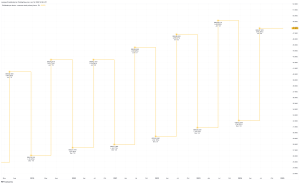

The BP (LSE: BP) share price is having a rough time. Down 11% in 2024 so far, the big oiler has underperformed its index peer Shell. It’s lagged the FTSE 100 too.

Things have got so bad that the stock’s sitting at a 52-week low. But is this now an opportunity not to be missed?

Dirt cheap shares

Based on the valuation alone, BP certainly looks like a bargain at first glance. Right now, I can pick up a slice of one of the UK’s biggest companies for a little under eight times forecast earnings. That’s dirt cheap relative to the rest of the UK market where the average is around the mid-teens.

Then again, it’s actually fairly average within the energy sector. The aforementioned Shell, for example, trades on a price-to-earnings (P/E) ratio of eight.

To me, this says more about how investors feel about the industry in general.

Lower demand

A lot of gloom can probably be attributed to a slowdown in demand, particularly from China. Rising inventory levels have also pushed analysts to lower their 2024 oil price outlook.

Inflation has been coming down in Western economies too. As a rough rule of thumb, the energy sector tends to do well when it’s going the opposite way. Higher prices lead to higher revenue and more profit. This tends to increase investment in exploration and production. Demand for these stocks rises accordingly.

US inflation peaked in June 2022. This might help to explain why the BP share price is struggling. And that’s despite the company beating market expectations on profit in its most recent quarter.

Passive income powerhouse

Despite these headwinds, it could be argued that BP is still worth picking up at this level for the cash it throws off.

The £68bn behemoth currently has a forecast dividend yield of 5.7% that looks set to be covered over twice by expected profit. This put it towards the top of the FTSE 100 as far as payouts are concerned. The index itself yields ‘just’ 3.5%.

On the flip side, it’s worth being aware that BP has a chequered history on this front. When the global economy is walloped for six — such as at the start of the Covid-19 pandemic — a big cut has usually followed.

This isn’t necessarily a reason for me to avoid investing. The fact that management elected to raise the Q2 dividends per share by 10%, for example, is encouraging. I also like how BP has been cutting costs. It now has a lot less debt than it did a few years ago.

But the volatility of dividend payments does help to justify why I’d never depend on just one stock for this purpose. A bit of diversification is always sensible, especially as a number of other FTSE 100 companies have hiked their cash returns far more consistently.

My verdict

BP’s current troubles look temporary to me. As such, I reckon that buying the shares now could prove to be a canny move in time, even though there’s always a chance that the price could still move lower in the interim.

If generating passive income were a priority and I had the cash burning a hole in my pocket, I’d begin building a position today.

This post was originally published on Motley Fool