Aviva‘s (LSE:AV.) a FTSE 100 share I opened a position in almost a year ago. I’ve topped up my holdings since then. And I plan to increase my stake again when I next have cash to invest.

I believe the financial services giant looks highly attractive in terms of growth and dividends. And its shares also look dirt cheap across a variety of measures too.

Here’s why I think the company’s a top blue-chip to consider right now.

Growth

Earnings growth’s been patchy at Aviva in recent years. Its bottom line dropped during the Covid-19 crisis, and then again in 2022 due to rising interest rates.

But the company moved back into growth in 2023. And City analysts expect profits to keep rising over the next three years at least, and by healthy double-digit percentages:

| Year | Earnings per share | Earnings growth |

|---|---|---|

| 2024 | 43.98p | 17% |

| 2025 | 50.87p | 16% |

| 2026 | 55.83p | 10% |

These bright forecasts reflect analyst expectations of falling interest rates and improving economic conditions. Combined, these could stimulate consumer spending and boost the performance of Aviva’s asset management division.

Profits will also benefit from ongoing demographic changes in its European and North American markets. More older people means higher demand for retirement, protection and wealth products.

Dividends

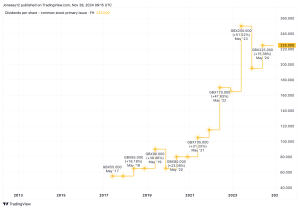

Like earnings, Aviva’s dividend record has been up and down since 2019.

However, with earnings tipped to shoot higher — and the company’s balance sheet significantly strengthened under current CEO Amanda Blanc — shareholder payouts, which have risen steadily since the end of the pandemic, are tipped to follow suit:

| Year | Dividend per share | Dividend growth |

|---|---|---|

| 2024 | 35.43p | 6% |

| 2025 | 38.13p | 8% |

| 2026 | 40.88p | 7% |

Dividends are never guaranteed. But Aviva’s cash-rich balance sheet puts it in great shape to meet these forecasts.

Its Solvency II shareholder coverage ratio was 205% as of June, more than twice the level that regulators require.

Value

Based on current earnings forecasts, Aviva shares trade on price-to-earnings growth (PEG) ratios of 0.6 for 2024 and 2025, and 0.9 for 2026. Any reading below 1 indicates that a share is undervalued.

The Footsie company also offers excellent value based on expected earnings. Dividend yields are a huge 7.4% for this year, 8% for 2025 and 8.6% for 2026.

By comparison, the average dividend yield for FTSE 100 shares sits way back at 3.7%.

A top buy

As with any UK share, Aviva exposes its investors to a degree of risk. Profits and dividends could disappoint if, for example, interest rates fail to decline steadily, dampening product sales. It also faces intense competition from the likes of Legal & General, Zurich and AXA.

But on balance, I believe the potential benefits of owning Aviva shares outweigh these risks. And its low valuation provides a cushion in case newsflow worsens which, in turn, could limit any share price reversals.

On balance, I think Aviva’s one of the best ‘all-rounders’ on the FTSE 100 today.

This post was originally published on Motley Fool