When I look for shares to buy for my portfolio, my attention is on whether I think owning them will help me make money over time, or lose money.

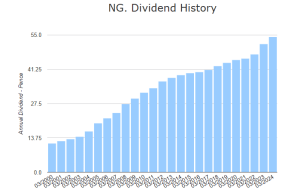

When it comes to making money, that could be in the form of a higher share price when I sell, dividends, or both. One UK share I own has a stellar dividend record, having increased its payout per share annually since before the turn of the century. The company’s management has signalled that it hopes to keep doing so – and the share yields 8.9%.

Here is why I like it, what concerns me about it, and why I plan to keep it in my portfolio for the long term.

Proven business model and massive cash generation

The share in question is FTSE 100 stalwart British American Tobacco (LSE: BATS). As the name suggests, the company manufactures and markets tobacco products in the UK, US, and around the world.

That is a huge market and one with a customer base that has proven willing to keep spending on the products even during economic downturns. Cigarettes are cheap to manufacture. There is a large market for them.

Thanks to British American’s portfolio of premium brands such as Lucky Strike, it has pricing power. That means it is able to generate substantial free cash flows. In turn, they have been able to fund large and growing dividends.

Some problems with the BATS investment case

But when a share offers a high yield like British American, it can signal investor discomfort. When it comes to this UK share in particular, I see several reasons for that.

One is that many investors choose not to invest in tobacco shares on ethical grounds. I respect that view although I do not share it myself. That self-selecting pool of investors means tobacco shares often carry a higher yield than the market as a whole.

Another challenge is the decline in cigarette use in most markets. The market is huge and I think is likely to remain so for years, if not decades. But it is in serious structural long-term decline and there is a risk that regulatory interventions could speed up that process further.

I also think the firm’s balance sheet is a risk to ongoing growth of the dividend.

As British American is such a cash flow machine, lenders are often keen to let it borrow cash. At the half year point, adjusted net debt had fallen meaningfully compared to one year beforehand. But it still came in at £33bn. Servicing and repaying that could eat into the company’s ability to keep paying out dividends, if for example declining cigarette sales mean free cash flows fall substantially

In it for the long run

Still, no dividend is ever guaranteed and all shares involve risks. Definitely British American involves risk.

But few blue-chip UK shares offer a yield like it. I am hopeful that the dividend can not only be maintained but in fact grow in years to come. I plan to keep holding my shares for the long term.

This post was originally published on Motley Fool