It has been said there is no such thing as easy money, but passive income comes pretty close, I think. The only real effort here is picking the right shares and waiting for the dividends to roll in.

I started with the £9,000 that was sitting in my savings account around 30 years ago. And I invested this in a ‘passive income portfolio’ consisting of very-high-quality shares that pay very high dividend yields.

Picking the right stocks

A relatively new addition to this is abrdn (LSE: ABDN). This fulfils all three key criteria that I look for in my passive income portfolio stocks.

First, it has a very high yield – 8.7% currently (derived from its 14.6p 2023 dividend and its £1.68 share price). This compares to the present average FTSE 100 yield of 3.6% and the FTSE 250’s 3.3%.

Second, it looks very undervalued against its competitors. It trades on the key price-to-book ratio (P/B) measurement of stock value at just 0.6 against its peer average of 4.1. This makes it less likely that any dividend gains will be nullified by extended share price losses, in my view.

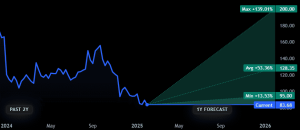

And third, it looks set for very strong earnings growth – analysts estimate 52.3% a year to end-2026. This is what drives dividend rises and share price gains over time.

A risk here is that its ongoing reorganisation falters, allowing its peers to gain a competitive advantage. Another is any sustained net shrinkage in its assets under management, resulting perhaps from increased financial markets’ jitters.

Piling on the passive income

Assuming that I was starting out again with £9,000 and invested it in abrdn, I would make £783 this year in dividends.

Over 10 years, I would have another £7,830 to add to my £9,000 initial investment, given the same average yield (although this can go up or down, based on movements in share price and changes in annual dividends).

After 30 years on the same basis, this additional return would have risen to £23,490. It would generate £2,044 a year of passive income, or £170 each month.

Using the magic of compounding

This is a very nice return – but it could be even better than that, and by a huge margin.

This would involve using the dividends paid to me to buy more abrdn shares. The process is known as ‘dividend compounding’ and is the same idea as compound interest in a bank account.

By doing this, an 8.7% average yield would make me an extra £12,415 after 10 years, instead of £7,830. After 30 years I would have made an additional £112,245 instead of £23,490.

My total investment pot in abrdn would be worth £121,245, paying me £10,548 a year in passive income!

There would be tax to pay on these gains according to individual circumstances, of course. And assuming some inflation over the period, the buying power of that income would be less by then.

However, it shows exactly how a relatively small initial investment can be supercharged into a much bigger passive income for life.

This post was originally published on Motley Fool