ratio is 0.9, which suggests investors only have to pay 90p for each £1 of sales.

I’m tempted by this bargain stock

Vistry specialises in affordable homes and social housing, which could be a nice place to be as Labour battles to fix the housing crisis. As with every housebuilder, much depends on factors beyond its control, such as interest rates, jobs and incomes, planning hurdles, supply chain issues, and so on.

Encouragingly, a 12.6% return on capital employed (ROCE) tops both Persimmon at 10% and Taylor Wimpey at 9.8%. Vistry’s operating margins are forecast to climb from 8.7% to 9.8%, while its debt-to-equity ratio is modest at just 22%.

So there’s a lot to like here, for those willing to ignore the fact that it struggles with the basics of preparing company accounts.

I wouldn’t call Vistry the very best share to buy in November, but there’s an opportunity here. It’ll take time to recover. Several years of accurate accounts will help. I’ll take a small position when I have the cash, and bide my time. I never could resist a bargain.

This post was originally published on Motley Fool