I’ve been keeping close tabs on Legal & General (LSE: LGEN) in recent times as its shares yield a whopping 9.2%. So, it’s pretty easy to see why I’m excited.

That said, the stock hasn’t posted the best performance lately. While the FTSE 100 has climbed 6.1% in 2024, Legal & General is down 9.5%. Its share price has seen a slightly better 1.9% gain across the last 12 months. However, it’s still down 12.1% in the last five years.

Yet despite its poor showing, I reckon now could be a good time to consider snapping up some shares.

A meaty payout

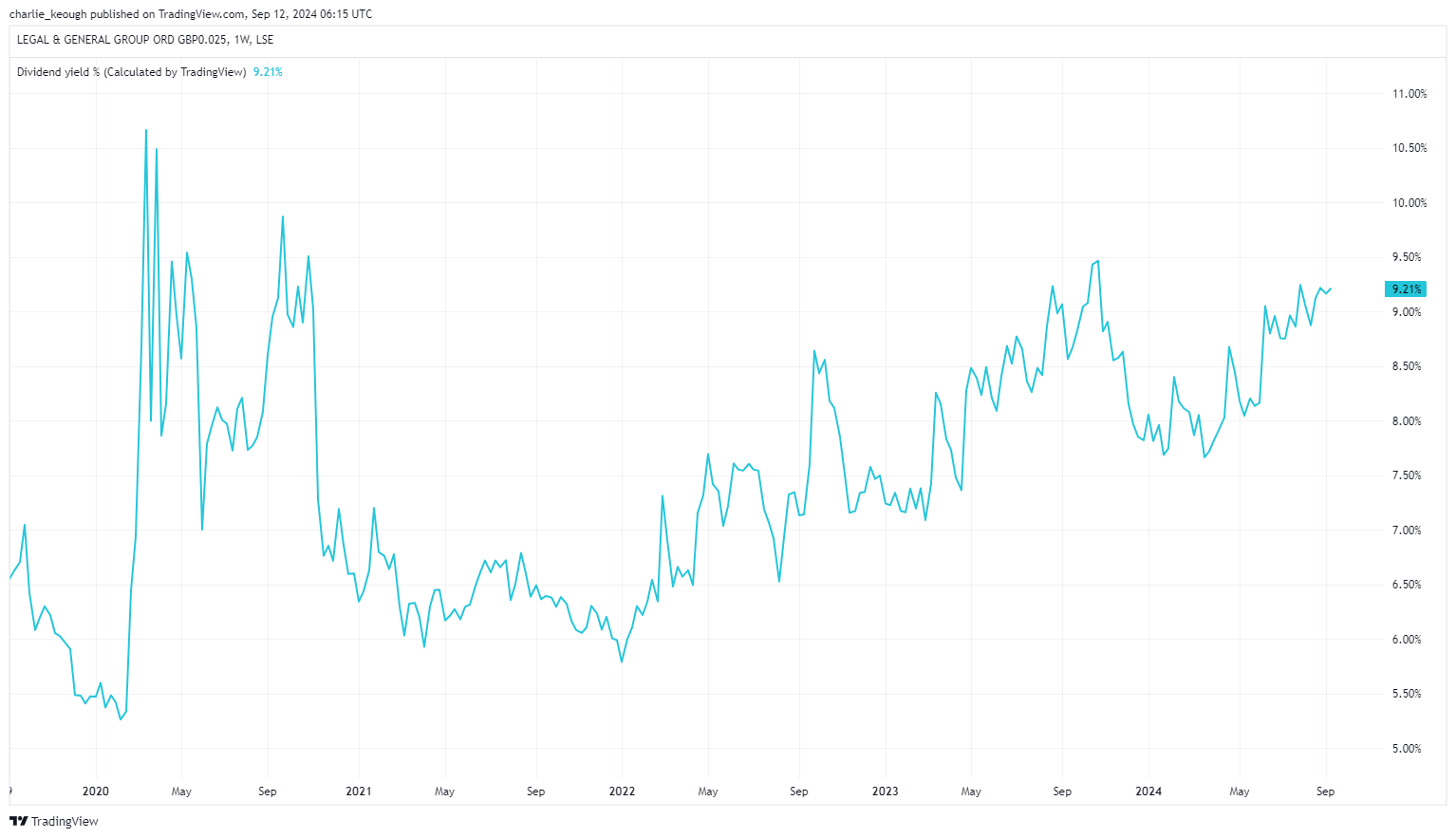

The first reason for that is obviously the passive income on offer. Its payout is the second highest on the Footsie, just behind M&G, which has a 9.5% yield. The FTSE 100 average is 3.6%. As the chart shows below, Legal & General’s payout has been rising over the last five years.

Created with TradingView

That’s because management has emphasised increasing shareholder returns in recent times. For example, in the last decade, its payout has risen every year except for 2020, where it was flat. In 2014, it paid a dividend of 11.25p per share. Last year, it was 20.34p.

That sort of progressive action is what I like to see when buying shares for income. Dividends are never guaranteed. We’ve seen this recently with the likes of Vodafone and Burberry. Therefore, its solid track record fills me with confidence that the business will keep rewarding shareholders in the times to come.

Attractive price

But aside from its dividend, what else does Legal & General have going for it? One thing is its valuation.

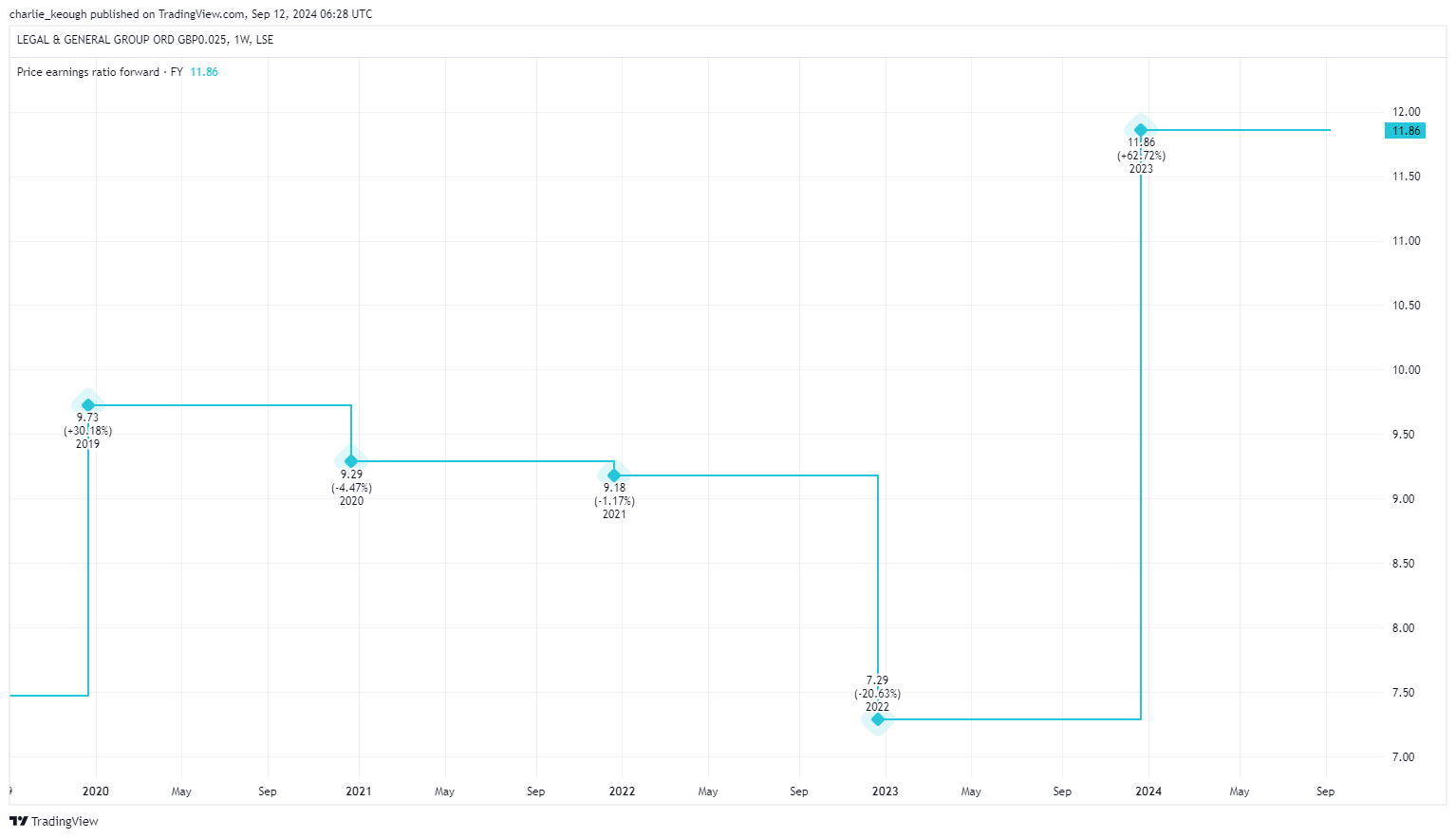

As seen below, at its current price of 224.8p, the stock trades on a forward price-to-earnings ratio of 11.9. That sits just above the FTSE 100 average, but it’s cheaper than peers such as Aviva (13.7).

Created with TradingView

The risks

Despite the handsome income on offer and its solid valuation, I see a few risks with its shares.

First, ongoing economic uncertainty is a threat. For example, a delay in future interest rate cuts would harm investor confidence and as a result could impact the firm’s assets under management. We’ve seen this play out over the last couple of years.

On top of that, the business recently announced restructuring plans, which naturally comes with risk.

I’m keen to buy

Then again, these plans are also exciting. As part of its revamp, the business is set to streamline into three core units with the ambition of increasing efficiency and boosting shareholder returns.

The firm aims to see compound annual growth of between 6% and 9% for its core operating earnings over the next three years.

Sixteen analysts offering a 12-month target price for the stock have an average price of 262.6p. That represents a 17.2% premium from its current price. In the weeks ahead, I’ll be picking up some shares if I have spare cash.

This post was originally published on Motley Fool