Achieving financial independence through passive income requires a well-thought-out and strategic approach. But there’s no better time to start than the present. Sure, there’s always some learning curves along the way but that’s all part of the process.

While there’s no guaranteed path to riches, investing in dividend-paying companies can be a viable strategy. Even a few thousand pounds in savings can be enough to get the ball rolling.

However, it still involves some risk and requires a healthy dose of dedication and patience.

Some helpful tips to get started

When starting out, it’s crucial to understand the tax implications. In the UK, using a Stocks and Shares ISA can provide significant tax advantages. UK residents can invest up to £20k per year into their ISA and benefit from a tax break on the capital gains.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Diversification is another key concern. Spreading investments across various sectors and regions reduces risk and enhances potential returns. With a careful blend of growth and income stocks, a portfolio could generate an average yield as high as 7%. Paired with a selection of growth stocks could achieve a further 5% in returns from price appreciation.

It may seem attractive to cash out dividends as soon as they’re paid but patience is key. Reinvesting those dividends means the returns won’t just grow — they’ll snowball, compounding over time into exponential growth.

An initial investment of £5k would be a good start but for real growth, adding a further £100 or £200 per month would really get the ball rolling.

Let’s consider an example portfolio with the above averages. Starting with £5k and putting in £200 a month, it could grow to £58,280 in 10 years, with dividends reinvested. Assuming the yield maintains an average of 7%, it would pay £3,579 a year in dividends.

If I kept that rolling for another 10 years, it could reach £226k, paying £14,350 a year in dividends.

What kind of stocks could achieve that?

Maintaining such returns would require a careful selection of stable stocks with reliable prospects. Think big, established FTSE 100 companies like Unilever, BT Group, and GSK. But there’s also some top quality on the FTSE 250 and one I like the look of this month is ITV (LSE: ITV).

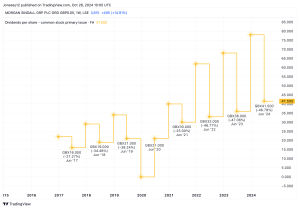

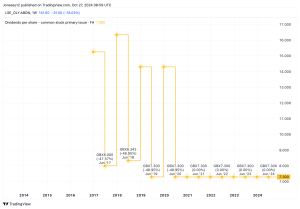

With a 6.7% yield and a low payout ratio of 46%, I have no reason to worry about payments being cut – unless another economic disaster occurs. Covid caused a cut in 2020 but before that, dividends were paid consistently and increased annually for many years.

However, the broadcaster’s earnings-per-share (EPS) has shot up this year, prompting some analysts to speculate about a reversal. On average, they expect a fall from 10p per share to 8.5p by year-end. That could limit price growth in the short term.

It also faces intense competition from global streaming giants like Netflix. Its streaming service ITVX has enjoyed some success but this venture remains uncertain against well-established players.

Still, with return on equity (ROE) expected to be almost 20% in three years, I like its long-term prospects. The shares have paid me decent dividends so far and I expect they will continue to do so.

This post was originally published on Motley Fool