I’m tired of working weekends. If I want to relax and still maintain the lifestyle I’m accustomed to, I need a second income. One that doesn’t require working seven days a week!

But how can I earn more income without putting in the extra hours at a second job?

Well, I’ve been looking into high-yield dividend stocks and I think I’ve come up with a plan. The research is done and the numbers look solid. Now I just need to start putting in the initial investment capital.

This is my strategy.

Crunching the numbers

My plan involves investing a small part of my monthly salary into dividend stocks. But first, I must figure out how much to invest and what kind of returns I can expect. Otherwise, I could die before the investment returns anything significant.

I have about £7,000 in savings and can’t afford to spare much more than £300 a month. That means I could put in about £10,000 the first year and an additional £3,600 each consecutive year. Seems like even a decent return of 10% wouldn’t pay much after the first year, right?

Fortunately, the miracle of compounding returns will work in my favour!

Doubling down on dividends

The secret ingredient to this plan is dividends. I need to build a portfolio of stocks with an average yield of at least 7%. Then I need to reinvest the dividends to compound the returns.

The FTSE 100‘s full of great dividend stocks. Plus, a good portfolio should also benefit from around 5% a year price growth. It all adds up!

Still, it’ll take some time. Doing the maths, I found that in 12 years my investment could have reached £139,460, paying dividends of around £10,000 a year. Then I could stop the monthly contributions and just enjoy the returns.

That’s not bad!

So which stocks are these?

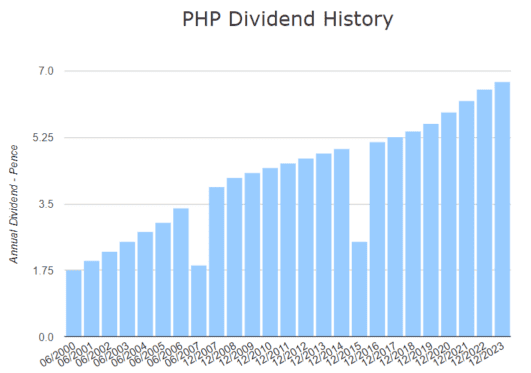

One good example of the type of stock I want to target is real estate investment trust (REIT) Primary Health Properties (LSE: PHP). Since the year 2000, the share price has grown from 25p to over 90p, delivering an annualised return of 5.7%.

On top of that, it has a 7% yield and has been paying consistent dividends for 20 years. Plus, payments have been increasing at an annual rate of 3.2%.

That sounds like the perfect stock for my strategy!

But everything comes with some risk. While REITs have an added tax benefit, they’re highly susceptible to housing market issues. We all know what happened in 2008 – when the housing market crashed, the stock fell 54%. What’s more, it has lots of debt and limited interest coverage, so that’s something to watch carefully.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Minimal risk, maximum returns

To reduce risk, I’ll spread my investment over at least 10 dividend stocks from different industries. Some other good options I’ve already chosen include Aviva, HSBC and Imperial Brands.

I’ll also open a Stocks and Shares ISA, which allows me to invest up to £20,000 a year tax-free. That ensures my plan gets me the maximum returns.

Will this work? It’s impossible to say for sure. Markets can go up or down based on all kinds of factors, from political issues to environmental changes. There’s always some risk of losses. But as the saying goes, “no risk, no reward”!

This post was originally published on Motley Fool