The problem with pensions is how bloomin’ long it takes to get to them. The State Pension age has shifted from 65 all the way to 67 in 2026 and then a proposed 68 in 2039.

Even a self-invested private pension (SIPP) only permits withdrawal at 55, changing to 57 from 2028. These goalposts could keep shifting too. All told, a pension doesn’t really fit what I might call a second income.

Numbers game

A true second income is withdrawn alongside income from a job or a small business. Having an additional stream of cash can take the weight off of big decisions like changing jobs or switching career.

Bumped up high enough, that second income source might open up an early, perhaps a very early retirement. I think it’s telling the number of internet communities that have sprung up to teach each other how to retire in their 40s or even 30s.

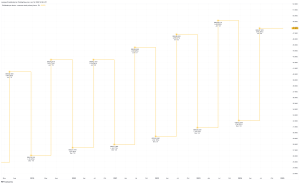

Figuring out a second income is nothing more than a numbers game. I have an amount I start with then I pull a few levers to make it into an amount I finish with. I can run through the process very quickly given a couple of hypothetical amounts.

Something like £7,000’s a decent enough starting point. It’s below the cash total the average British household has in savings and could be used to target a £500 monthly second income.

Drip feeding

The next question is how much am I adding? Drip feeding small amounts of cash from the day job makes this process very powerful. The cash will (hopefully) be growing at the top with good investment choices. It’s also growing at the bottom as more cash is funnelled in.

This adds fuel to the exponential fire. And it results in amounts that seem somewhat hard to believe for those who haven’t delved into the stock market before.

I’ll need to invest in stocks too, and this is where some get unstuck. Personally, I like to keep it simple. Great management, great products. One company that can boast both over the years is Unilever (LSE: ULVR). Its ethos is built around cultivating “sticky” brands that customers keep coming back to.

I suspect that brand names like Pot Noodle or Magnum ice cream will adorn supermarket shelves for many more years to come. And that’s something I can build a second income around. The shares have been rising and I’m looking to open a position in the company for my own portfolio soon.

Risks

I will say that no stock’s infallible. And such a big consumer goods firm does have an ongoing battle with inflation eating into its margins.

Assuming a 10% return rate (lower than Unilever’s historical figure), that £7,000 with £200 a month extra could turn into £191,889 after 20 years. With a 4% drawdown rate, I’d receive £639 each month, clearing my goal, and then some.

But whatever numbers I’m impressed by, it’s important to be more fluid than rigid. Life takes a bloomin’ long time in the grand scheme of things, and who knows what the future will bring?

Whatever comes, a general goal I keep in mind is to save amply and invest smartly. Doing this with a relaxed attitude can help me weather the inevitable crises that come along the way.

This post was originally published on Motley Fool