Investors often jump at any chance to buy FTSE 100 shares at a ‘discount’, especially during market downturns or when companies face temporary setbacks. I get it — who can say no to a bargain, right? Many of my own investment decisions have been influenced by price dips.

While this strategy can be profitable, it’s important to look beyond the price tag. Before diving into these opportunities, I carefully evaluate a company’s recovery potential. Merely buying cheap stocks can lead to significant losses if the underlying business is weak.

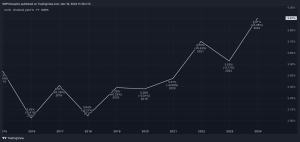

The UK property developer Vistry Group (LSE: VTY) caught my attention when it suddenly fell 30% last week. Property can be a risky industry so I’m checking if the stock is worth considering.

Strong foundations

Despite some volatility, the UK housing market has generally shown a steady demand for new homes. As a leading developer, Vistry stands to benefit from this underlying demand. The company’s portfolio includes various housing types, from affordable homes to luxury properties, which can help mitigate risks associated with specific market segments.

Moreover, its substantial land bank provides a solid foundation for future growth, allowing it to potentially capitalize on rising land values. So why the price drop?

The company attributed overall building costs as the key contributor to a profit warning announced last week. On Tuesday, 8 October, it was revealed that the total cost to complete nine developments had been understated by 10%. This could cost the company between £80m and £115m in profit.

More than £1bn was wiped from the stock’s value after the warning was announced. However, the shares have already begun a mild recovery, up 8% at the time of writing.

A challenging environment

The housing market is particularly sensitive to economic conditions. Factors such as interest rate changes, employment levels, and consumer confidence can significantly impact demand for new homes. Currently, supply chain issues are affecting the delivery of crucial building materials.

In addition to rising construction costs, Vistry faces intense competition from other major property developers in the UK, including Barratt Developments and Taylor Wimpey.

It must also overcome regulatory hurdles, planning permission delays, and environmental constraints. These can all increase costs and delay projects, potentially hurting the share price.

Financial position

Vistry has been actively involved in strategic initiatives, such as mergers and acquisitions, to expand its operations and strengthen its market position. To fully assess its financial health, I’ve considered three key financial ratios. Together, these ratios indicate the developer is efficient at generating profits and is sufficiently solvent, with decent financial leverage.

- Return on equity: expected to be 10.3% in three years, it’s above the industry average of 7.8%

- Net profit margins: at 6.9%, this percentage is up from 5.2% a year ago

- Debt-to-equity ratio: with £3.34bn in equity and £645m in debt, this is a low 19%

In my opinion, it looks like a healthy company operating in a risky industry. The current dip is likely a once-off, caused by external factors pushing up costs. However, if these issues persist, profits could take another hit as operational costs increase.

Overall, I think it’s a good opportunity, so I plan to buy the stock this week.

This post was originally published on Motley Fool