For years, I knew exactly what to expect when I checked out the National Grid (LSE: NG) share price.

The stock would look fair value at around 15-16 times earnings, while the dividend yield would be solid at just over 5%. I once called this the “only no-brainer buy on the entire FTSE 100“. I wouldn’t say that today.

I had one concern. National Grid already had £40bn of debt and had to spend billions more readying the power transmission network for the green transition. That chicken came home to roost sooner than I expected, with the shares crashing in May after the board launched a £7bn rights issue.

FTSE 100 bargain?

At the Fool, we love buying quality companies when their shares are taking a beating and suddenly look cheap. So do I. But I didn’t have the cash and missed out on the opportunity. Should I grab it today?

National Grid shares bottomed out at 838.4p on 29 May. They’ve since jumped 11.2% to today’s 932.44p. Over one year, they’re down just 1.54%. It feels like I’ve missed my moment.

The shares look good value judging by their trailing price-to-earnings (P/E) ratio, which is just 11 times earnings. However the forward P/E for 2025 is actually higher at 13.2 times, so I’m not totallly dazzled.

It’s a similar story with the dividends, where the trailing yield of 6.11% is better than I’d normally expect, but the 2025 forecast yield of 5.03% is a bit worse.

Debt’s still an issue. Markets are forecasting net debt of £41.86bn in 2025, rising to £48.76bn in 2026. The assumption has always been that due to its regulated earnings, National Grid can afford to borrow more than other companies.

But my faith has been rattled by recent events. It owes a colossal sum, roughly double forecast 2025 annual sales of £20.11bn.

Yes, National Grid is a monopoly, with the pricing power that brings. Yes, it offers great earnings visibility. And yes, we need it to keep the lights switched on, so it’s not going anywhere. But can we trust those dividends? I’m not convinced.

An awful lot of debt

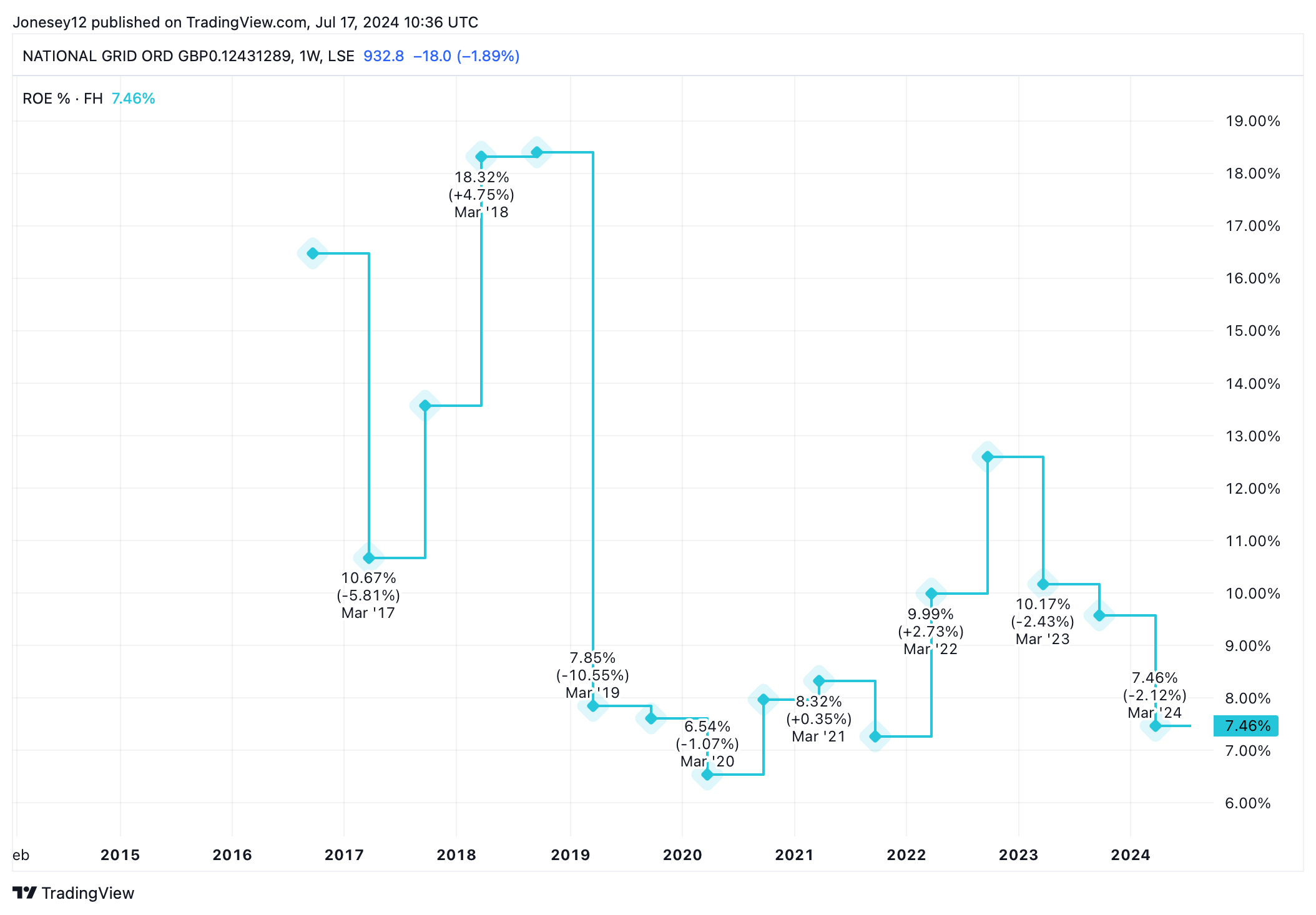

Its return on equity, which is often a guide to profitability, has been heading the wrong way. Let’s see what the charts say.

Chart by TradingView

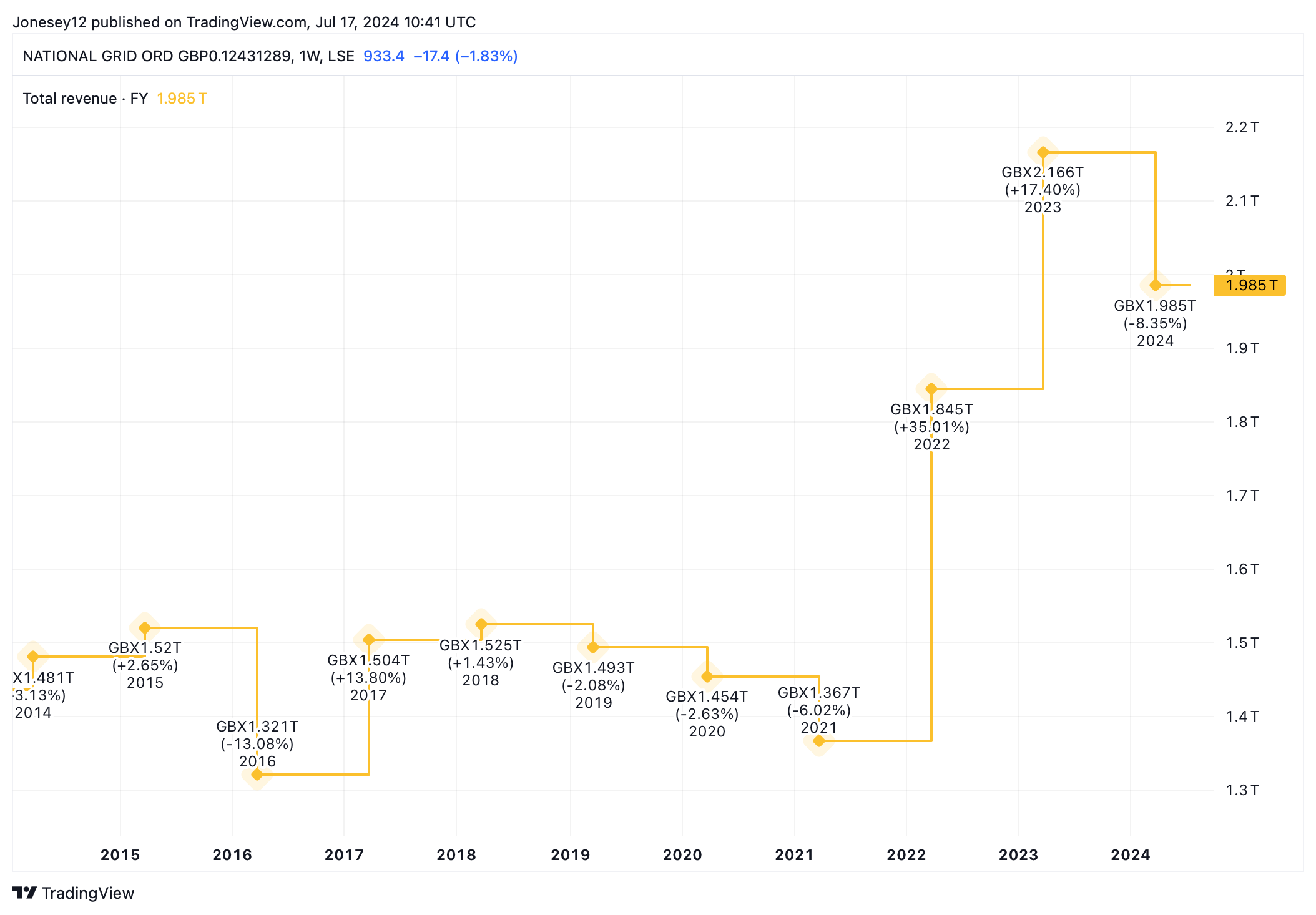

On the plus side, 13 analysts offering one-year price forecasts suggest the shares will hit 1,104p, up a hefty 18% from today. Revenues may have slumped lately, but as this chart shows, the long-term trajectory’s positive.

Chart by TradingView

But you know what, I don’t like it. It doesn’t feel right investing in a company that carries this much debt, and has to invest so much in infrastructure. The shadow of HS2 looms large.

My bet is that hitting net zero targets will cost even more than we would like to imagine. I can get higher yields elsewhere on the FTSE 100, from companies with much less on their plate. I’ll chase them instead.

This post was originally published on Motley Fool