UK investors have countless passive income opportunities to take advantage of in the stock market. The London Stock Exchange is home to a vast number of high-yield shares, including businesses like Somero Enterprises (LSE:SOM).

Right now, the company’s offering an impressive 7.6% yield. And at a share price of 322p, investors only need to snap up 4,920 shares to start earning an extra £100 each month.

An under-the-radar industry leader

Somero’s not a household name. The firm designs and manufactures laser-guided concrete screed machines used by the construction industry, particularly when building infrastructure or large commercial properties. Think shopping malls, car parks, warehouses and the like.

Traditionally, concrete laying can be done by hand. But with Somero’s machines, the job can be completed significantly faster and to a much higher quality, saving time and money. So much so, that the company has outgrown its competitors by a wide margin.

But in the last few years, it’s been a bit of a bumpy ride for Somero. Higher interest rates have pushed back a lot of projects. And these delays have ultimately hampered demand for its screed machines. Pairing that with awkward weather conditions, the stock’s understandably taken a tumble as growth becomes challenging.

However, the cyclical nature of the construction sector’s nothing new to Somero. Management’s navigated such adverse conditions plenty of times in the past. Pairing this experience with a highly cash generative business model when times are good, the group has no debt on its balance sheet and a healthy cash war chest to keep it afloat during the bad times.

That’s how dividends have kept flowing even during the pandemic. And when paired with a falling share price, investors now have the opportunity to reap a massive yield.

The risks of cyclicality

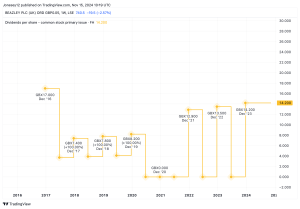

Somero’s cash flow’s almost entirely tied to the status of the construction sector across the globe, especially in its core North American market. And this dependency’s clearly shown in its financial statements. Revenue and profits have been quite lumpy, as have dividends.

The history of Somero’s shareholder payouts has been a bit of a rollercoaster ride, rising and falling constantly. And in most cases, the lack of consistency doesn’t exactly sound inviting to most income investors. That’s likely a leading reason why shares have and continue to trade at a relatively low price-to-earnings ratio for most of its history.

Yet, despite all this volatility, dividends, over the long run, have trended upward. And now that interest rates are starting to fall, the company’s presented with a massive backlog of construction projects that could put it in a post-inflation boom if management can successfully capitalise on it.

That’s why, despite the inconsistency, I’m eager to top up my position in this enterprise once again and potentially reap what could be enormous passive income over the next few years.

This post was originally published on Motley Fool