Tesla‘s (NASDAQ:TSLA) stock has seen better days. The electric vehicle (EV) manufacturer’s shares are now changing hands for 40% less than they were in November 2021.

Increased competition — particularly from China — and rising costs have put a dent in the company’s growth story.

But things could change on 5 November.

That’s the day when voters in the US go to the polls and choose their next president. Bookmakers suggest the result is too close to call. Perhaps that’s why Elon Musk recently declared his support for Donald Trump. And is offering a financial incentive to encourage people to register to vote.

Protectionism

In September, Joe Biden increased the tariff on EV imports from China to 100%. The tax — initially levied at a more modest 27.5% — was first introduced by Trump during his presidency.

If Kamala Harris wins, it’s likely she will keep the rate unchanged.

However, ‘The Donald’ has said he’ll impose a 200% charge on all EV imports — not just those from China — if he’s elected again. The threat to widen the scope of the tariffs is believed to be the reason behind Tesla’s recent decision to mothball the construction of its gigafactory in Mexico.

On balance, Tesla should benefit from any increase in import taxes. Even if it can’t bring its cheaper-to-make vehicles across America’s southern border, it has the capacity to ramp up production from its factories inside the country.

It can then take advantage of the expected fall in demand for imports from Europe and elsewhere. And the implications could be significant. In 2023, America imported $19bn of EVs.

Could history repeat itself?

Also, Musk will be hoping that another Trump presidency will have a similar impact on his company’s stock price as last time.

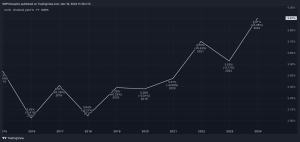

In January 2017, when Trump became America’s 45th president, Tesla’s stock was changing hands for $16. When he left office four years later, the shares were worth $282. That’s a 16-fold increase.

However, it wasn’t until 23 months later, in November 2021, that they reached their all-time high of $407. Musk should thank President Biden for that.

Reasons to be cautious

But there’s no guarantee that Trump will win or that he’ll increase tariffs.

Politicians promise many things on the campaign trail. In theory, the idea of protecting American jobs by heavily taxing imports sounds appealing. But consumers may resent having to pay more for the cars they want to buy from overseas.

And they might not buy Teslas instead. All of America’s mainstream manufacturers are producing EVs at competitive prices.

One analyst has suggested the “politicisation of Elon” might alienate Democrats.

Also, Tesla’s cars are beginning to look a little tired. Its cheapest vehicle — the Model 3 — hasn’t had a refresh since it was launched in 2017.

Final thoughts

So far, I’ve resisted the temptation to buy Tesla stock.

I’ve always thought it was expensive. And even with the recent fall in the company’s share price, this hasn’t changed. The stock is currently trading on a forward price-to-earnings (P/E) ratio of 79, which is the highest of the Magnificent Seven.

That’s too rich for me.

However, like many, I’m going to follow the final weeks of the US election campaign with interest. But I suspect not as closely as Elon Musk and Tesla’s shareholders.

This post was originally published on Motley Fool