Lower interest rates, falling inflation, and growing GDP have been pushing dividend shares higher. And there could well be more to come.

When the price of shares goes up, dividend yields come down. So with this set to continue, investors might not get many more chances to lock in some unusually high yields.

Higher prices, lower yields

British American Tobacco‘s (LSE:BATS) a good example of the kind of thing I have in mind. Over the last month, the stock’s climbed almost 15%.

As a result, the dividend yield’s fallen from around 9.6% to 8.3%. That might not sound like much, but it can make a big difference for investors with a long-term perspective.

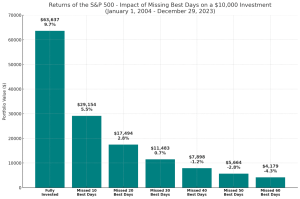

After 30 years, a £10,000 investment that grows at 9.6% a year becomes worth £156,428. By contrast, £10,000 compounding at 8.3% a year over the same period only reaches £109,358.

Investing isn’t just about buying shares with the highest dividend yields. But a choice between buying the same stock when its dividend yield compared to when it’s lower is an easy – and important – one.

Dividend growth

There’s another dimension though. While an improving macroeconomic environment might be causing British American Tobacco’s share price to rise, they could also be good for its earnings.

An improving economy could help boost consumer spending on nicotine and tobacco products. Lower inflation and cheaper debt should also help the firm reduce costs and interest payments on its debt.

If profitability improves, I’d expect British American Tobacco’s dividend to increase. So even buying the stock at today’s prices, an annual return of 9.6% might still be on the cards after a couple of years.

I therefore don’t think it’s too late to buy dividend shares. Buying them at lower prices might be better, but an improving macroeconomic picture should lead to higher returns over time.

Potential returns

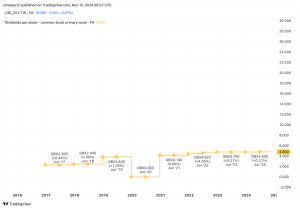

British American Tobacco’s a Dividend Aristocrat, with over 25 years of consecutive increases. And at an 8.3% starting yield, the returns could be spectacular over time, if it can keep this going.

Doing this won’t be entirely straightforward. The obvious risk is that its traditional product – cigarettes – is in decline and this doesn’t look like it’s going to reverse any time soon.

The company does have some things it can do to try and offset this though. These include increasing prices, launching its next generation products, and reducing its share count through buybacks.

From here, it doesn’t take much for the stock to be a great investment. Over 30 years, 2% annual dividend growth would result in a return of 14.88% a year on an investment at today’s prices.

Long-term passive income

Lower dividend yields mean investors need to be a bit more careful. With a less margin of safety, the anticipated growth needs to come through.

Nonetheless, even with share prices rising, I think there are still opportunities for income investors looking for stocks to buy. An improving economic picture should bring better profits for businesses.

This post was originally published on Motley Fool