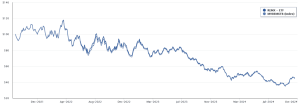

Conditions have been challenging for UK income investors in recent months. Dividend stocks delivered 8.6% fewer dividends on a headline basis in the third quarter, according to Computershare.

The £25.6bn total was the worst result since the depths of the Covid-19 pandemic. Excluding one-off dividends, total payments fell 3.5% at stable exchange rates from quarter three of 2023.

Dividends fell for a variety of factors, like a stronger pound and a larger proportion of share buybacks. However, a £2.6bn decline in mining dividends took a big bite out of the quarterly total.

Payouts from utilities stocks also dropped, while banking and oil dividends also failed to inspire.

A dividend stock I’d buy

The good news is that UK dividends are tipped to increase over the full year. However, the pace at which rewards are tipped to grow isn’t exactly impressive.

For the full year, headline dividends are tipped to rise just 2%. This is also almost half the 3.8% growth rate Computershare had previously tipped. Meanwhile, underlying dividends are expected to fall 0.3% on an underlying basis. That’s down from growth of 0.1% previously forecast.

I’m not prepared to accept such mediocre dividend growth as an income investor. So here’s a FTSE 250 passive income share I’m considering buying to target better rewards.

Georgia on my mind

Political turbulence is rising in the Eurasian nation of Georgia. And it threatens to get bumpier after the European Union referendum scheduled for this weekend.

This has obvious implications for the country’s economy and, consequently, a wide range of Georgian businesses. But pleasingly, Georgia’s economy is (for the time being, at least) tipped to continue booming.

The International Monetary Fund (IMF), for instance, thinks GDP will increase 6% in 2025. That’s far ahead of the global average of 3.2%.

In this landscape, I think investing in TBC Bank Group (LSE:TBCG) remains an attractive idea that I’m considering. I certainly believe its low forward price-to-earnings (P/E) ratio of 4.4 times could be enough to counter Georgia’s uncertain political landscape.

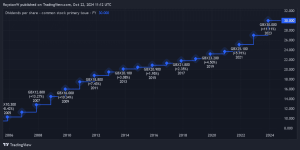

Predictions of healthy profits growth mean the bank’s dividends are also expected to keep soaring. Earnings rises of 10% and 20% are predicted for 2024 and 2025 respectively.

9% yield

Last year, TBC Bank raised its annual dividend 32% year on year, to 7.22 Georgian lari (GEL) per share. In 2024, City analysts expect it to rise an extra 3%, to 7.45 GEL. And for 2025, the bank’s total dividend is tipped to balloon 21%, to 9 GEL per share.

Of course, dividends are never guaranteed. But I think TBC’s in good shape to meet these forecasts. Predicted payouts are covered three times over by anticipated earnings, providing a wide margin of error if the bottom line disappoints.

TBC also has a strong balance sheet it can use to meet forecasts — its CET1 ratio was a robust 16.8% as of June.

With its gigantic dividend yields, I think the business could help supercharge my passive income. These are 7.4% for 2024 and 9% for next year.

This post was originally published on Motley Fool