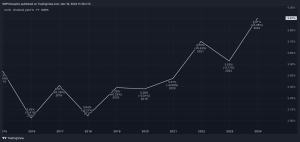

At 8,220 points, the FTSE 100 is less than 200 points away from the all-time highs that were reached earlier this year. Yet as we start the final quarter of the year, there are several reasons being flagged as potential catalysts for a strong push higher through to year-end. Here’s why I think that 9,000 points isn’t unrealistic, as well as a stock that could help the rally.

Faster cuts

One factor would be faster-than-expected interest rate cuts in November and December from the Bank of England. In an article released last week, Governor Bailey hinted that this could be the case. He stated the committee could be “a bit more aggressive” in cutting rates.

If this happens, it could help to spark a surge in the stock market. Investors would likely cheer the good news. Typically, lowering interest rates helps to generate economic growth, as consumers spend instead of save. This helps to feed through to higher profits for businesses, especially the ones that deal directly with the retail crowd.

Less uncertainty

Another point that could bump the FTSE 100 up is more geopolitical certainty. For example, investors have been nervous with one eye on the upcoming U.S. presidential election. Yet once this has passed and we have more stability, markets could be less volatile. Further, I think we could get a truce or ceasefire deal in the Middle East in the coming month, as the global community helps to step in and ease tensions.

However, this can also be flipped to be a risk to my view. If tensions actually pick up, the world could be quickly pulled into a much wider conflict that could even trigger a stock market crash.

A share that could help

A move to 9,000 points would be slightly less than a 10% increase from current levels, in just under three months. For this to happen to the index, some constituents would need to pull their weight!

As an example, I think that Marks & Spencer (LSE:MKS) could help lead a charge. The stock is already up 61% over the past year. Yet this has been supported by the growth in financial results. For example, in the annual results that came out earlier this year, the profit before tax figure jumped by 41% versus 2023.

I don’t think that momentum has run out yet. Earlier this month, the company announced it would be recruiting 11,000 seasonal workers for this holiday season. To me, this shows that it’s anticipating a very busy period. Given that it sells to consumers directly, it should feel the full benefit if interest rates get reduced faster than expected.

Some might be concerned that the price-to-earnings ratio is at 15.12. Of course, this is above the fair value benchmark of 10 that I use. Although it’s at risk of being overvalued, it certainly isn’t at such a crazy high that I’m worried about it.

If certain stocks like Marks & Spencer do keep rising and are fuelled by factors including improved risk sentiment, I think the FTSE 100 could hit 9,000 points by year-end.

This post was originally published on Motley Fool