Could the very best share to buy today be one I already hold? I certainly hope so, but there’s a mystery at the heart of this one.

The company in question is pharmaceutical giant GSK (LSE: GSK). In its former incarnation as GlaxoSmithKline, this was one of the most popular and admired FTSE 100 stocks of all.

It was a true Dividend Aristocrat, regularly yielding around 5.5% a year, while holding out the prospect of long-term share price growth too.

No stock smashes it forever though. Glaxo hit blockages in its drugs pipeline as it struggled to replace blockbuster treatments that had gone off patent. CEO Emma Walmsley responded by freezing dividend payments at 80p a share for what seemed like forever, and diverting the savings into R&D.

The shares are a shocker

While that was a shame for income seekers, I understood her thinking and assumed it would generate superior returns over time.

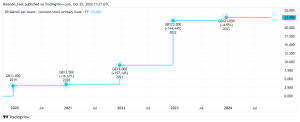

Many thought peeling off consumer healthcare arm Haleon would help, too. It certainly helped Haleon, whose shares have climbed nicely, but has it worked for GSK? Not so much. Its shares are down 0.99% over one year. But over five years, they’re down 17.25%, which is rubbish, frankly.

The GSK share price has fallen 11.3% over the last six months but I wasn’t too concerned, because there was a legal shadow hanging over the company.

GSK had pulled blockbuster heartburn drug Zantac from sale in the US in 2019, following claims that it contained “unacceptable levels” of probable cancer-causing ingredients. GSK called this “inconsistent with the science” and it went to court.

I still think it’s too cheap to resist

The shares crashed 9% on 3 June after a Delaware judge gave the green light to 70,000 Zantac lawsuits. Then Morgan Stanley terrified investors by claiming GSK could take a staggering $30bn hit.

Having bought GSK shares, I was terrified too. But there was a little I could do apart from hang on and hope Morgan Stanley was wrong. So imagine my joy when GSK agreed a $2.2bn settlement covering more than 90% of all legal claims. On 9 October, its shares jumped more than 6% on the news.

And then they fell again. What gives? We’ve all seen how FTSE 100 rival AstraZeneca has transformed itself into the UK’s biggest company. Surely Glaxo can get a piece of that? Not yet, is the disappointing answer.

GSK has reported a string of positive trial results in the last couple of weeks without moving the dial. But with the stock trading at 9.38 times earnings, well below the FTSE 100 average of 15.4 times, I still think there’s plenty of value here.

Analysts remain optimistic, with the 18 brokers offering one-year price forecasts setting a median share price target of 1,837.5p. If they’re right, that’s up 27.85% from today.

GSK’s yield has crept up to 4%. That’s still below the glory days, but okay. I wouldn’t say GSK is the very best FTSE 100 share to buy today, but it still looks good value to me. I’ll top up my stake the moment I have the cash.

This post was originally published on Motley Fool