I’ve been drawing up a watchlist of FTSE 100 stocks to buy in the autumn and there’s lots to choose from right now. I’ve boiled my choice down to five to buy when I have the cash. I’m particularly excited about number three.

My first pick is oil and gas giant BP. Frankly, I just can’t believe how cheap its shares are right now.

The falling oil price is the obvious reason. Brent crude is now down to $73 a barrel, as Chinese demand slips and US recession fears grow. After falling 15.76% in a year, the shares are trading at a dirt-cheap valuation of just 6.21 times earnings while yielding a juicy 5.41%.

The BP share price could slide further if the outlook worsens but with a long-term view, I think it looks like an unmissable buy today.

I’m backing JD Sports Fashion to climb higher

I hold consumer good giant Unilever but would happily buy more. It’s on the mend after a turbulent time, and should resume its former role as a solid defensive portfolio holding.

The Unilever share price is up 23.06% in a year so it’s not as cheap as it was, trading at 22.63 times earnings. The yield is so-so at 3%. But I think there’s plenty of scope for earnings growth, which should drive investor rewards.

Now to my third pick. The one I really like. I bought trainer and sportswear retailer JD Sports Fashion (LSE: JD) in January, after a shock profit warning triggered by disappointing Christmas sales sent the stock into a spiral.

The JD Sports Fasion share price soared 18% in a week after results published on 22 August showed a solid 2.4% rise in like-for-like sales. The board said it remained on course to hit its pre-tax profit guidance range of £955m to £1.035bn, while the recent acquisition of Alabama-based retailer Hibbett will deepen its US exposure.

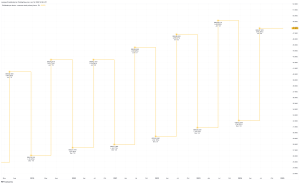

On 25 August, I wrote that JD Sports Fasion shares may take a breather after their blistering recovery, and so it’s proved. They’re down 6.67% in the last week. As a benchmark, the stock is up a modest 7.29% over 12 months. I think this is a good moment to top up my stake at a fair price.

The company is nicely set for the future but there are risks, as recession fears linger and consumers continue to struggle. Trading at exactly 11 times earnings, I still can’t resist it.

I like to buy out-of-favour stocks and would add spirits giant Diageo to my buy list. Its shares are down 22.98% over 12 months, following a shock drop in Latin American sales. I’m a little concerned the world is losing its taste for alcohol, but still think there’s an opportunity here.

Finally, I’d buy high street retailer Next. Its long-term performance in a troubled sector has been stellar, the shares are up 44.3% over one year and 70.12% over five.

They’re not super-cheap, trading at 15.26 times earnings while the yield is low at 1.46%. But it’s a brilliant company that deserves its place in my list of top five FTSE 100 shares to buy. I only wish I’d snapped it up years ago.

This post was originally published on Motley Fool