I’ve been closely watching Legal & General (LSE: LGEN). Its shares are down 10.2% in 2024 and 9.4% in the last six months. They’ve been heading in the opposite direction of the FTSE 100, which is up 6.9% year to date.

Zooming out makes a slightly better reading for shareholders of the financial services stalwart. While it has still posted a loss, the stock’s down just 1.5% over the last 12 months.

Yet despite its poor performance lately, I reckon now could be a smart time to consider buying some shares. That’s certainly what I’m doing for my portfolio.

Dividend yield

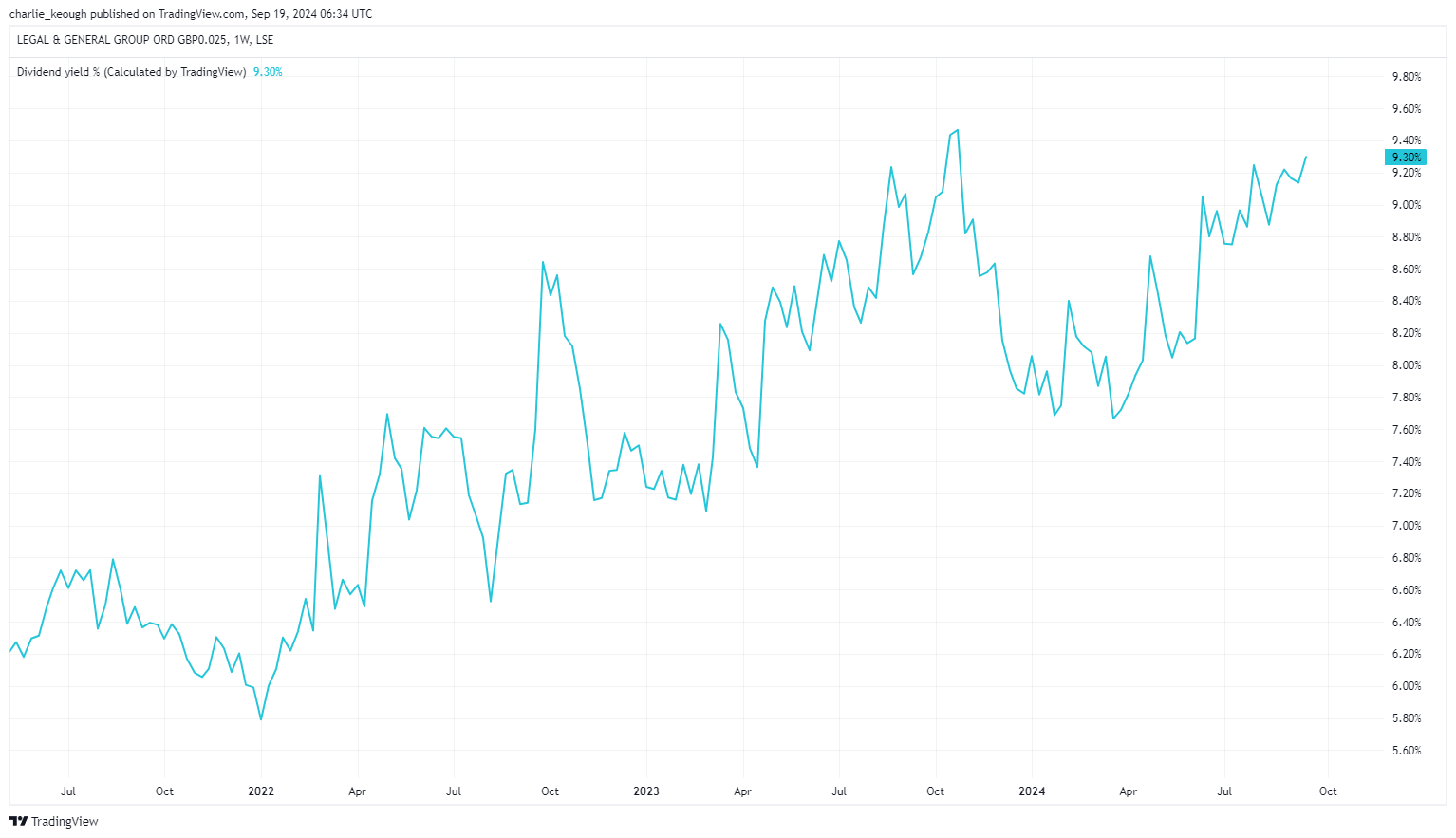

There are a couple of reasons I say that. Let’s start with the main one, its whopping 9.3% dividend yield.

For context, the FTSE 100 average payout’s 3.6%. With its near double-digit yield, Legal & General has the third-highest dividend on the index.

What’s even better, as seen below, is that its yield has been slowly trending upwards over the last five years. While of course dividends are never guaranteed, a rising yield is always nice to see.

Created with TradingView

While its weak share price performance this year has aided in pushing its yield higher, that doesn’t paint the full picture. In recent years, management has made a big push to boost shareholder returns.

In the last decade, its dividend has risen by over 80%. More recently, the firm announced a cumulative dividend plan, set to end this year, that will see it return nearly £6bn to shareholders.

More to like

As an investor who targets income, it’s easy to see why I’ve been tracking Legal & General shares closely. But there are other reasons I like the stock.

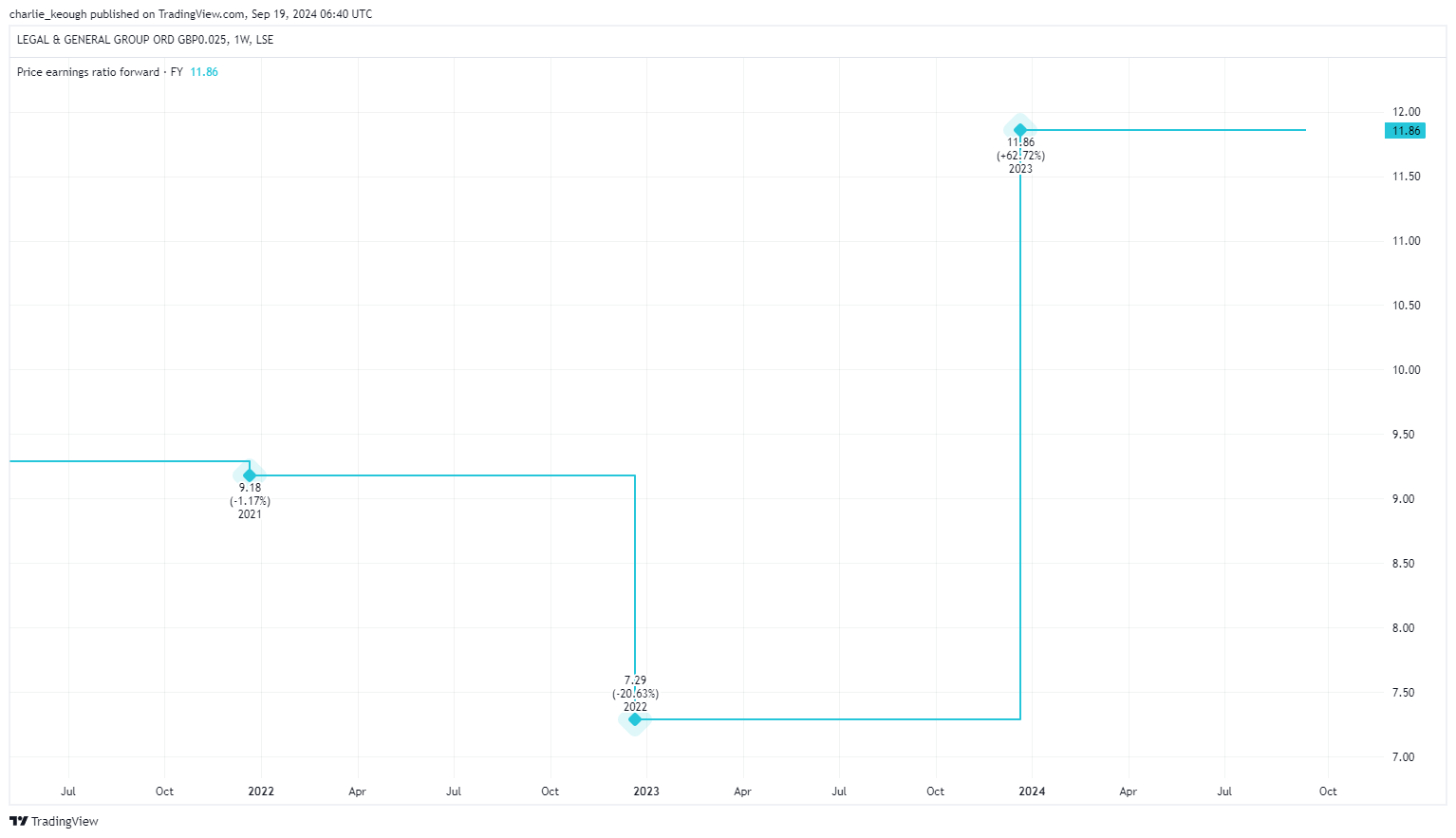

Its valuation is one. As highlighted below, the stock trades on 11.9 times forward earnings. For a company of Legal & General’s quality, I think that could be a steal.

Created with TradingView

I also believe the business is in a strong position to excel in the years to come. One reason for that is because of the ageing population. With people living longer, demand for retirement, wealth, and protection products are on the rise.

Over the next 25 years in the UK, the number of people older than 85 will double to 2.6m. With a dominant grip over areas such as the pension risk transfer market, Legal & General stands to benefit from this.

My concerns

That said, there’s a reason its share price is down this year. We’re still facing challenges such as inflation and high interest rates. While we’re beginning to see rate cuts in both the UK and US, ongoing uncertainty about future reductions is a detriment to Legal & General’s operation.

For example, a delay in future cuts would harm investor confidence and, as a result, could see the firm’s assets under management waver. We’ve seen this happen over the past couple of years.

A no-brainer buy?

But with the stock looking cheap, as well as the meaty passive income on offer and long-term growth potential, I’d happily snap up Legal & General today if I had the cash. At 223.1p, I think it could be a cracking addition to my holdings.

This post was originally published on Motley Fool