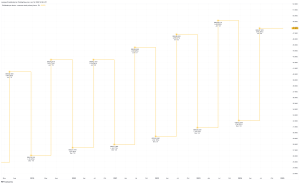

As we approach the final months of 2024, many investors are keenly eyeing the performance of Lloyds (LSE: LLOY). The bank’s share price has been a real success story this year, influenced by various macroeconomic factors and company-specific developments. Based on current trends and potential catalysts, I believe the Lloyds share price could finish the year around the 65p mark. Here’s my rationale.

Economic recovery

The UK economy has shown resilience in 2024, with inflation gradually cooling and consumer confidence improving. The Bank of England has begun to ease its monetary policy, with interest rates starting to come down from their peak. This environment bodes well for Lloyds, as it could lead to increased lending activity and improved net interest margins.

However, we must remember that economic forecasts can be fickle, and any unexpected downturn could put pressure on the bank’s performance and share price.

Strong results

The bank’s recent financial results have been encouraging. In its last reported earnings, the bank posted a profit before tax of £4.51bn for the trailing 12 months. The price-to-earnings ratio of 7.8 times suggests that it’s still reasonably valued compared to its peers and historical averages, although competitors Barclays and Standard Chartered are admittedly expected to grow earnings more aggressively in the coming years.

A discounted cash flow (DCF) calculation suggests the shares are as much as 51% below estimated fair value. Furthermore, a price-to-book (P/B) ratio of 0.8 suggests there could be a decent opportunity here. Of course, this isn’t guaranteed, but shows the potential if management can continue to execute the strategy well.

Generous dividend

With a dividend yield of around 5%, Lloyds remains a favourite for income-seeking investors. The bank’s payout ratio of 41% indicates that there’s a decent amount of room for dividend growth if earnings continue to improve. As interest rates stabilise or steadily decrease, high-yielding dividend paying companies could become even more appealing to investors searching for reliable income streams.

Eyes on the future

Management has been investing heavily in digital capabilities, which should start to bear fruit in terms of improved customer experience and operational efficiency. The focus on streamlining operations and reducing costs could lead to higher profitability, potentially driving the shares higher.

As the UK’s largest mortgage lender, the bank’s fortunes are closely tied to the housing market. While higher interest rates have cooled the property market in 2024, recent signs of a recovery and government measures to boost homeownership could provide a significant boost for the mortgage sector.

While I’m optimistic here, it’s crucial to acknowledge the risks. A severe economic downturn, geopolitical tensions, or unforeseen regulatory changes could all negatively impact the bank. As always, the regulatory landscape remains challenging, but the firm has demonstrated its ability to navigate these waters effectively.

One to watch

Considering these factors, I believe the Lloyds share price could reach 65p by the end of 2024. This represents a modest but respectable increase from current levels, reflecting both the bank’s potential for growth and the challenging environment it operates in.

However, investors should remember that such predictions are inherently uncertain. To me, the company’s attractive dividend yield and solid fundamentals make it an interesting prospect for long-term investors. I’ll be adding it to my watchlist for now.

This post was originally published on Motley Fool