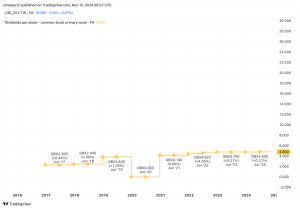

The Rolls-Royce (LSE:RR.) share price has given investors plenty of reasons to celebrate. Since the start of 2024, the engineering giant’s shares have climbed by a whopping 60%. And zooming out to when CEO Tufan Erginbilgiç took over the business, shareholders have reaped a massive 410% return, as well as the restoration of dividends.

Combined, the FTSE 100 stock’s now trading at record highs. But can it maintain this momentum moving forward?

Varied opinions

When looking across the wide range of broker forecasts for this business, the future of the Rolls-Royce share price seems riddled with mixed opinions. The most optimistic forecast currently predicts that shares will continue surging to 675p by this time next year. Yet, the most pessimistic view predicts the price could collapse to as low as 240p!

Both predictions have some merit behind them. Starting with the positives, the cost-cutting initiatives and refocusing of operations have led to a long-overdue explosion in free cash flow generation. This helped bolster earnings significantly ahead of initial expectations, opening the door to deleveraging the balance sheet.

The firm still holds a net debt position. However, with a large chunk of debts getting paid off, the cracks in Rolls-Royce’s financials are seemingly getting fixed. And now that large engine flying hours are climbing again across the travel industry, demand’s simultaneously rising, opening the door to further growth.

As for the negatives surrounding this business, most of the major issues have been, or are being, addressed by management. Debt remains a significant drag on operations.

However, as previously stated, the group’s newly-minted cash generation capabilities are steadily resolving this problem. In fact, debt rating agency Moody’s recently upgraded the quality of Rolls-Royce’s bonds earlier this year. So why are some analysts still predicting a potentially massive share price decline?

Justifying the valuation

The pessimism from certain analysts doesn’t appear to stem from a lack of quality. But rather, it seems bearish predictions originate from the group’s valuation. At a share price of 475p, the firm’s price-to-earnings ratio sits at 17. While some of its peers sit at similar valuations, they’re in a far stronger financial position with deeper penetration into the aerospace and defence industry.

Therefore, the recent rally in the Rolls-Royce share price appears to be largely driven by expectations that management can maintain momentum. Now that the tailwinds from the long-haul travel market recovery have stopped blowing, a slowdown could be imminent. And as all growth investors should know, slowdowns can trigger a lot of volatility in stocks trading at a premium.

Time to buy?

Rolls-Royce, as a business, looks like it’s on track to continue growing in the long run. But this future performance seems to be already baked into the stock price today. If that’s true, then management would have to keep beating expectations for the share price to hit the forecast of 675p. And that’s far easier said than done.

Therefore, I’m not tempted to snap up shares at the current price right now, despite the growth potential. But suppose the valuation takes a tumble, or Rolls-Royce continues to defy expectations? In that case, I may have to rethink my position.

This post was originally published on Motley Fool