Anyone who follows the world of stocks and shares will know that the Rolls-Royce Holdings (LSE:RR.) share price has been on a stellar run since the pandemic nearly wiped out the aerospace and defence contractor.

From their post-Covid low, the company’s shares have risen nearly seven-fold.

Given this performance, it’s therefore not surprising that my fellow Fools write regularly about the company. As you’d expect, they always produce interesting and insightful articles giving their opinions on the pros and cons of buying the stock.

The company’s also the subject of much discussion in newspapers, magazines, and online chat forums.

And if you can’t get enough of the company, try entering ‘Rolls-Royce share price’ into Google. The last time I did, it returned over 32.7m results!

What are they all talking about?

Much of this debate centres on whether the stock is overvalued.

For the year ended 31 December 2023 (FY23), the company reported underlying earnings per share (EPS) of 13.75p. With a current (13 September) share price of 494p, it means the stock trades on an eye-watering historical price-to-earnings ratio of 35.9.

But with five profits upgrades since 2020, it’s hard to keep track of earnings predictions.

The summary of brokers’ forecasts on the company’s website is currently estimating EPS of 25.9p, in FY27, implying a forward P/E ratio of 19. This is much more sensible and suggests to me that the current share price has already factored in a large element of the anticipated earnings growth.

Other investors are enthusiastic about the reinstatement of the dividend, which was suspended in 2019. Personally, I wouldn’t get too excited — it’s likely that the yield will be well below the average for the FTSE 100.

And more recently, some concern has been expressed about possible problems with the firm’s Trent XWB-97 engines. A Cathay Pacific Airways plane from Hong Kong to Zurich had to turn back after an engine reportedly caught fire.

But if I’m being honest, you’ve probably heard most of this before. I suspect you’ve got this far because you want to hear something new.

Well, here it is.

Whisper it quietly

Nobody appears to have noticed that Rolls-Royce is technically insolvent. Remember, you heard it here first.

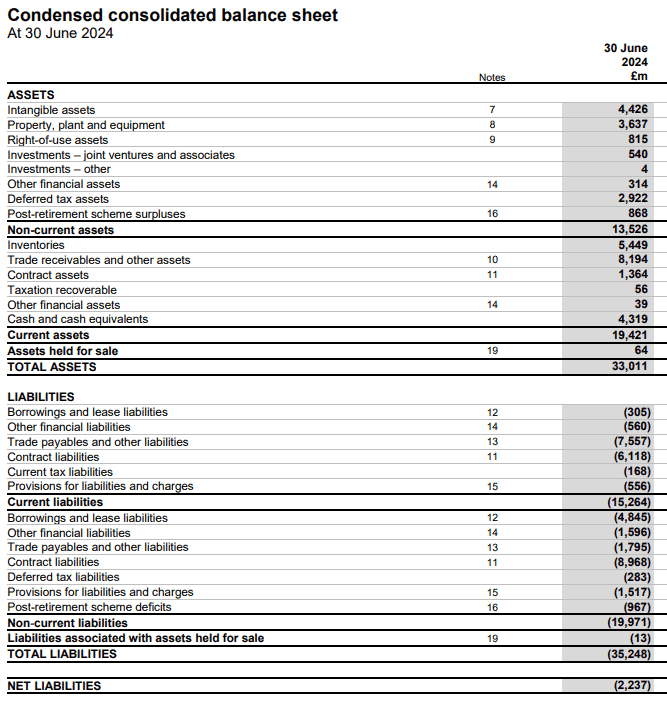

A look at its balance sheet at 30 June 2024, shows that its liabilities exceeded its assets by £2.2bn. And yet is has a stock market valuation of £42bn.

A closer examination reveals £15.1bn of contract liabilities (cash received in advance from customers), borrowings of £5.2bn, and provisions for losses on contracts of £2.1bn.

In addition, nearly £1bn will be needed to fund the group’s pension schemes.

But in truth none of this really matters if the group continues to be cash generative. And for the year ending 31 December 2024, it’s forecasting free cash flow of £2.1bn-£2.2bn.

If it continues performing like this, its balance sheet will quickly improve.

My view

For what it’s worth, I don’t intend buying Rolls-Royce shares any time soon. But not because of the imbalance between its assets and liabilities.

Personally, I think it’s a great company with some quality products. But I fear I’ve left it too late. However, if the share price were to take a bit of a tumble, I’d take another look.

But for now, I’m going to sit this one out.

This post was originally published on Motley Fool