Over the last 12 months, the Lloyds Banking Group (LSE:LLOY) share price is up 40%. A rise like that makes it easy to think the moment to buy the shares has passed.

That’s especially true with banking stocks, which have benefitted from high interest rates recently. But I think Lloyds could still be a bargain even at today’s prices.

A cyclical high?

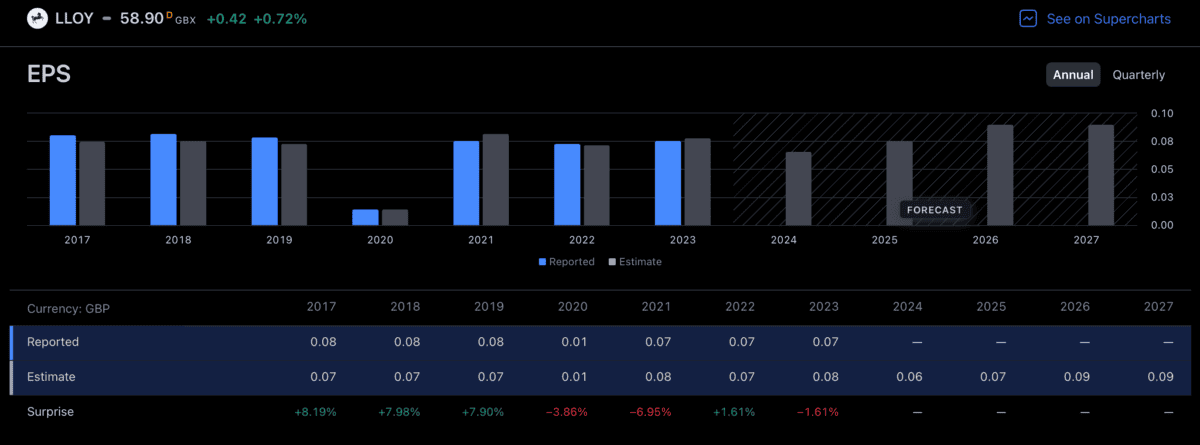

In 2023, Lloyds pulled in 7p in earnings per share. With the stock currently priced at around 59p, that implies a price-to-earnings (P/E) ratio of just under 8.5.

That’s not high – the FTSE 100 average is 15. And while Lloyds probably doesn’t have the same growth prospects as Diploma or RELX, it’s an awful lot cheaper.

The obvious question for investors is whether that 7p in earnings is going to be sustainable. If it isn’t, then the appearance of value might be an illusion.

Analysts are fairly optimistic in this regard. Earnings are expected to fall to 6p per share in 2024, but over the next few years, the average forecast is for Lloyds to manage around 8p per share.

Source: TradingView

The dip to 6p is worth taking seriously. A decline of 1p might not seem like much, but it amounts to a 14% decline for a company that just managed 7p per share last year.

Equally though, an average of 8p per share in future brings the P/E ratio down to 7.4. If the company is going to achieve that until 2027, it’s hard to see the stock as anything other than a bargain.

Risks

Based on analyst estimates of future earnings, the Lloyds share price looks cheap to me. But the big question is what might cause net income to come in lower than anticipated.

One issue is potential liabilities around the sale of motor insurance. The bank is under investigation at the moment for this and there might well be a fine that obstructs future earnings.

The trouble with this kind of risk is that it brings quite a lot of uncertainty. Analysts might try and estimate the size of the damage, but it’s the kind of thing that’s difficult to forecast accurately.

Another potential issue is interest rates. These have started falling in the UK, but this is probably a bad thing for Lloyds, as it’s likely to weigh on margins in the future.

Lower borrowing costs do reduce the risk of defaults, so it might not be entirely negative. But I’d rather rely on the bank to manage this risk and have the opportunities that come with higher rates.

In short, the issue with Lloyds is that a lot of what determines its profitability isn’t under its control. The bank can respond to situations as they develop, but there’s an inevitable element of risk.

Is it a bargain?

In general, businesses that have pricing power are preferable to those that don’t. And while Lloyds is in the latter category, it’s trading at a valuation that arguably reflects this.

It’s not top of my list of shares to buy, but I think there could be value here. I definitely see it as a mistake to dismiss the stock as a bargain just because it’s 40% more expensive than it used to be.

This post was originally published on Motley Fool