With interest rates dropping, now could be the time for growth shares across the globe to thrive.

Here are two from the London stock market with profits that are tipped to surge. What’s more, they look dirt cheap at current prices.

Pan African Resources

A charging gold price means investing in the precious metals sector could be a good idea. Mid-tier miner Pan African Resources (LSE:PAF) is one of my favourite sector choices right now.

This business operates a string of gold mines in South Africa. And this month it commissioned its Mogale Tailings Retreatment (MTR) asset ahead of schedule and under budget.

The low-cost project will give margins a boost and lift group production to 220,000 ounces by the end of 2025. This couldn’t come at a better time as the gold price booms — the precious metal struck another record high near $2,734 per ounce overnight.

Of course there’s no guarantee gold prices will keep rising. Commodity prices are notoriously volatile, meaning Pan African’s growth projections are by no means nailed on.

But conditions appear to be perfect for bullion values to keep rising. Geopolitical tension is growing, and central banks are stocking up on gold as uncertainty over the US international role grows. A fresh era of interest rate cuts, meanwhile, is fueling inflationary pressures and with them, demand for gold.

City analysts expect Pan African’s earnings to soar 35% in 2024, and by another 34% next year. This leaves the company trading on a forward price-to-earnings (P/E) ratio of 6.7 times and a price-to-earnings growth (PEG) multiple of 0.2.

Any reading below one indicates that a share is undervalued.

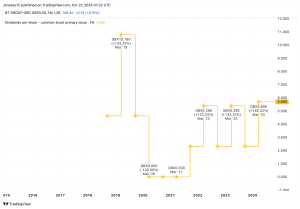

As an added bonus, bright growth forecasts mean that dividends are also tipped to rocket over the period. And so the African miner also carries meaty dividend yields of 3.7% and 6.3% for 2024 and 2025, respectively.

Springfield Properties

Housebuilder Springfield Properties (LSE:SPR) has fallen back into penny stock territory below 100p per share. I believe this could be an attractive dip buying opportunity to consider, and especially as the UK housing market rebounds.

City brokers think Springfields’ earnings will rebound sharply from recent heavy drops. A 13% bottom-line rise is predicted for this financial year (to May 2025). A 28% leap is predicted for financial 2026, too.

And so the business trades on a forward PEG ratio of 0.9, below that widely accepted value watermark of one.

Things are looking up for the housebuilders as interest rates fall and mortgage affordability improves. In September, Springfield predicted “strong year-on-year growth in affordable housing revenue as well as a significant improvement in affordable housing gross margin” for this year, with reservation rates rising in the first few months of financial 2025.

Buyer affordability could accelerate rapidly too as inflation moderates. Goldman Sachs tips interest rates to drop to 2.75% in the next year, down from 5% currently.

A fresh economic shock in the UK could hit Springfields’ earnings forecasts. But I still think this growth share’s worth a close look, and especially at current prices.

This post was originally published on Motley Fool