There are a lot of high-yielding dividend stocks on the FTSE 250, making it difficult to pick the winners. Many are fresh additions that lack the long and reliable dividend track records seen on the FTSE 100.

So it can take a bit of digging to uncover those with long-term passive income potential. With Greencoat UK Wind (LSE: UKW), I think I may have found one.

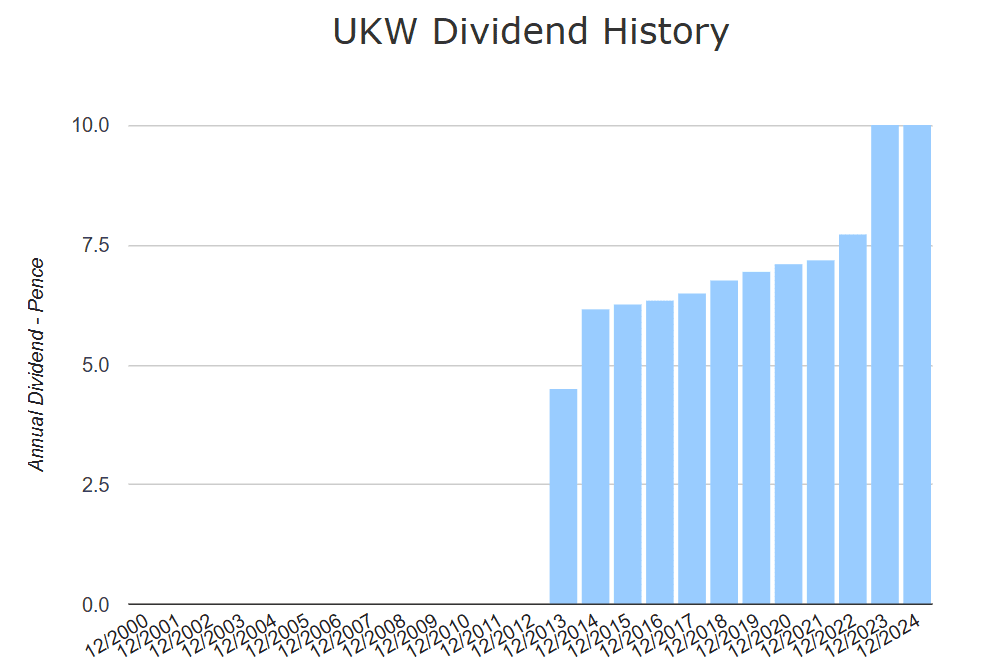

As one of the more reliable dividend stocks on the index, this renewable energy investment trust has attracted income investors seeking stable, inflation-linked returns. Its yield currently stands at around 9% and has been growing steadily at a rate of 5% per year.

But with the share price slipping 18% over the past year, is it still a great opportunity to consider — or a potential value trap?

What does Greencoat UK Wind do?

Greencoat UK Wind is a renewable infrastructure fund that invests in wind farms across the UK. Its portfolio comprises over 50 wind farms, bringing steady cash flow from long-term contracts and government-backed subsidies. The company’s revenue is largely protected from market fluctuations, as a significant portion comes from fixed-price contracts and inflation-linked subsidies.

This can be both an advantage and a disadvantage, as we’ll soon discover.

Why has the share price fallen?

Despite a solid business and clean balance sheet, the share price has struggled to grow recently. Since early 2023, its been dropping and is now down 18% in the last 12 months.

The decline could largely be attributed to rising interest rates. As a yield-focused investment trust, it competes with bonds and other fixed-income assets. When interest rates rise, investors demand higher yields, putting pressure on share prices.

If inflationary fears push discount rates higher, it reduces the current value of its future cash flows, further impacting the stock price.

Can it recover?

As we can see from the above, a key factor in UKWind’s potential recovery is the outlook for interest rates. If inflation continues to ease and the Bank of England begins cutting rates later this year, sentiment towards the stock could improve.

Its assets remain highly profitable and the dividend is well-covered by cash flow. Moreover, the UK government’s commitment to renewable energy provides long-term potential for the sector.

Key attraction: the dividend

With inflationary pressures limiting price growth, the key attraction here is the dividends. Before 2024, the company had a 10-year track record of increasing its dividends in line with inflation. In 2024, it maintained the same 10p annual dividend it paid in 2023, pausing its policy of inflation-linked growth.

Still, the 9% yield could translate to a lucrative quarterly income stream.

Unlike traditional stocks, its dividends are backed by operational wind farms generating stable revenues. This makes the income stream more predictable compared to companies with volatile earnings.

My verdict

Investors seeking passive income should consider UK Wind as it offers an attractive yield on the FTSE 250. The stable, inflation-linked dividends provide a compelling reason to hold the stock.

However, the near-term risk remains tied to interest rate movements. To some degree, the current price dip could be a good opportunity but in current market conditions, it’s difficult to predict a recovery.

Those with a risk appetite to ride out the volatility could benefit from a high-yielding, defensive asset with long-term growth potential.

This post was originally published on Motley Fool