Investing in the FTSE 100 is all about careful selection. I’m looking for some of the highest-growth, biggest-yielding, and most stable investments I can find.

Banking in on credit ratings

Experian (LSE:EXPN), a global leader in information services, is one of the ‘big three’ credit reporting agencies globally. The other two companies are Equifax and TransUnion.

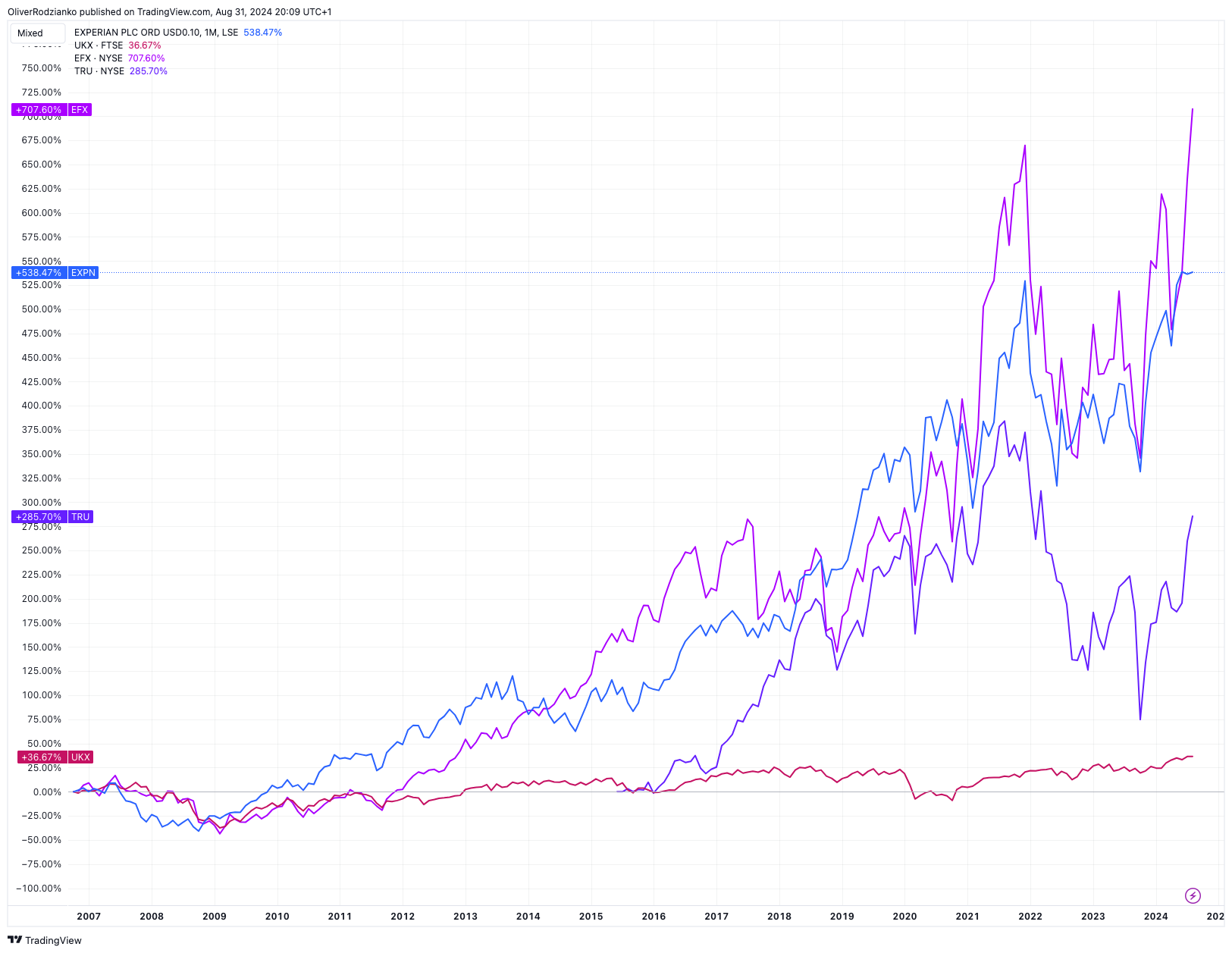

Since 2007, Experian has done remarkably well, coming in second of the big three in price growth. Furthermore, as the chart below shows, the company has strongly outperformed the broader index it’s a part of.

This shows how lucrative it can be for me to pick individual companies to invest in. Of course, high growth can also mean there’s a lot of potential for volatility. So, I have to make sure I invest at a reasonable valuation.

Good value for money

Experian currently has a higher valuation compared to historically. However, it deserves this because its growth rates are also better than before.

The shares have a price-to-earnings (P/E) ratio of 35.5, which is higher than its 10-year median of 31.

However, its earnings per share excluding non-recurring items are expected to grow at 10.2% per annum over the next three years. This is much higher than the 8.7% annual earnings per share growth rate the business has achieved as a median over the past 10 years.

Therefore, I think the market has fairly valued Experian, despite it having a high P/E ratio. This is good because it means I’m taking on less risk than if the company was overvalued. That’s because the price is less likely to contract from changes in investor sentiment alone.

Could AI take its position?

Despite the fact that Experian uses artificial intelligence (AI) to enhance traditional credit scoring models, there’s a growing and potentially undervalued threat from emerging fintech startups.

Competitors that specialise in AI could create more tailored and specific solutions at a reduced cost. This threat is currently small because AI hasn’t been around for long enough. However, as developers become more accustomed to intelligent technologies, I think there’s a significant opportunity for new companies to take market share.

Luckily, Experian benefits from an established and widely recognised brand. Therefore, management will be wise to continue to trade on this in light of new technological competition.

The best big three investment?

Even though Equifax has grown faster than Experian in price since 2007, I’m more bullish on the latter right now for its valuation. The former has a P/E ratio of over 65 right now, which is too high for me. And its 10-year average is 33.7.

However, it’s worth noting that analysts forecast that Equifax will deliver very strong annual earnings per share growth of 21.9% over the next three years. That’s much higher than the 10.2% expected for Experian, but I still prefer a lower valuation.

A watchlist contender

I’ll potentially buy Experian shares soon. If I’d invested £5,000 in the shares 12 months ago, I’d currently be sitting on almost £6,650. That’s not even taking into account the 1.25% dividend yield. I’m gutted I missed out on that growth, but let’s hope I don’t miss out on any of its future returns.

This post was originally published on Motley Fool